Performance has not been broad based across sectors. Consumer oriented industries yet to pick up

Aditi Gupta

Economist

Bank of Baroda

Mumbai, November 24, 2023: Q2FY24 India Inc.’s performance based on a sample of a 3,265 companies spread out across 35 sectors in Q2- FY24 has been ambivalent. The quarter was marked by increased profitability, even as sales growth remained muted. At a disaggregated level, while banks and service related sectors benefited from higher credit offtake and pent-up demand respectively, signs of stress were visible in certain pockets. Consumer oriented industries such as FMCG etc. noted muted growth as rural demand continues to lag. This will be a key factor to monitor going forward.

Corporate performance of India Inc. in Q2-FY24 has been marked by higher profitability even though revenue growth has moderated to a large degree. Lower commodity prices have resulted in lowering input costs and improved profitability. On the other hand, sales growth has remained muted for the second consecutive quarter. While base effect can explain some part of this moderation, delay in festive season and patchy monsoon have also weighed on revenue growth as demand was affected.

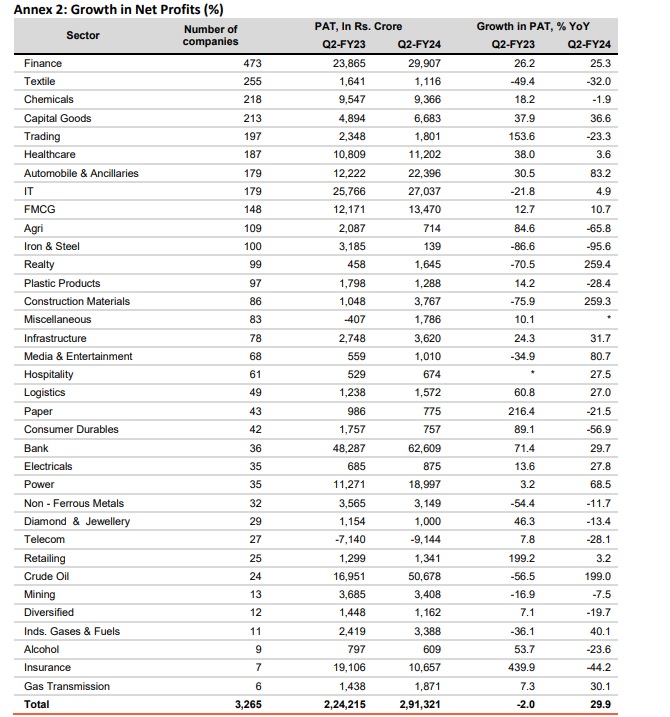

For a sample of 3,265 companies, sales growth in the last quarter rose at a meek pace of 2.8%, compared with a 24.3% growth in Q2-FY23. Expenditure growth has declined sharply by 4.2%, after increasing by 28.5% in Q2-FY23. This was led largely by a decline in costs of raw materials. As a result, profitability parameters have shown a sharp improvement. Operating profits, profit before tax and net profits have all registered double digit growth in Q2-FY24. Profits after tax, which had declined by 2% in Q2-FY23, rose at an impressive pace of 30% in Q2-FY24.

The overall performance has been skewed to an extent due to the inclusion of BFSI sector which includes banks, finance and insurance companies. To get a clear picture, we exclude the BFSI sector, and the sample reduces to 2,749 companies. While the overall picture remains the same of higher profits and lower sales, the magnitude is different. Excluding the BFSI sector, net sales have declined by 0.5%, which is in contrast to a small but positive growth in the overall sample. However, profit growth is even higher led by a relatively higher decline in expenses. Interest cover ratio of the companies has shown a marked improvement, led by both lower growth in interest costs as well as higher growth in profits. The interest cover ratio of the companies has improved to 5.64 from 4.49 last year. This bodes well from the perspective of debt service capability of these companies.

Sector-wise movement in interest cover

It must be noted that RBI has kept its policy rate unchanged since Feb’23. However, in order to meet their business requirements, banks have increased the rates charged on fresh rupee loans. In fact, the weighted average lending rate (WALR) on fresh loans stood at 9.38% in Sep’23 versus 9.2% in Jun’23 and 8.59% in Sep’22. Overall growth in bank credit for this quarter was 17.6% which was marginally lower than 18.9% last year. Even so, the ICR has shown an improvement as the higher interest costs have been offset by a sharp uptick in profits.

There has been an improvement in the interest cover ratio for major sectors during Q2-FY24. The following observations can be made:

Sector-wise performance

In terms of sector wise performance, net sales in 19 sectors have been higher than the sample average which is 4.3% (excl. miscellaneous). However, when compared with last year, only 7 sectors have seen higher growth in net sales relative to the same quarter last year. These include: banks, finance, real estate, electricals, mining, healthcare and media and entertainment. For net profits, the number of sectors showing higher growth than the average of 22.1% are 16. Even when compared with the same period last year, 11 sectors show higher growth in profits. Hence, clearly the profit picture which seems upbeat at an overall level requires a much closer look.

As has been the case for the last few quarters, banks have continued to perform extremely well in Q2-FY24 as well, with both profits as well as sales increasing by more than 20%. Buoyant credit demand, along with higher interest rates and improved asset quality has helped profitability of banks. This is also true for the finance sector as well which comprises of NBFCs and HFCs etc.

Infrastructure oriented industries and capital goods have also done reasonably well in Q2- FY24. This also holds true for real estate and construction materials. On the other hand, despite some traction in sales, profits in mining and non-ferrous metals remained negative. Services continued to do well supported by pent-up demand. This is especially true for hospitality which exhibited double-digit growth in both sales and profits. On the other hand, both net sales and profit growth in the retail sector remained muted amidst a drop in discretionary spending and delay in festive season.

