PV wholesales are expected to grow in single digits on an aggregate level due to waning demand trends and a comparably elevated baseline

The research department,

Mumbai, January 5, 2024:

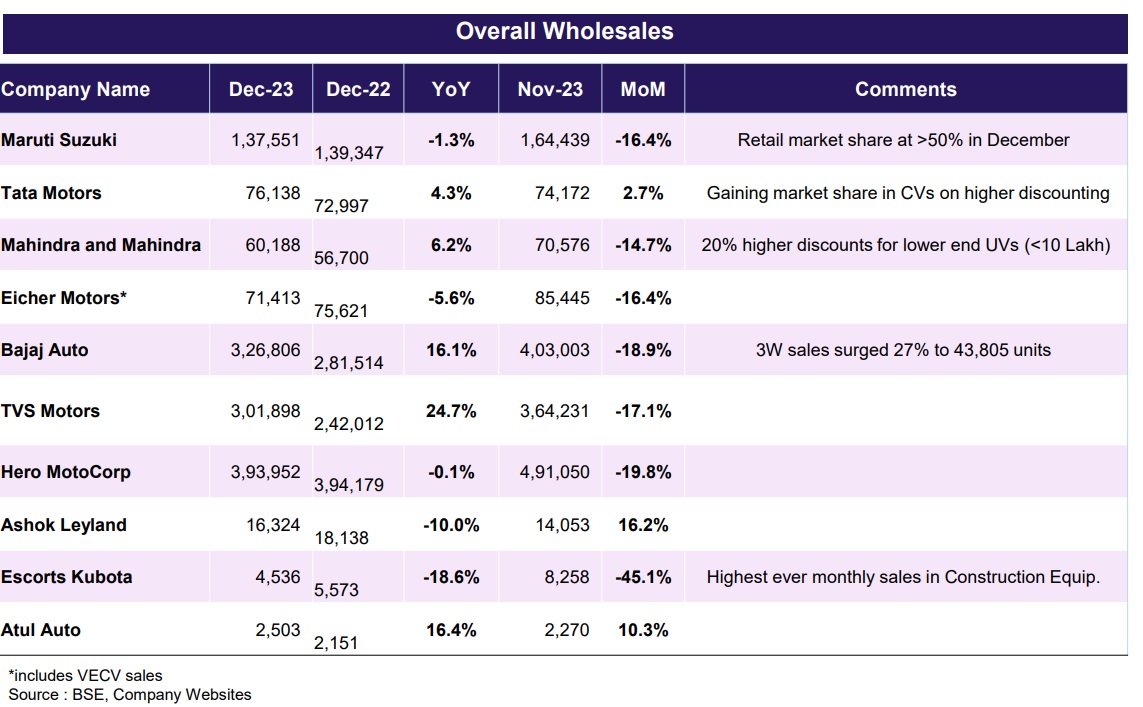

Passenger Vehicles

In line with expectations, passenger vehicle dispatches in December were a mixed bag. The PV numbers reflected robust growth in the demand utility segment, while the small car segment continued to grapple with sustained sluggishness despite steep discounts. The entry level segment now makes 30% of industry vs 35% last year. It is to be noted that wholesales in December is seasonally low as OEMs focus on inventory destocking during the month. The price hikes announced from January 2024 led to some pre-buying in the popular models of Maruti Suzuki. Additionally, there is an uptick in emission-friendly products (CNG & EV) as customers find the higher mileage and lower cost of ownership attractive. Looking ahead, we expect PV wholesales to grow in single digits on an aggregate level due to waning demand trends and a comparably elevated baseline.

Maruti Suzuki Domestic PV wholesales declined 6.5% YoY in December, owing to weak demand in the entry-level segment despite higher discounts of Rs. 20,000-20,500 per vehicle. However, its SUV portfolio continued its growth trajectory and registered 39% YoY growth. Maruti’s SUV market share has increased to over 20% compared to 10% last year mainly owing to its mid-SUV Grand Vitara which sold 114,000 units in 2023 vs 34,000 in 2022. Overall, the company’s market share ticked up marginally to 41.7% in 2023 from 41.5% in 2022. Maruti's retail market share in December was above 50% which shows that retail demand is intact.

