The markets started the week on a tepid note followed by a sharp recovery under the leadership of the Auto and Metal counters

Aditya Gaggar,

Director,

Progressive Shares

Mumbai, November 25, 2023:

Projects & Plans In Pipeline

India to be a USD7tn economy by 2030: CEA

PE/VC investments decline to USD3.4bn in Oct

Q2 economic growth likely at 7%, to beat RBI forecast: ICRA

COVERAGE NEWS: 20 Nov 2023-24 Nov 2023

Aurobindo Pharma Ltd: (i) The USFDA concluded a pre-approval inspection (PAI) at Units I and III, formulation manufacturing facilities of APL Healthcare, (subsidiary of Aurobindo) with zero observations. The inspection, which was conducted during 13-17th November, closed with a classification of No Action Indicated (NAI)

(ii) Evive Biotech, a global biopharmaceutical company devoted to developing novel biologic therapies and Acrotech Biopharma (Acrotech), WoS of Aurobindo Pharma USA Inc., announced that the USFDA approved Ryzneuta (Efbemalenograstim alfa) indicated to decrease the incidence of infection, as manifested by febrile neutropenia in adult patients

(iii) Auro Trading Private Ltd has been incorporated as a wholly owned subsidiary of the company to carry on trading in generic formulations business.

Cipla Ltd: The company has received a warning letter dated 17th November, 2023 from USFDA for the routine cGMP inspection conducted at its Pithampur manufacturing facility between 6th–17th February, 2023. This warning letter summarizes contraventions regarding methods or controls followed at the facility which do not conform to the prescribed cGMP regulations and contains directional guidance for necessary corrections.

Container Corporation of India Ltd: Container Corporation of India Limited (CONCOR) and Indraprastha Gas Limited (IGL) have signed a Memorandum of Understanding (MoU) to explore the possibility of setting up LNG/LCNG infrastructure within the premise of CONCOR terminals. This strategic partnership aims to revolutionize the logistics sector replacing diesel with natural gas.

Sterlite Technologies Ltd: CRISIL has reaffirmed (i) the long term rating as CRISIL AA/watch with developing implications (ii) Rs6400mn NCDs as CRISIL AA/watch with developing implications and (iii) Rs8000mn commercial paper as CRISIL A1+/ watch with developing implications.

Texmaco Rail & Engineering Ltd: The board has announced the launch of QIP at a floor price of Rs135.90 per share. The issue price will be determined by the company in consultation with the book running lead managers.

Royal Orchid Hotels Ltd: The company has inaugurated Regenta Place Igatpuri (50 room property); this represents the 14th addition to the hotel portfolio in the state of Maharashtra.

ICICI Bank Ltd: CARE Ratings Limited has reaffirmed CARE AAA; Stable to ICICI Bank’s infrastructure bonds; ratings reaffirmed.

Gland Pharma Ltd: Following the pre-market inspection covering USFDA’s quality system/cGMP regulations for medical devices by USFDA at the company’s Pashamylaram facility at Hyderabad between 23rd-26th August, 2023; Gland Pharma has received Establishment Inspection Report (EIR) from the USFDA indicating closure of the inspection.

Sudarshan Chemical Industries Ltd: The company has launched three new products viz; Sumica Bright Silver 41137, Sudatherm Cobalt Blue 6421K and Sudatherm Cobalt Green 6451K which would cater to the requirements of both domestic as well as the international markets.

Zen Technologies Ltd: The company has signed a MOU with Government of Goa for setting up of new R&D and manufacturing facility with an investment of Rs500mn.

The Week That Went By:

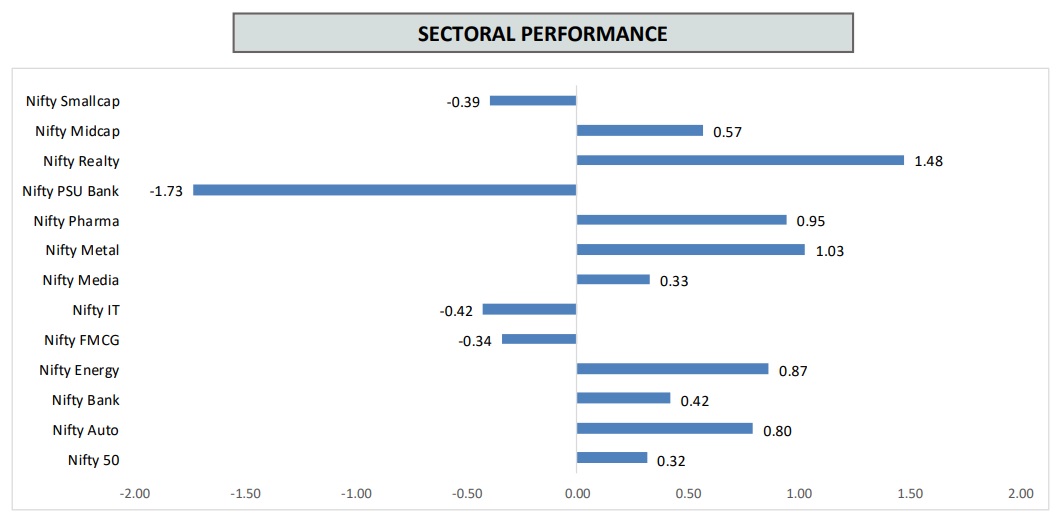

The markets started the week on a tepid note followed by a sharp recovery under the leadership of the Auto and Metal counters. Multiple attempts by the index to violate its immediate resistance of 19,840 did not work and finally settled the week at 19,797.70 with weekly gains of 62.90 points. On a sectoral front, Realty and Pharma were the outperformers while from the Auto, 2-wheeler counters outshined the sector; and on the flip side, PSU banking was the major laggard.