The performance of IT services has remained downbeat this quarter amidst a challenging global macro-economic environment.

Auto sector has also recorded a good performance this quarter with both sales and profits registering double-digit growth. Strong demand, easing semi-conductor issues and lower commodity prices aided this performance. However, the performance of other consumer goods, such as FMCG and consumer durables was somewhat dismal, with both registering muted sales growth. Weak rural demand due to delayed and patchy monsoon as well as shift in festive season were the primary reason for the weak performance.

Some key takeaways from investor presentations for key sectors has been summarized below.

FMCG - Major players indicated a significant divergence between rural and urban demand - Rural demand continued to be weak - Erratic rains and high food inflation impacted demand - Delay in festive season also impacted sales - Prices of raw materials have eased - Increased competition including from small regional players has also impacted growth - Price cuts by some companies in certain segments - Inventory levels were higher due to stocking up ahead of the festive season - Market players positive on future outlook amidst festive demand, easing liquidity pressure, government spending and pickup in domestic growth - Rural demand to also get a boost from lower inflation, higher MSPs and good kharif sowing - Risks remain from volatility in global commodity prices, geo-political uncertainties and El-Nino shock

Real estate

Housing demand remained upbeat in Q2FY24 despite it being a seasonally weak quarter - Steady domestic growth along with a pause in RBI’s interest rate cycle and moderation in inflation has lifted consumer sentiments - Demand shifting towards premium and larger configuration segments - Companies foresee a further uptick in sales during the festive season and are responding with new launches

Gems and jewellery

Sales maintained a healthy momentum despite seasonal factors - Profits were however lower due to elevated gold prices - Lower export demand due to challenging global outlook continue to weigh on future outlook - Festive demand and upcoming marriage season are key tailwinds.

Automobiles

Sector witnessed strong growth in both sales and profits - Led by softening commodity prices and easing supply-chain disturbances related to semi-conductors, raw material costs eased further - Sale of passenger vehicles and commercial vehicles outperformed - Weakness in rural demand manifested in lower sales volumes of two-wheelers and tractor sales - Demand for EVs was robust despite FAME-II subsidy cut - Outlook for H2 is positive on the back of a gradual decline in inflation, festive demand, seasonality, improved supplies and new launches.

Cement

Demand for construction materials including cement boosted by buoyancy in infrastructure sector and housing demand - Cement prices have also edged up due to higher demand 6 - Input costs have come down - Cement demand is poised to grow further fuelled by continued focus on infrastructure sector and real estate sector

Paints

Erratic rainfall and delayed festive season impacted business - Rural demand lagged urban - Traction was seen in luxury segment - Exports were impacted by weakness in global demand and currency depreciation - Input prices moderated - Outlook is positive supported by festive and marriage season, pickup in construction sector and government’s capex - Headwinds remain from escalation in the war in Middle-East and its impact on commodity prices and global demand Fertilizers - Prices of raw materials have moderated but showed an upward trend from Aug’23 - Sales was impacted due to decline in government subsidy under the NBS and erratic rainfall - Decline in import prices of P&K fertilizer impacted sale growth - Urea sales lower due to lower gas prices –

Fertilizers prices are inching up due to demand and supply mismatch these include phosphatic fertilizers such as DAP, NPK, MOP - Forecast of a normal North-East monsoon bodes well for the sector in the coming quarter

Crude oil - Oil marketing companies (OMCs) registered a stellar growth in profits amidst improved margins due to lower oil prices globally.

Iron and steel

Robust demand for steel due to increase in auto production and government spending - Weak demand from overseas markets, especially Europe - Prices of raw materials such as coking coal and iron ore have increased but the impact will be felt in next quarters - Outlook for H2 is positive with strong double-digit growth expected led by government’s infra spending, PLI, demand from housing and auto sector - Rural demand also poised for a revival - Private sector capex expected to pick up amidst high capacity utilization and deleveraging.

Hospitality

Improvement in revenues and profits of hotels - Demand continues to be strong - Foreign travel still recovering - Both average room rate (ARR) and revenue per available room (RevPAR) have posted solid gains, especially in the luxury segment - Supply continues to lag behind demand - Positive impetus from G-20, ICC Men’s World Cup and marriages.

Textiles

Retail demand remained weak due to drop in discretionary spending - Global macro landscape also unfavourable - Issues with domestic availability of cotton and high import duties - Signs of improvement particularly for woven fabrics - While demand is expected to improve gradually, lower production of cotton poses a big risk to the industry.

Concluding remarks

Corporate performance in Q2FY24 has been broadly in line with the trend seen last quarter. While profit growth has seen a marked improvement, sales growth has been much more sombre. A correction in commodity prices and the resulting decline in input costs for companies has contributed to the uptick in profits. However, various sectors have performed differentially. Even so, performance of banks and financial institutions has been consistently remarkable. Apart from this, infrastructure linked industries have also continued to perform well amidst the government’s big capex push. Auto, real estate and hospitality industries are also benefitting from pent-up demand and changing consumer preferences amidst emergence of a growing middle-class. On the other hand, other consumer driven sectors such as FMCG, consumer durables etc. have been impacted due to weak rural demand due to patchy monsoon, elevated food inflation and delay in festive season. On the positive side, the outlook for almost all sectors looks bright with companies betting big on the festive demand. Positive tailwinds will also come from lower commodity prices and a dip in domestic inflation. However, this will be contingent on a pickup in rural demand which in turn will demand. While kharif sowing has progressed well despite some irregularities, concerns remain over the rabi crops due to low reservoirs level in the country.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)