How has the equity market performed?

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, March 21, 2024: There has been some discussion over the movements in stock indices in India. But if one takes a deeper look at what is happening around the world, it can be seen that stock indices in other countries too have done equally well. While the current levels in India may look higher than expected, the fact is that the world has done better than expected which is reflected in the stock indices. Further, India has been a favoured destination for FPI and we do well here on a global scale.

The report throws light on these aspects.

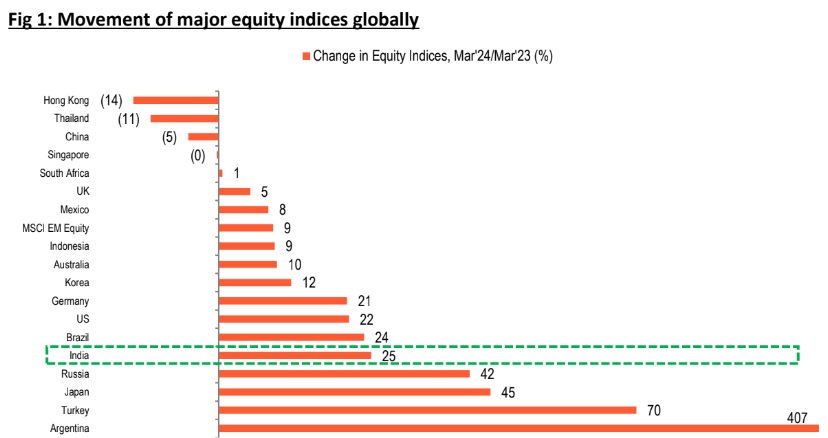

Global equity indices have broadly witnessed an uptick for the 12-month ending Mar’24 (till 18 Mar).

Amongst major indices, India has been an outperformer registering 25.5% increase in Mar’24

compared with Mar’23. This is far higher compared to MSCI EM index which witnessed an increase of

only 9.1% in the same period. This is attributable to India’s domestic resilience. In fact, second advance

estimate projection of India’s growth for FY24 has surpassed market expectations. All these factors

remained conducive to an increase in the domestic equity indices. Added to this, was buoyant FPI flows

in the equity segment. The 12-month flow for India (equity) was only next to flows to the US and Japan.

Stocks in Japan rose considerably. Liquidity conditions remained supportive from an ultra-low

rate, thus giving the equity market the desired impetus. Apart from this, widening policy

divergence with the US,sustained growth of profit of major Japanese companies and concerns

over weaker growth in China, have garnered more flows.

Equity market in Russia has performed considerably well. This is on account of growth holding

ground due to increased military spending and robust private consumption supported by

wage growth.

Stock market indices in Argentina and Turkey have also gained considerably. But these

numbers need to be read with caution as inflation is significantly higher in these regions, thus

inflating the numbers.

In the US, the equity index (Dow) has inched up by 21.7%. There has been different narrative

surrounding growth in the US, swinging from hard to soft landing. However, macro data

pointed to growth remaining stable; from better new home sales data to stickier earning data

and improvement in personal income, all pointed towards some degree of recovery.

o Even in terms of equity flows, US topped the chart garnering around ~US$ 90bn equity

flows for the 12-month period ending Mar’24 (till 15 Mar 2024). Going forward, a lot

is contingent on evolution of Fed fund trajectory, where a delayed start to the rate

cut cycle is a possibility to prevent overheating of the economy. Preferably, the timing

of the cut seems favourable in Jun’24. Post that, easier liquidity conditions would

further support equity market of the region.

In Germany as well, equity market inched up. This is despite weaker growth conditions in the

region. ECB commentary on the other hand remained broadly cautionary with cues for rate

cut along the same time as Fed.

Gains in equity markets in S. Korea, Australia, Indonesia, Mexico have remained in the median

range. In Hong Kong and China, equity indices showed significant moderation. Weak external

environment, strain in the property sector and muted domestic consumption demand have

all contributed to a fall in the indices. Investors are seeking a more holistic approach rather

than the piecemeal approach undertaken by the regulators of the region.

What has supported equity flows in India?

India has remained an outperformer on account of following reasons:

Robust growth conditions: Notwithstanding uncertain external environment, India’s growth

indicators showed considerable resilience. The government’s focus on capital spending,

improved capacity utilization of the manufacturing sector and services sector outshining

especially financial, real estate and professional services, all have been positive. Notably,

domestic flows got boosted from an increased interest of savers in Mutual Funds. Going

forward, we expect this momentum to continue. India’s growth for FY25 is projected at 7.8%.

Further with more discipline towards formalization of savings, more flows are bound to come

in the near term.

Corporate Performance remaining robust: This has instilled confidence in investors in the

domestic economy. Robust profit growth compensated for the lower growth in revenues.

Added to this was the improvement in the debt servicing capability of firms.

Government’s adherence to fiscal discipline: Progressively bringing down fiscal deficit to GDP

ratio while focusing on quality spending and less reliance on market borrowing have also

impacted investor sentiments positively, thus contributing to an increase in equity flows.

Going forward, with the expectation of the return of the current government to power would

further provide stability to the financial market in terms of continuity of policies.

Investors are convinced that inflation has peaked. This means that the direction of monetary

policy will be in downward direction though the timing cannot be conjectured as of now.

The rupee remains strong, tending towards appreciation rather than depreciation. The

fundamentals in terms of current account balance, FDI, FPI, ECBs have been quite favourable.

This is a factor that investors take into account when investing in any country.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda.

Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation

to do so for any securities of any entity. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel,

directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any

information that may be displayed in this publication from time to time.