Nifty50=19,794.70

BSE Sensex30=65,970.04

Nifty Midcap 100=42,050.45

Nifty Smallcap100=13,827.50

Result Synopsis

Foods & Inns Ltd CMP: Rs172 Target: Rs250

The net sales for the quarter under review de-grew by 3.4% to Rs2368mn as compared to Rs2451mn in the same quarter last year. The Ebitda margins for the quarter under review stood at 13.9% as against 11.3% in Q2FY23. The net profit came in at Rs134mn as against Rs137mn in the comparative quarter last year. The EPS for the quarter under review stood at Rs2.51 as compared to Rs2.73 in the corresponding period last year.

Outlook and Recommendations:

The company has reported more or less flattish performance in the quarter under review which also marks the beginning of the peak season coming to an end. The call offs window for these contracts is 15 months and the Management is confident that the entire stock will be called off by the end of contract period. The emerging verticals of F&I include a lot of initiatives taken by the company. In order to improve the asset utilization during the mango off-season, the company is expanding in other fruits and vegetables categories. With minimal modifications to the existing machinery the company has added products like Guava, Tomato, Chilly, Papaya, Banana, Tamarind, Ginger, Garlic etc., which contribute 8-10% of overall revenues. The Management is continuously working for market expansion, adding newer geographies as well as introducing new value-added products. The key triggers which continue to favour F&I include the Quality Control Certifications (which act as entry barriers), stickiness to marquee customers as well as diversified market presence, brand restructuring, reimagining packaging and looking at sustainable waste management alternatives. The company has recently started participating in the food expo, and is seeing some traction from the customers related to Tetra Recart, spray dried segment as well as frozen food category. F&I continue to focus on value creation coupled with sustainable growth where larger volumes lead to absorption of overheads and thus help in improving the operational efficiency. The focus of the Management remains on delivering high quality products and capitalizing on new opportunities while trying to grow on a sustainable basis, thus we continue to maintain our target price of Rs250.

MARKET OUTLOOK

The index formed a bullish candle on the weekly chart but was unable to clear its primary hurdle of 19,840; and on the flip, the support levels shifted upwards, with the nearest level being 19,730. On an hourly chart, it is forming an Ascending Triangle Formation where the breakout point arrives at 19,870, and post breakout, we can expect a target of 20,170. Among the sectors, Auto segment moved as per our anticipation, and momentum in the constituents is indicating continuation of an existing uptrend (Already recommended Bajaj Auto, Eicher Motors, and Hero Motocorp and will stick to it, Bharat Forge- Flag and Pole Breakout). During the week, BankNifty tested its dual support of 200DMA as well as 43,250 and bounced back sharply which indicates a strong support base has already been made while on the higher side, needs to breach its hurdle of 44,060 & 44,400. From the Energy space, we continue to remain bullish on the OMC's counters (BPCL and HPCL). Pharma was also seen extending its uptrend by registering new highs; we believe, that the ongoing momentum will continue from hereon as well with a minor correction (profit booking) in between (FDC- Flag and Pole Breakout, Granules- Inverted Head & Shoulder Breakout). Another sector that is in the primary uptrend is Realty but it has already witnessed a sharp run-up from the past couple of weeks and now the correction is due (profit booking) which will offer a better opportunity to reenter.

SECTORAL GAINER

With gains of 1.48%, the Realty sector was the outperformer of the week. The majority of them ended the week in green with Prestige (+4.69%) and Oberoi (+4.08%) being the top performers while Swan Energy and Brigade were the underperformers. The sector has already witnessed a sharp run-up in the past couple of weeks and now the correction is due (profit booking) which will offer a better opportunity to reenter.

PSU Banking sector ended the week with a loss of 1.73% and underperformed the Benchmark Index. All the components ended the week in red where Indian Bank (5.64%) and Central Bank (4.24%) were the major laggards.

(DISCLAIMERS AND DISCLOSURES: Progressive Share Brokers Pvt. Ltd. and its affiliates are a full-service, brokerage and financing group. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. PSBPL or its associates and Research Analyst or his/her relative's does not have any material conflict of interest in the subject company. The research Analyst or research entity (PSBPL) has not been engaged in market making activity for the subject company. PSBPL or its associates may have received any compensation including for brokerage services from the subject company in the past 12 months. PSBPL or its associates may have received compensation for products or services other than brokerage services from the subject company in the past 12 months. PSBPL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Subject Company may have been client of PSBPL or its associates during twelve months preceding the date of distribution of the research report and PSBPL may have co-managed public offering of securities for the subject company in the past twelve months. PSBPL and/or its affiliates may seek investment banking or other business from the company or companies that are the subject of this material.)