Mukesh D. Ambani: I am happy to share that this year, Reliance became the first Indian company to cross the Rs 100,000-crore threshold in pre-tax profits

FinTech BizNews Service

Mumbai, April 22, 2024: Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited, today announced the financial and operational performance of Reliance Industries Limited (RIL) for the quarter and year ended 31st March 2024.

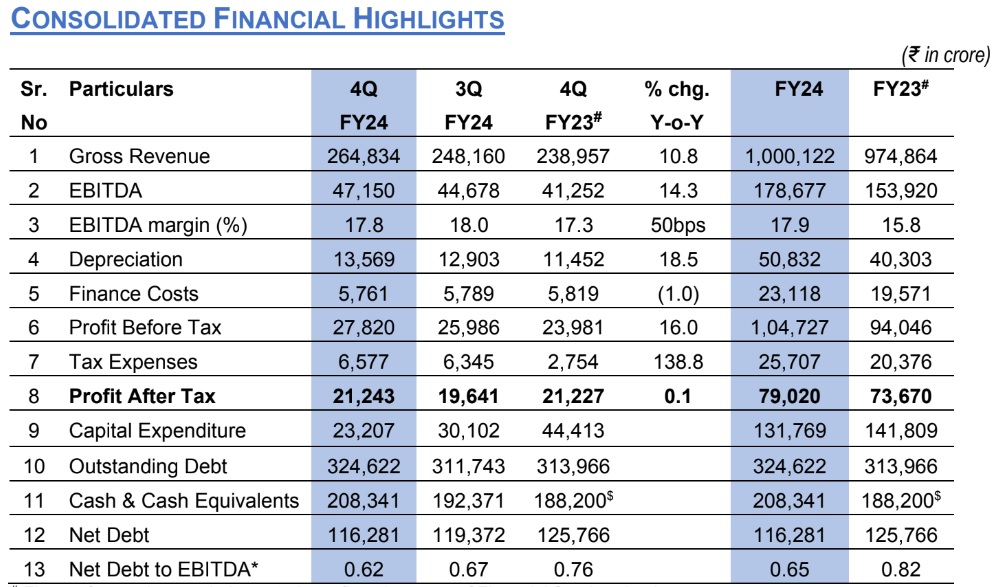

•RECORD ANNUAL CONSOLIDATED REVENUE AT Rs 1,000,122 CRORE ($119.9 BILLION), UP 2.6% Y-o-Y.

•ANNUAL CONSOLIDATED EBITDA AT Rs 178,677 CRORE ($21.4 BILLION), UP 16.1% Y-o-Y

•ANNUAL CONSOLIDATED PBT CROSSES Rs 100,000 CRORE, AT Rs 1,04,727 ($12.6 BILLION), UP 11.4% Y-O-Y

•QUARTERLY CONSOLIDATED EBITDA AT Rs 47,150 CRORE ($5.7 BILLION), UP 14.3% Y-o-Y

Annual Performance

• Gross Revenue was Rs 1,000,122 crore ($ 119.9 billion), up 2.6% Y-o-Y, supported by continued

growth momentum in consumer businesses and upstream business.

o Revenue for JPL increased by 11.7% Y-o-Y, led by robust subscriber growth of 42.4 million

across mobility and homes and benefit of mix improvement in ARPU.

o Revenue for RRVL grew by 17.8% Y-o-Y with strong growth across all consumption baskets,

gross area addition of 15.6 million sq. ft.and record footfalls of over a one billion.

o O2C revenue decreased by 5.0% primarily on account of lower product price realization

following a 13.5% Y-o-Y decline in average Brent crude oil prices. This was partially offset by

higher volumes.

o Revenue from Oil & Gas segment increased significantly by 48.0% mainly on account of higher

volumes from KG D6 block (+56.8%), despite lower gas price realisation from KG D6 field.