Mahindra & Mahindra Mahindra sold 35,171 SUVs in the month of December domestically, recording a 24% YoY growth on strong demand for the XUV300 (W8 variant) and XUV700 (AX5 variant) which were the highest-selling models. However, the company struggled in exports which declined 41% YoY to 1,178 units due to the company facing supply challenges on select parts which it hopes to mitigate in the coming months.

Tata Motors Tata Motors PV dispatches grew 8% YoY to 43,675 units, owing to healthy demand for its CNG portfolio and electric options. Despite coming off a high base, Tata’s moderate rise can be attributed to the sharp growth registered in emission-friendly product categories. The company also observed strong growth in the hatchback segment, defying the prevailing industry-wide weakness.

Two Wheelers

Indian two-wheeler dispatches were a mixed bag in December, with Bajaj and TVS exceeding expectations and Hero MotoCorp and Eicher Motors falling short of their flat growth expectations. Domestic demand remained healthy on the retail side, especially in the northern states compared to the west/south as rural income was impacted in these regions due to uneven rainfall. This should help Hero MotoCorp recover market share as it is the market leader in most of the northern states. With increased government spending and improved liquidity, encouraging farm activity, and the upcoming marriage season, we anticipate a positive momentum in the fourth quarter of this fiscal year. The electric vehicle (EV) adoption in the country has grown about 50% in 2023. The registrations of EVs in the country rose to 15.13 lakh units in 2023 from 10.25 lakh units in the previous year. Within the EV segment, two-wheelers continue to lead the space. The registrations of two-wheeler EVs in the country grew 34% YoY to 8.49 lakh units in 2023. Though electric two-wheeler sales increased, only a handful of players - either legacy automotive manufacturers or deep-pocketed startups - ruled the space this year. For instance, IPO-bound Ola Electric witnessed around a 140% surge in its vehicle registrations in 2023 to 2.62 lakh units from 1.10 lakh units last year. Similarly, Ather Energy, which raised around Rs. 1,000 crores this year in fresh funding, witnessed an over twofold rise in its vehicle registrations to 1.04 lakh units.

On the other hand, legacy two-wheeler player, TVS Motors, emerged as one of the key names in the EV segment this year, with its vehicle registrations increasing 250% YoY to 1.65 lakh units in 2023. Hero MotoCorp and Bajaj Auto also saw a big increase in their EV registrations. While some of these top players were embroiled in FAME-II controversies and saw a muted start to 2023, they managed to regain momentum by August. This growth was fuelled by rising fuel prices and lower operating costs, making e-bikes an increasingly wallet-friendly option. With an expansion to smaller towns, new model launches and manufacturing capacity scaling up, we estimate 2- wheeler EV sales to swell past a million sales in 2024.

TVS Motors

TVS dispatches in December grew 25% YoY owing to robust growth in domestic 2W (up 33% YoY) sales as well exports (up 13% YoY). While the Apache series comprising seven models is seeing strong demand, the Raider has carved a niche of its own. Its key international markets have sustained positive growth and the momentum will improve further. TVS’ iQube sold 11,232 units in December, up 1.5% YoY. In CY23, TVS iQube sales soared 216% to 187,181 units, solidifying its position as the second biggest EV OEM and a 19% market share.

Hero MotoCorp Hero

MotoCorp’s wholesales in December were marginally lower as domestic demand has come off the festive highs and some level of inventory clearance for less popular models also took place. Exports did well by posting a growth of 26% YoY as macroeconomic conditions improved in key markets. Further consolidating its market leadership, Hero sold around 55 lakh units in CY23, marking a growth of 5% over 52.5 lakh units in CY22. In December, the company announced its partnership with Ather Energy for an interoperable fastcharging network across India. Through this collaboration, EV users will be able to seamlessly use both VIDA and Ather grids across the country. The combined network will cover 100 cities with over 1,900 fast-charging points.

