Q2FY24 Result Update

Shreyansh Shah,

Research Analyst,

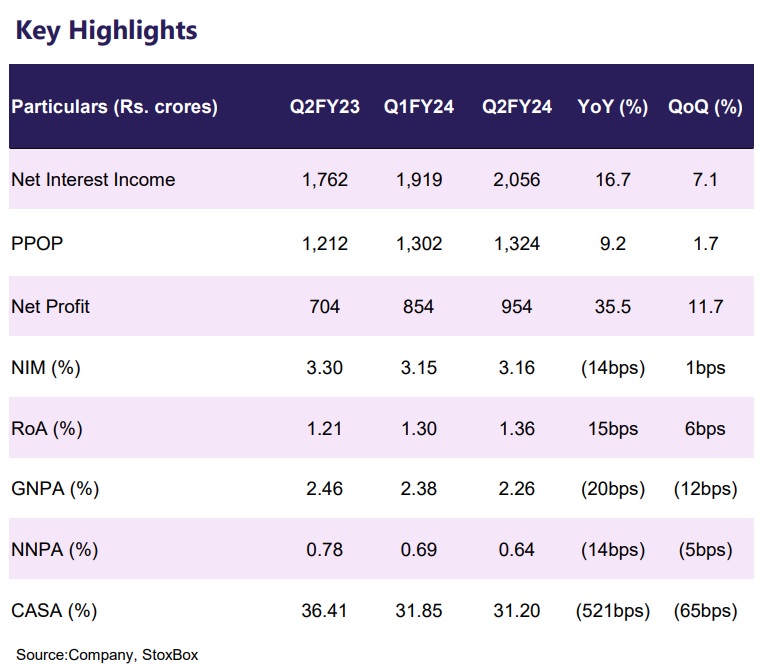

Mumbai, 20 October 2023: Federal Bank’s highest ever net profit is aided by right product mix. Net Interest Income stood at Rs2,056 crores in Q2FY24, showing a 7.2% QoQ / up 16.7% YoY growth, beating market estimates of Rs2,000 crores. Pre-provision operating profit (PPOP) stood at Rs1,324 crores in Q2FY24, registering a growth of 1.7% QoQ / up 9.3% YoY. Provisions declined significantly to Rs. 44 crores in Q2FY24 from Rs. 156 crores in Q1FY24 and Rs. 268 crores in Q2FY23. The bank’s quarterly net profit surged to Rs. 954 crores in Q2FY24, up 11.7% QoQ / up 35.5% YoY and beating market estimates of Rs. 840 crores. NIM stood at 3.16% in Q2FY24, up 1bps QoQ / down 14bps YoY, mainly due to the rise in the cost of funds. Gross NPA was the lowest in the last thirty-four quarters and stood at 2.26% in Q2FY24, down 12bps QoQ / down 2bps YoY on account of an improvement in the asset quality. Net NPA stood at 0.64% in Q2FY24, down 5bps QoQ / down 14bps YoY. Credit cost in Q2FY24 stood at 0.13%, down 28bps QoQ / down 40 bps YoY due to the decline in provisions. Cost to Income ratio advanced to 55.47% in Q2FY24 from 50.87% in Q1FY24 and 48.88% in Q2FY23 on account of the opening of new branches. Capital Adequacy Ratio climbed to 15.50% in Q2FY24 from 14.28% in Q1FY24 and 13.84% in Q2FY23, led by the increase in deposits due to the withdrawal of Rs. 2,000 notes. Gross Deposits showed robust growth and stood at Rs. 2,32,868 crores in Q2FY24, up 4.7% QoQ / up 23.1% YoY. Gross Advances stood at Rs. 1,92,817 crores in Q2FY24, up 5.1% QoQ / up 19.6% YoY. CASA declined to 31.20% in Q2FY24 from 31.85% in Q1FY24 and 36.41% in Q2FY23.

Valuation and Outlook

As expected, Federal Bank reported healthy numbers in Q2FY24 and surpassed street expectations, beating net profit estimates. The bank’s focus on commercial lending and vehicle financing alongside its NR deposits helped the increase in advances. This helped the bank not to face the brunt of NIM compression, which is expected to be seen in the overall banking sector. The bank saw remarkable momentum in its vehicle financing and registered a growth of 67% on a yearly basis. Also, its focus on commercial lending helped it to marginally improve NIMs sequentially. Although its cost-to-income ratio increased, this was primarily attributed to 23 new branches opened by the bank in this quarter. Due to the bank's focus on tieups with fintechs, DSAs and co-lending ties with many microfinance companies, the bank will be able to achieve its targeted 20% growth in FY24 and its business strategy is playing out well. We believe that the bank’s focus on growing relatively higher-yielding loan portfolios will partially shield it from the pressure of increasing cost of funds in the medium term. However, there is a high chance that NIM compression may be visible in the forthcoming quarters, but its return ratios are bound to grow and our outlook for the bank remains positive.

Key Concall Highlights

• Federal Bank achieved the highest-ever net profit in Q2FY24.

• The capital raise by the bank in Q2FY24 has bolstered the bank’s financial position and will help it to expand its business aggressively.

• It was evident that the bank had been smartly able to grow its net interest income along with NIMs in Q2FY24 due to its focus on high-yielding business. The management remains confident that this growth will be sustained in the medium term.

• NR savings (non-resident) book has been traditionally a significant part of Federal Bank’s business. However, degrowth has been observed in this segment. There has been some pivot from NR savings to NR term which has led to a structural change. Thus, the bank is becoming more prominent in the domestic business.

• Federal Bank has revised its full-year NIM guidance from 3.25% earlier to 3.22% for FY24.

• The bank management has given 18-20% credit growth guidance for FY24.

• The bank hopes to increase its share of higher-yielding assets in its loan book through business banking, commercial banking, commercial vehicles and credit cards.

• The bank saw healthy growth in its deposits in Q2FY24 and around 20bps repricing in the cost of funds have been taken place in Q2FY24. Since the major portion of its deposits are term deposits, there will repricing for another one or two quarter. This will impact NIMs going forward. However, the bank is trying to mitigate this impact by finding alternate ways to ensure the blended cost of funds is in control.

• Due to the bank’s focus on growing business aggressively, its cost-to-income ratio has seen some rise. This increase in the cost-to-income ratio is not only due to 23 new branches added in Q2FY24 but also due to volume-related variable costs and additional marketing expenses. The bank expects that the costto-income ratio will be on the rise for a few quarters.

• The bank has continuously reduced credit costs due to prudent provisioning and keeping stringent checks on its loan book. Notably, the bank has not seen any corporate banking losses for long, and its SMAs are also lower for many quarters. The bank guides that their credit costs will be in the range of 25- 30bps in FY24.

• There was no impact on NIMs due to the I-CRR, as the impact was offset by increased capital (via QIP) raised in Q2FY24.

• The bank is very well on the path to achieving 1.4% RoA by FY25, and this target may be achieved earlier. Thus, they have the luxury of spending a little more to ensure franchise expansion happens. They may do 100 branches or more in the full year or a little more this year.

A link to disclaimer of StoxBox.