• EBITDA increased by 16.1% Y-o-Y to Rs 178,677 crore ($ 21.4 billion) with positive contribution from all key operating segments.

o JPL EBITDA increased 12.8% Y-o-Y with higher revenue and margin improvement.

o RRVL EBITDA increased sharply by 28.5% Y-o-Y with margin expansion of 60 bps to 8.4%.

o O2C EBITDA increased marginally, supported by optimized feedstock sourcing and strong

domestic demand in a challenging margin environment.

o Oil and Gas EBITDA increased sharply by 48.6%, led by higher gas and condensate production

with the commissioning of the MJ field during the year.

• Depreciation increased by 26.1% Y-o-Y to Rs 50,832 crore ($ 6.1 billion) on expanded asset base

across all the businesses, higher network utilization in Digital Services business and ramp-up in upstream production.

• Finance Costs increased by 18.1% Y-o-Y to Rs 23,118 crore ($ 2.8 billion) due to higher liability

balances and higher market interest rates.

• Tax Expenses increased by 26.2% Y-o-Y to Rs 25,707 crore ($ 3.1 billion) on account of utilization of tax credits in previous financial year.

• Profit after tax increased by 7.3% Y-o-Y to Rs 79,020 crore ($ 9.5 billion).

• Capital Expenditure for the year ended March 31, 2024, was Rs 131,769 crore ($ 15.8 billion) with investments in pan-India 5G roll-out, expansion of retail infrastructure and new energy business. This excludes amount incurred towards spectrum and is adjusted for capital advances and regrouping of assets.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Gross Revenue was Rs 264,834 crore ($ 31.8 billion), up 10.8% Y-o-Y, supported by double-digit

growth in O2C and consumer business. Oil & gas segment revenues increased sharply by 42.0% with higher volumes from KG D6 block.

• EBITDA increased by 14.3% Y-o-Y to Rs 47,150 crore ($ 5.7 billion) with strong contribution from all businesses.

o JPL EBITDA increased 12.5% Y-o-Y with higher revenue driven by sustained momentum in

subscriber additions.

o EBITDA for RRVL increased sharply by 18.5% led by business efficiencies and a 60bps margin

expansion to 8.6%.

o Resilient O2C EBITDA despite weak margin environment. Lower transportation fuel cracks

were offset by reduced SAED impact.

o Oil and Gas segment EBITDA increased sharply by 47.5%, led by 66.4% higher gas and

condensate production from KG D6 block.

• Depreciation increased by 18.5% Y-o-Y to Rs 13,569 crore ($ 1.6 billion) on expanded asset base across all the businesses, higher network utilization in Digital Services business and ramp-up in upstream production.

• Finance Costs decreased by 1.0% Y-o-Y to Rs 5,761 crore ($ 691 million) due to lower average liability balances.

• Tax Expenses increased sharply Y-o-Y to Rs 6,577 crore ($ 789 million) due to availing of tax credits

in the corresponding quarter of the previous year.

• Profit after tax improved marginally Y-o-Y to Rs 21,243 crore ($ 2.5 billion).

• Capital Expenditure for the quarter ended March 31, 2024, was Rs 23,207 crore ($ 2.8 billion).

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited said: “Initiatives across RIL’s businesses have made a remarkable contribution towards fostering growth of various sectors of the Indian economy. It is heartening to note that alongside strengthening the national economy, all segments have posted a robust financial and operating performance. This has helped the Company achieve multiple milestones. I am happy to share that this year, Reliance became the first Indian company to cross the Rs 100,000-crore threshold in pre-tax profits.

Performance of the digital services segment has been boosted by accelerated expansion of subscriber base, supported by both mobility and fixed wireless services. With over 108 million True 5G customers, Jio truly leads the 5G transformation in India. From upgrading the hitherto 2G users to smartphones, to leading the effort of producing AI-driven solutions, Jio has proved its capability in strengthening the nation’s digital infrastructure.

Reliance Retail continued to provide customers endless choices through its robust omni-channel presence. We continue to offer product differentiation and superior offline experience through stores re-modelling and revamping of layouts. Our digital commerce platforms also provide newer solutions to users with a broad brand catalogue. Reliance Retail also works towards strengthening millions of merchants through its unique initiatives in new commerce space.

