We do not see any further compression in NIMs in the medium term

Shreyansh Shah,

Research Analyst, StoxBox

Mumbai, 21 October 2023: HDFC Bank’s Net Interest Income stood at Rs27,385 crores in Q2FY24, missing market estimates of Rs 28,000 crores. Pre-provision operating profit (PPOP) stood at Rs22,694 crores in Q2FY24. Provisions stood at Rs. 2,904 crores in Q2FY24. The bank’s quarterly net profit of Rs. 15,976 crores in Q2FY24 surpassed market expectations of Rs14,000 crores. After absorbing the debt-funded cost for additional liquidity and merger management, NIM stood at 3.6% in Q2FY24. Gross NPA stood at 1.34% in Q2FY24, down 7bps on a proforma merged basis as on 30th June 2023. Net NPA stood at 0.35% in Q2FY24. Capital Adequacy Ratio stood at 19.5% in Q2FY24. Gross Deposits stood at Rs. 21,72,858 crores in Q2FY24, with savings account deposits at Rs. 5,69,956 crores, current account deposits at Rs. 2,47,749 crores and time deposits standing at Rs. 13,55,153 crores. Gross Advances stood at Rs. 23,54,633 crores in Q2FY24. CASA stood at 37.6% in Q2FY24.

Valuation and Outlook

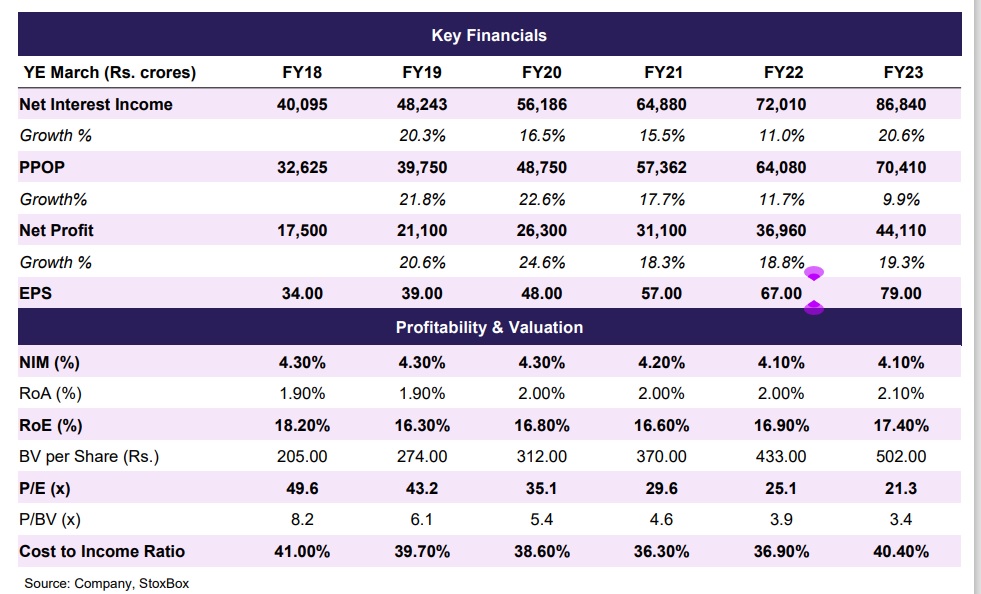

India’s largest private sector bank presented for the first time its Q2FY24 results after the merger with one of the largest housing finance lenders, HDFC Ltd., on 1 July 2023. The bank came out with decent numbers, beating street estimates for net profit in Q2FY24. However, due to the merger effect, the numbers were not comparable on an apple to apple basis. With NIMs seen contracting for banks this quarter due to the highinterest rate environment, HDFC Bank saw a sharp decline due to the merger effect (extra liquidity) and incremental CRR. However, its profitability improved, mainly contributed by treasury gains and healthy business growth. Though some aspects of the bank’s Q2FY24 numbers were expected due to the bank’s analyst meeting in September 2023, our key focus area was on the management’s commentary on the roadmap going forward. With HDFC Bank’s focus on expanding its business in commercial and rural banking (CRB) due to the revival seen in the rural economy and going aggressive on construction financing which it consummated from HDFC Ltd., we feel that the NIMs have bottomed out and we do not see any further compression in NIMs in the medium term. Furthermore, the bank’s accessibility to lower cost of funds will support the NIM expansion. A stable economy will aid the bank to grow in double digits with regards to the credit demand in the long term. On the asset quality side, we feel all adjustments due to the one-off event of the merger and transition from IND-AS to I-GAAP have been taken care in H1FY24. Going forward, due to the bank’s legacy of healthy credit profiling, we do not see any further deterioration in its asset quality and expect it to be stable. Also, due to prudence in restructuring the non-performing loans and adequate provisions by the bank, we do not see any significant uptick in the non-performing assets. With the bank’s focus on branch expansion in semi-urban and rural areas, we feel that the bank is poised to perform better in the forthcoming quarters. Also, due to the vast branch network of the bank, the bank’s subsidiaries can get access to large cross-selling opportunities, thus indirectly supporting the topline growth. Therefore, our outlook on the bank remains positive from a long-term perspective.

Key Concall Highlights

• The merger led to some one-offs on account of the debt-funded liquid assets to meet the liquidity coverage ratio as per banking norms.

• The bank had some amount of buildup of liquidity to meet the liquidity coverage ratio norms and provide an extra cushion for contingencies. However, the bank was fortunate as incremental CRR was announced, and this cushion came in extremely handy. However, this excess liquidity and incremental CRR affected the bank’s NIM by approximately 25bps.

• The bank is confident that one of the non-retail books of the erstwhile HDFC Ltd., which was restricted as per the RBI norms, will not incur any incremental cost losses on account of this book into their profit and loss statement going forward. However, some tail remains from this book, which could slip into substandard in future, but the impact on the overall bank's gross NPA will not be significant.

• The bank which consummated construction finance, which was not the area of focus before the merger, will be focused on, and strategies will be planned to grow it steadily. The segment will help contribute to the top line and its margins.

• Although the bank saw compression in NIMs, its return ratios remained intact, with RoA at around 2% and RoE at about 16.2%. The management expects these ratios to improve going forward.

• The bank’s management has given a guidance that it will sustain its RoA in the range of 1.9-2.1% in the forthcoming quarters.

• The bank’s management feels that the current retail account offers them a huge opportunity and are focused on encashing the opportunity.

• The GNPA in Q2FY24 stood at 1.34% which was slightly higher than the previous quarter. The 22bps increase can largely be attributed to restructured accounts in erstwhile non-retail HDFC Limited, which are current and performing but have been classified as NPA according to the extant guidelines.

• HDFC Bank will take steps to run down its LRD loan book (leasing, renting and development). However, it will continue to grow the construction finance loan book which it got from HDFC Ltd.

• The management does not anticipate any material changes in the bank’s fee income, which comprises 65% of its Other Income. “The management expects return ratios to improve going forward.” “The bank is confident that they will be able to recoup some of the margins due to the substitution of high-cost bonds with the bank’s deposits and restructuring of their business loans mix, which will be more focused on retail advances where the yields are higher.” “The bank’s management feels that the current retail account offers them a huge opportunity and are focused on encashing the opportunity.”

A link to disclaimer of StoxBox.