The increase in footfalls and expansion of store footprint, streamlining of operations driving margin improvement

FinTech BizNews Service

Mumbai, July 19, 2024: Reliance Industries Ltd today declared Q1 FY25 results. It reported a consolidated revenues at Rs257,823 crore ($30.9 billion), up 11.5% Y-o-Y for the Q1 FY25.

Reliance Retail

• Reliance Retail’s Gross Revenue for the June 2024 quarter grew 8.1% Y-o-Y to Rs75,615 crore

• Reliance Retail’s quarterly EBITDA at Rs5,664 crore which was up by 10.5% Y-o-Y, led by increase in footfalls and expansion of store footprint, streamlining of operations driving margin improvement

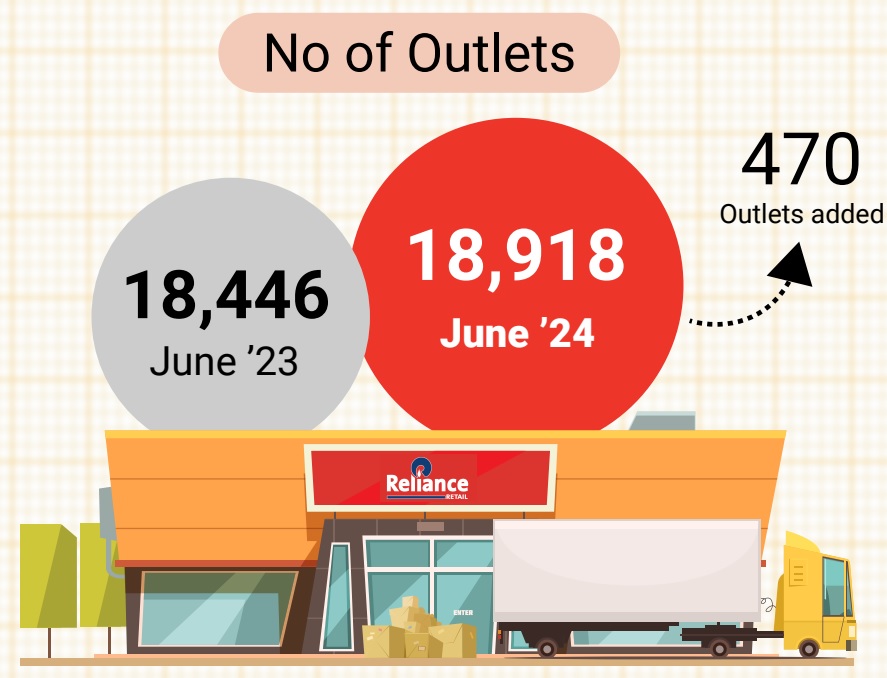

• Reliance Retail expanded its store network with 331 new store openings taking the total store count to 18,918, with area under operation at 81.3 million sq. ft. The quarter recorded footfalls of over 296 million, a growth of 18.9% Y-o-Y

• The registered customer base grew to 316 million, making Reliance Retail one of the most preferred retailers in the country. The total transactions recorded were at 334 million, up 6.4% Y-o-Y.

Consumer Electronics

• Consumer Electronics business growth led by customer walk-ins and increasing average bill value.

• Digital stores delivered steady growth led by summer season for AC’s, refrigerators and events like T20 world cup and IPL for TVs

• resQ, the services business, added over 50 service centers, expanding the reach to 1,200+ centers. The business launched on-demand services across 45 cities. • Own brand / PBG introduced several new products across categories even as it continued to grow its merchant base which was up over 100% Y-o-Y.

• JioMart Digital business growth was driven across categories. The business expanded its merchant base by 14% Y-o-Y. Fashion & Lifestyle

• The business remained focused on continuously refreshing assortment in line with emerging trends and expansion of store footprint. This has helped business maintain fashion newness in the stores providing customers with a better shopping experience every time they visit.

• With customers continuing to enjoy their shopping in new formats for their fashion needs, business has been scaling up new formats such as Yousta, Azorte, GAP etc. • AJIO delivered steady performance as it expanded its product catalogue by over 20% compared to last year and added over 1.9 million customers. AJIO successfully executed its flagship marketing property ‘Big Bold Sale’ with 21% higher traffic and 50% higher conversions against business as usual.

• Premium Brands business continued to lead premium and luxury segment with widest portfolio of brands. Business added new brands and collections during the period to the Sephora business which is a destination for beauty shopping. The business also added new stores to the network of Pret A Manger to further strengthen its F&B business.

• AJIO Luxe delivered robust growth with options count increasing by 39% Y-o-Y and brand portfolio crossing 700 brands.

• Jewelry delivered steady growth driven by launch of multiple new collections led by ‘Vindhya’ for Akshay Tritiya and ‘Vivaham’ wedding collection. The business benefited from its outreach to customers during events and festivals particularly during Akshay Tritiya. Grocery • Grocery delivered another quarter of steady growth led by big box formats and expansion in Tier 2 and beyond cities.

• The business successfully executed ‘Summer Ready Sale’ (up 30% Y-o-Y) and ‘Full Paisa Vasool Sale’ (up 32% Y-o-Y) events during the period as customers continued to enjoy the wide choice of offers across categories.

• The growth was broad based with pulses and cereals and non-food categories registering strong growth. Seasonal categories like ice-creams, cold drinks etc. performed well as customers enjoyed these products during the summer season.

• Grocery New Commerce business continued to expand its kirana partner base as Metro format scaled with 30 new store openings taking the count to over 200 stores with presence across 180+ cities

JioMart

• JioMart delivered steady performance with average bill value growing by 16% Y-o-Y. Notably, the non-grocery categories continue to do well with >50% growth in average bill value led by consumer electronics.

• The option count continued to grow with its seller base growing by 69% Y-o-Y giving customers access to a wider product catalogue to choose from.

• The business enhanced customer experience through addition of new functionalities to the platform. Notable ones were enabling category access from home page, weight variant drop down enabled for grocery amongst others.

Consumer Brands

• Consumer brands continue to deliver growth across categories as it deepens its presence in general trade channel which delivered 150%+ Y-o-Y revenue growth. • Many new products were launched under the brands of Maliban, Ravalgaon, Campa and Independence strengthening our bouquet of products across categories.

Isha M Ambani | Executive Director, RRVL, said: “Reliance Retail delivered resilient performance during the period and strengthened its position as India's foremost retailer. The steady expansion and growth of our retail business not only signifies our commitment to customer centricity but also mirrors the resilience and vitality of the Indian growth narrative.”