Strong demand for fuels globally, and limited flexibility in refining system worldwide, supported margins and profitability of the O2C segment. Downstream chemical industry experienced increasingly challenging market conditions through the year. Despite headwinds, maintaining leading product positions and

feedstock flexibility through our operating model that prioritises cost management, we delivered a resilient performance. The KG-D6 block has achieved 30 MMSCMD of production and now accounts for 30% of India’s domestic gas production.

We remain committed to our projects and initiatives, including those in the New Energy segment, which will bolster the company, and help it deliver sustainable growth for the future.”

OIL TO CHEMICALS (“O2C”) SEGMENT

QUARTERLY REVENUE AT Rs 142,634 CRORE ($ 17.1 BILLION), UP 10.9% Y-o-Y

QUARTERLY EBITDA AT Rs 16,777 CRORE ($ 2.0 BILLION), UP 3.0% Y-o-Y

Annual Performance

• Segment Revenue for FY24 decreased by 5.0% Y-o-Y to Rs 564,749 crore ($ 67.7 billion) primarily on

account of lower product price realization following a 13.5% Y-o-Y decline in average Brent crude oil

prices. This was partially offset by higher volumes.

• Segment EBITDA for FY24 was marginally higher at Rs 62,393 crore ($ 7.5 billion) with optimized

feedstock sourcing, advantageous ethane cracking, and lower SAED impact, although the margin

environment across transportation fuel and downstream chemicals remained weak through the year.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Segment Revenue for 4Q FY24 increased by 10.9% Y-o-Y to Rs 142,634 crore ($17.1 billion) primarily

on account of improved realization for transportation fuels segment and higher volumes.

• Segment EBITDA for 4Q FY24 marginally increased by 3.0% Y-o-Y to Rs 16,777 crore ($ 2.0 billion)

supported by advantageous feedstock sourcing, ethane cracking and higher domestic product

placement.

• Primary and secondary units were stabilized post major turnaround in previous quarter with

maximized throughput.

• Advantageous Crude sourcing from Latin America was increased to minimize crude basket cost.

• Middle Distillates production was maximized with grade mix optimization for capturing the market

arbitrage post Red Sea crisis.

• Downstream chemical production was optimized to meet captive and domestic demand with subdued Petrochemical deltas.

• Improved Gasifier performance helped in minimizing the fuel mix cost.

Business Environment

• In 4Q FY24, global oil demand rose by 1.6 mb/d Y-o-Y to 102 mb/d due to higher demand, mainly

from Americas, and Asia. Jet/Kero posted a strong Y-o-Y demand growth of ~0.69 mb/d while for

gasoline demand increased by 0.16 mb/d Y-o-Y. Diesel demand grew Y-o-Y by 0.26 mb/d.

• Dated Brent averaged $83.2 /bbl in 4Q FY24, an increase of $2 /bbl on Y-o-Y basis. Crude oil

benchmarks rose Y-o-Y as demand trend remained positive amid tanker constraints through Red sea

crisis. Continuation of voluntary production cuts by OPEC+ and reduced availability of Russian

production further supported oil prices.

• Global refinery crude throughput was lower by 0.2 mb/d Y-o-Y at 81.8 mb/d in 4Q FY24.

• Domestic demand of HSD, MS & ATF increased by 4.2%, 8.4% and 10.1% respectively over same

quarter last year.

• On Y-o-Y basis, domestic polymer and polyester demand remained flat.

Transportation fuels

Annual Performance

• Singapore gasoline 92 RON cracks eased by $3.1/bbl Y-o-Y & averaged at $11.6/bbl in FY24 vs

$14.7/bbl in FY23 mainly on increased supplies from new refineries in the Middle East and China.

However, cracks stayed supported due to lower exports from China, unplanned refinery outages and

firm demand trends.

• Singapore gasoil 10-ppm cracks declined sharply by $17.7/bbl Y-o-Y & averaged at $23.0/bbl in FY24 vs $40.7/bbl in FY23 due to resilient Russian diesel supplies despite sanctions, lower industrial activities & growing supplies from new Middle East refineries.

• Singapore Jet/Kerosene cracks declined by $11.7/bbl Y-o-Y & averaged at $21.2/bbl in FY24 vs

$32.9/bbl in FY23. Jet/Kero cracks declined in line with the gasoil cracks despite jet demand rising by

1.1 mb/d Y-o-Y in FY24 as healthy exports from China kept the market well supplied.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Singapore Gasoline 92 RON cracks fell Y-o-Y to $13.3 /bbl in 4Q FY24 from $15 /bbl in 4Q FY23.

High stock build in US compared to previous year led to lower Gasoline cracks in 4Q FY24.

• Singapore Gasoil 10-ppm cracks fell Y-o-Y to $23.1 /bbl in 4Q FY24 from 28.6 mb/d in 4Q FY23.

Cracks declined due to weak demand, ample supply from new refineries as well as from those

returning from maintenance and resilient Russian diesel exports. Also, Red Sea tension resulting in

higher freight led to lower exports from Asia to Europe keeping Asian markets well supplied.

• Singapore Jet/Kero cracks fell Y-o-Y to $21.1 /bbl in 4Q FY24 from $26.5 /bbl in 4Q FY23 amid

increased exports from China and higher freight rates.

Polymers

Annual Performance

• Polymer prices declined Y-o-Y with subdued global demand and volatile feedstock energy price

environment. Prices declined across polymer, PP price down by 11%, PE by 10% and PVC by 19%.

• In line with lower energy chain prices, key feedstock prices were also down Y-o-Y. US Ethane price

was at 23 cpg, down by 48% Y-o-Y in line with lower US gas prices. Singapore Naphtha price was at

$ 621/MT, down by 11% Y-o-Y. EDC price decreased by 20% Y-o-Y.

• Polymer margins were down 8% to 21% on Y-o-Y basis with subdued demand globally in a well-

supplied market. PE margin over Naphtha was lower at $333/MT during FY24 as against $362/MT in

FY23. PP margin over Naphtha was lower at $315/MT during FY24 as against $360/MT in FY23. PVC

margin over Naphtha & EDC was lower at $373/MT in FY24 as against $474/MT in FY23.

• FY24 polymer domestic demand improved by 14% Y-o-Y. PE was up by 20%, PP by 9% and PVC by

9%. Polymer domestic markets witnessed healthy demand from end use sectors like agrochemicals,

pipes, retail & FMCG packaging, pharma, furniture, households, consumer durables, paints,

automotive and infrastructure.

• A robust supply chain network and superior customer service supported optimal product placement in the domestic market. RIL continued to maintain leadership position in domestic polymer market.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Polymer price declined Y-o-Y with subdued global demand and volatile feedstock energy price

environment. Prices declined across polymer, PP price down by 7%, PE by 4% and PVC by 13%.

• US Ethane price was at 19 cpg, down by 23% Y-o-Y in line with lower US gas prices. Singapore

Naphtha price was at $ 661/MT, stable Y-o-Y. EDC price increased by 21% Y-o-Y amidst supply

constraint.

• Polymer margins were down 9% to 34% on Y-o-Y basis with subdued demand globally and supply

overhang. PE margin over Naphtha was lower at $308/MT during 4Q FY24 as against $340/MT in

4Q FY23. PP margin over Naphtha was lower at $300/MT during 4Q FY24 as against $367/MT in

4Q FY23. PVC margin over Naphtha & EDC was lower at $316/MT in 4Q FY24 as against $482/MT

in 4Q FY23.

• 4Q FY24 polymer domestic demand remained flat Y-o-Y. PP and PE demand improved by 7% and

6% respectively with healthy demand from retail & FMCG packaging, furniture, households, consumer durables, automotive and infrastructure. PVC demand down by 18% due to higher base effect in 4Q FY23.

Polyesters

Annual performance

• Polyester chain delta declined 6% Y-o-Y due to weaker PTA and Polyester product deltas offset by

improvement in PX and MEG delta. Polyester chain margin was $ 518/MT during FY24 as against $

550/MT in FY23.

• During FY24, PX margin over Naphtha improved Y-o-Y with higher decline in Naphtha prices

compared to product prices. PX supplies remained tight as integrated producers continued to optimise

production based on PX vs Gasoline economics. PTA margins were impacted due to large capacity

expansion mainly in China. MEG-Naphtha margins were higher with improvement in Asian MEG

prices led by higher global freights on account of Red Sea crisis and Panama Canal restrictions in 2H

FY24.

• On Y-o-Y basis, domestic Polyester demand improved by 4%. PFY demand was up by 2% while PSF

demand was down by 2% due to weak downstream demand in textiles particularly from Export market.

PET demand grew by 13% with healthy demand from beverage segment supported by cricket world

cup and surge in tourism activities.

• RIL is the only Indian company with crude to Polyester integration and continues to benefit from

integrated operations & flexibility to optimise production across chain.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Polyester chain delta declined 6% Y-o-Y due to weaker PTA and Polyester product deltas offset by

improvement in MEG delta. Polyester chain margin was at $ 486/MT during 4Q FY24 as against $

517/MT in 4Q FY23.

• During 4Q FY24, PX margin over Naphtha remained flat Y-o-Y with sluggish downstream demand

recovery post Chinese New Year.

• On Y-o-Y basis, domestic Polyester demand remained flat. PFY and PSF demand was down by 5%

and 3% respectively due to weak downstream demand from textiles. PET demand grew by 8% with

higher demand from beverage segment.

Jio-bp Update

• Reliance BP Mobility Limited (RBML) (operating under brand Jio-bp), running 1,729 country-wide retail fuel outlets, ran a country-wide brand campaign “You Deserve More”, showcasing pioneering

customer value propositions (CVPs). The campaign highlights high performance HSD & MS powered

by bespoke active technology available at prevailing market price across network.

• RBML continued to expand the portfolio of partnerships with international airlines and benefit from rapidly growing Indian aviation sector.

• To decarbonize transport, continued emphasis on EV and CBG / CNG network:

o Under Jio-bp Pulse, RBML has grown network to 4,520+ live charging points (incl. 26 of India’s

largest charging hubs with >100 CPs) at 330+ unique sites with industry leading charger uptime.

o Under Clean N Green, RBML is exclusively retailing Bio-CNG manufactured at RIL’s first batch

of 5 digestors alongside tying up with key City Gas Distribution (CDG) players to augment CNG

offering.

OIL AND GAS (EXPLORATION & PRODUCTION) SEGMENT

QUARTERLY REVENUE AT Rs 6,468 CRORE ($ 775 MILLION), UP 42.0% Y-o-Y

RECORD QUARTERLY EBITDA AT Rs 5,606 CRORE ($ 672 MILLION), UP 47.5% Y-O-Y

Annual Performance

• FY24 revenue is higher by 48.0% on a Y-o-Y basis mainly on account of higher gas and condensate

production. This was partly offset by lower gas price realisation from KG D6 and CBM Field.

• The average price realised for KG D6 gas declined in line with falling trend in international gas prices

to $ 10.1/MMBTU in FY24 vis-à-vis $ 10.6/MMBTU in FY23. The average price realised for CBM gas

was $ 14.43/MMBTU in FY24 vis-à-vis $ 21.63/MMBTU in FY23.

• EBITDA increased sharply by 48.6% Y-o-Y to Rs 20,191 crore. EBITDA margin expanded by 30 bps

to 82.6%.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• 4Q FY24 revenue is higher by 42.0% as compared to 4Q FY23 mainly on account of higher volumes

partly offset by lower price realisation from KG D6 Field.

• KGD6:

o Block KG D6 is currently producing ~30 MMSCMD gas and ~ 23,000 Bbls per day of Oil /

Condensate.

o Development Plan for Additional Wells in R and Sat Cluster for incremental production approved

by Government.

• CBM:

o 40 multi-lateral well campaign underway to augment production – 13 wells completed and 10

under production ramp up.

o RIL successfully contracted 0.9 MMSCMD of CBM from Shahdol at 12.67% of Brent + 0.78 for 2

years