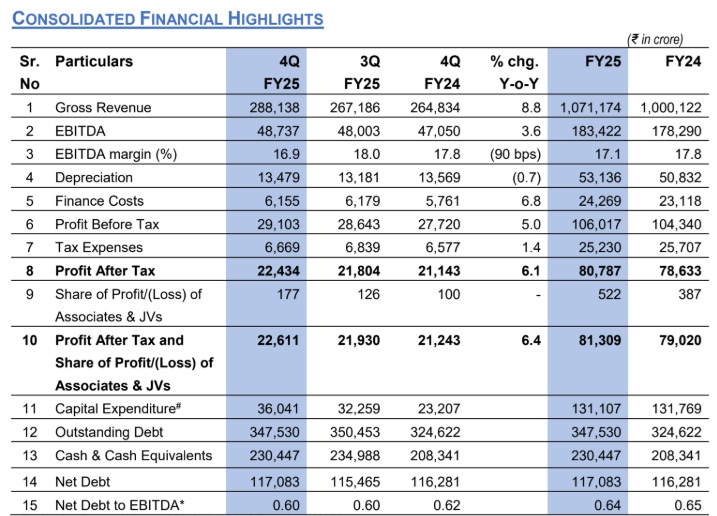

ANNUAL CONSOLIDATED PROFIT AFTER TAX AT Rs81,309 CRORE ($ 9.5 BILLION), UP 2.9% Y-O-Y

FinTech BizNews Service

Mumbai, April 25, 2025: The Board of Directors of the Reliance Industries Limited (RIL) today declared its audited financial results for the quarter and year ending March 31, 2025.

Following is the Financial and Operational Performance of Reliance Industries Limited (RIL) for the Quarter and Year ended 31st March 2025.

Annual Performance

• Gross Revenue increased by 7.1% Y-o-Y to Rs 1,071,174 crore ($ 125.3 billion)

o JPL revenue increased by 16.9% Y-o-Y led by higher ARPU on account of tariff revisions for

mobility services and improving subscriber mix. Strong growth in home connects and scale up of

digital services also contributed to revenue growth.

o RRVL revenue increased by 7.9% Y-o-Y led by growth in consumer electronics and grocery

consumption baskets.

o Oil to Chemicals (O2C) revenue improved by 11.0% Y-o-Y with higher volumes and increased

domestic product placement - Gasoline (+42%), Gasoil (+33%), ATF (+62%).

o Oil and Gas segment revenue increased by 3.2% due to higher volumes from KGD6 and CBM

blocks.

• EBITDA increased by 2.9% Y-o-Y to Rs 183,422 crore ($ 21.5 billion)

o JPL EBITDA increased by 16.8% Y-o-Y driven by strong revenue growth and sustained high

EBITDA margin.

o RRVL EBITDA increased by 8.6% Y-o-Y driven by strong productivity gains with recalibration of

store network.

o O2C EBITDA reduced by 11.9% on account of a weak margin environment across transportation

fuels and downstream chemical deltas. Earnings were supported by higher volumes, operational

flexibility, efficient feedstock sourcing and better capture of domestic margins.

o Oil and Gas segment EBITDA increased by 4.9% tracking higher revenues and improved

operating margins.

• Depreciation increased by 4.5% Y-o-Y to Rs 53,136 crore ($ 6.2 billion).

• Finance Costs increased by 5.0% Y-o-Y to Rs 24,269 crore ($ 2.8 billion), primarily due to higher

average liability balances.

• Tax Expenses declined by 1.9% Y-o-Y at Rs 25,230 crore ($ 3.0 billion).

• Profit After Tax and Share of Profit/(Loss) of Associates & JVs increased by 2.9% Y-o-Y to Rs

81,309 crore ($ 9.5 billion).

• Capital Expenditure for the year ended March 31, 2025, was Rs 131,107 crore ($ 15.3 billion).

Quarterly Performance (4Q FY25 vs 4Q FY24)

• Gross Revenue increased by 8.8% Y-o-Y to Rs 288,138 crore ($ 33.7 billion)

o JPL revenue increased by 17.8% Y-o-Y due to increased subscriber base across mobility and

homes, and sustained impact of the tariff hike.

o RRVL revenue increased by 15.7% Y-o-Y with growth across consumption baskets.

o Oil to Chemicals (O2C) revenue improved by 15.4% Y-o-Y due to increased volumes and broader

domestic product footprint.

o Oil and Gas segment revenue decreased by 0.4% due to lower gas production and lower oil

offtake from KGD6, partly offset with higher gas price realisation in KGD6 Field and higher CBM

production.

• EBITDA increased by 3.6% Y-o-Y to Rs 48,737 crore ($ 5.7 billion)

o JPL EBITDA increased by 18.5% Y-o-Y driven by strong revenue growth and improved margins.

o RRVL EBITDA increased by 14.3% Y-o-Y with improved operational efficiencies and superior

store operating metrics.

o O2C EBITDA reduced by 10.0% due to fall in transportation fuel cracks and polyester chain

margins partially offset by higher volumes and feedstock cost optimization.

o Oil and Gas segment EBITDA decreased by 8.6% on account of higher operating cost due to one-

time maintenance activity and a natural decline in KGD6 volumes.

• Depreciation was steady Y-o-Y to Rs 13,479 crore ($ 1.6 billion).

• Finance Costs increased by 6.8% Y-o-Y to Rs 6,155 crore ($ 720 million), primarily due to higher

average liability balances.

• Tax Expenses increased by 1.4% Y-o-Y to Rs 6,669 crore ($ 780 million).

• Profit After Tax and Share of Profit/(Loss) of Associates & JVs increased by 6.4% Y-o-Y to Rs 22,611

crore ($ 2.6 billion).

• Capital Expenditure for the quarter ended March 31, 2025, was Rs 36,041 crore ($ 4.2 billion).

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited said: “FY2025 has been a challenging year for the global business environment, with weak macro-economic conditions and a shifting geo-political landscape. Our focus on operational discipline, customer-centric innovation and fulfilling India’s growth requirements has helped Reliance deliver a steady financial performance during the year.

The Oil to Chemicals business posted a resilient performance despite considerable volatility in energy markets. Significant demand-supply imbalances in downstream chemicals markets have led to multi-year low margins. Our business teams ensured optimization of integrated operations and feedstock costs to enhance margin capture across value chains. The Oil & Gas business recorded its highest ever annual EBITDA led by higher production from our KGD6 and CBM blocks.

The Retail segment also delivered consistent growth. In FY25, the business focused on a strategic

recalibration of our store network, aimed at improving operational efficiencies and long-term sustainability.

Our enhanced product catalogue and user experience across all formats, strengthened customer engagement. The quick hyperlocal deliveries initiative has also gained significant traction in the market, connecting strongly with the users. Our suite of omni-channel offerings and wide-spread presence will enable Reliance Retail to continue delivering superior value to all its customers.

Our Digital Services business achieved record revenue and profit numbers. Steady increase in subscriber base, with an improving mix and increasing user engagement metrics boosted earnings. Strong adoption of our 5G services and our home broadband offerings continues with accelerated addition in subscribers and in the number of home-connects. Jio continues to invest in innovation, focusing on AI capabilities and next generation technologies, which will shape India’s digital future.

During FY25, we have laid a strong foundation for our projects in renewable energy and battery operations. In the coming quarters, we will see the transition of this business from incubation to operationalization. I firmly believe that the New Energy growth engine will create significant value for Reliance, for India and for the world.”