Eicher Motors

Royal Enfield recorded robust 13% YoY growth in its November sales amid robust domestic performance. Exports also registered a slight improvement of 2.2% YoY to 5,114 units but the monthly growth of 47% indicates a strong demand revival in key markets on easing of inflation. In November, the company introduced its much-awaited facelift of Himalayan 411, which comes at a starting ex-showroom introductory price of Rs 2,69,000.

Bajaj Auto

Exceeding expectations, Bajaj registered a robust 28% YoY growth in domestic market on robust double-digit growth in both 2Ws (up 26% YoY) and CVs (up 41% YoY). Exports grew marginally despite healthy demand as certain disruptions were encountered as a consequence of the challenges arising from the Red Sea issue, leading to delays in shipments within specific regions of Latin America and Africa. Going forward, we have an optimistic outlook for exports in the fourth quarter of this fiscal year.

Commercial Vehicles

CV OEMs reported lackluster wholesales for December, with most manufacturers reporting a decline in bulk products (LCVs) and strong but mixed growth across OEMs in the HCV segment. Major reasons for the decline include decreased freight demand, discounts being slashed post the festive season, and a lack of liquidity. However, the passenger carrier segment continued its robust trend and registered double-digit growth across OEMs driven by order wins in various state transport departments. Going forward, we believe that tonnage upgradation led replacement and acceleration in the implementation of scrappage policy will drive demand in FY25. It is estimated that there are ~11 lakh MHCVs (which is >20% of the on-road population, and 3x FY19 MHCV peak sales volumes) that need to be replaced and would be eligible for scrapping incentives. The government’s infrastructure initiatives, expansion in core industries, and sustained growth in e-commerce are also positives for the CV industry.

Mahindra & Mahindra Mahindra’s CV arm posted an overall ~8% YoY decline due to subdued demand for its LCVs < 3.5T, whereas its MHCV segment registered robust growth of 170% YoY. Its Electric 3W has done well, leading to overall 3W growth of 5%.

Tata Motors Tata’s CV wholesales were flat in December as healthy growth in HCV (up 10% YoY), ILMCV (up 8% YoY), and Bus (up 14% YoY) segments were offset by a 14% YoY decline in the LCV segment. Notably, Tata is gaining market share by offering higher discounts of ~100-200 bps in North Indian states like Haryana and Punjab.

Ashok Leyland Ashok Leyland registered a 10% YoY decline in December, owing to weak demand, inventory destocking, and lower discounts post-festive season. However, the bus segment continues to perform and registered 30% YoY growth due to strong demand from various state authorities and fleet operators. VECV Against expectations, Eicher’s CV business registered an 11% YoY growth on healthy demand across segments. Bus volumes grew 50% YoY followed by HD trucks (up 9% YoY) and LMD trucks (up 3% YoY).

Tractors

Tractor wholesales disappointed in December, with a double-digit drop due to weak rural sentiment owing to delayed crop harvest and subdued Rabi sowing. Retail demand also has slowed down as the festive season waned off and benefits related to government-led subsidies announced in the budget have not effectively reached customers. We believe that high-end tractors (40+ HP) will see a rise in demand going forward as new generation takes up agriculture, while the old-time farmers still prefer ~30HP tractors. Mahindra & Mahindra Domestic wholesales fell 17% in December as the retail sector experienced a deceleration in momentum owing to the customary reduction in agricultural activities during December. The announcement of increased horticulture production and the ongoing government backing for the agricultural sector is anticipated to bolster demand for tractors going forward.

Escorts Kubota In December, Escorts reported an 18.6% decline in tractor sales. However, their construction equipment segment registered their highestever monthly sales of 711 units, up 68% from December 2022. Amidst a surge in the nationwide infrastructure development initiatives, the construction equipment sector exhibited resilient performance across various segments in the ongoing fiscal year. We anticipate the demand momentum to persist as the government intensifies its focus on expediting project implementation and increased adoption of cutting-edge technologies and sustainable methodologies.

A link to disclaimer of StoxBox: