Responses have been drawn from over 380 manufacturing units from both the large and SME segments with a combined annual turnover of over Rs. 4.88 lakh crores

FinTech BizNews Service

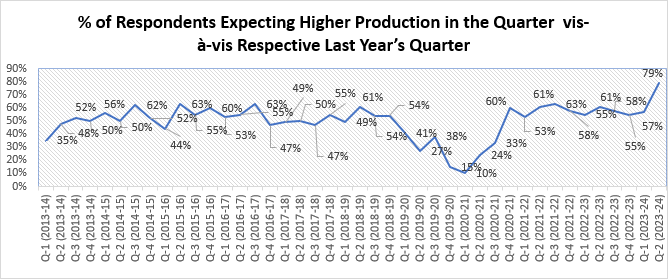

Mumbai, 13 November 2023: FICCI’s latest quarterly survey on Manufacturing reveals that momentum of growth has accelerated in Quarter 2 of 2023-24 which is likely to continue for the subsequent quarters of FY 2023-24 as well, notwithstanding slowdown in developed nations. In the Q1 April-June 2023-24, 57% of the respondents reported higher production levels. Further, over 79% of the respondents shared higher level of production in Q2 July-September 2023-24. This assessment is also reflective in order books as 80% of the respondents in Q-2 July-September 2023-24 have had higher number of orders and demand conditions continue to be optimistic in Q-2 Jul-Sept 2023-24 as well.

FICCI’s latest quarterly survey assessed the performance and sentiments of manufacturers for Q-2 July-September (2023-24) for ten major sectors namely Automotive & Auto Components, Capital Goods & Construction Equipment, Cement, Chemicals Fertilizers and Pharmaceuticals, Electronics & White Goods, Machine Tools, Metal & Metal Products, Textiles, Apparels & Technical Textiles, Paper, and Miscellaneous. Responses have been drawn from over 380 manufacturing units from both the large and SME segments with a combined annual turnover of over Rs. 4.88 lakh crores.

Capacity Addition & Utilization

Table: Current Average Capacity Utilization Levels as Reported in Survey (%)

Sectors | Average Capacity utilisation |

Automotive & Auto Components | 74 |

Capital Goods & Construction Equipment | 77 |

Cement | 80 |

Chemicals, Fertilizers & Petrochemicals | 68 |

Electronics & White Goods | 74 |

Machine Tools | 73 |

Metal & Metal Products | 78 |

Miscellaneous | 68 |

Paper & Paper Products | 90 |

Textiles, Apparels & Technical Textiles | 76 |

Grand Total | 74 |

Inventories

· 85% of the respondents had either more or the same level of inventory in Q-2 July-September 2023-24, which is almost equivalent to that of the previous quarter.

Exports

· On the export front, performance seems to be better than previous quarters as over 48% of the respondents reported higher exports in Q-2 July-September 2023-24 as compared to the 33% in Q-1 2023-24. However, further improvement in export demand is required in the light of country’s growth aspiration.

Hiring

Interest Rate

Sectoral Growth

· Based on responses, Electronics & white Goods, Cement, Automotive and Machine tools have displayed strong growth and are clear outperformers.

· Whereas, sectors like Capital Goods & Construction Machinery, Chemicals, Textiles, Metals, Paper and other sectors have displayed moderate growth.

Table: Growth expectations for Q-2 FY 2023-24

Sector | Growth Expectation |

Automotive & Automotive Components | Strong |

Capital Goods & Construction Equipment | Moderate |

Cement | Moderately Strong |

Chemicals, Fertilizers & Pharmaceuticals | Moderate |

Electronics & White Goods | Strong |

Machine Tools | Strong |

Metals & Metal Products | Moderate |

Miscellaneous | Moderate |

Textiles, Apparels &Technical Textiles | Moderate |

Paper & Paper products | Moderate |

Note: Very Strong >20%; Strong 10-20%; Moderate 5-10%; Low < 5%

Source: FICCI Survey

Production Cost

· There seems to be some moderation in the cost pressures on manufacturers in Q-2 July-September 2023-24. The cost of production as a percentage of sales for manufacturers in the survey has risen for 58% respondents as compared to 77% respondents for the previous quarter.

· Nonetheless, high raw material prices and high energy cost are the two main factors contributing to the high production costs.

Workforce Availability

· Most sectors have sufficient labor force engaged in their operations and are not facing shortage of labor at factories. While 82% of our respondents mentioned that they do not have any issues with workforce availability, the remaining 18% feel that there is still lack of skilled workforce available in their sector.