India’s inclusion in Bond Indices will help in supplementing the BoP surplus while ensuring incremental ‘Indianisation’ of Global hot money

Dr. Soumya Kanti Ghosh,

Group Chief Economic Adviser,

State Bank of India

Mumbai, July 16, 2024: India’s inclusion in Bond Indices will help in supplementing the BoP surplus while ensuring incremental ‘Indianisation’ of Global hot money

Shifting contours of portfolio funds allocation to multiple asset classes across different clusters of geographies, driven by strong currents of surging liquidity in an era of QT and pivot by Central Banks, positions India’s foray into global bond indices a Win-Win proposition, structurally strengthening the macros, credit markets and Yield Curve with benchmark likely to test 6.80% going ahead despite vagaries

Inflows tickle into the Indian Bonds post inclusion in JP Morgan’s EM-GB index..

JP Morgan Chase, largest US commercial bank, had announced last September slated inclusion of Indian Government Bonds (IGBs) to its benchmark Emerging-market Index Global Diversified (GBI-EM GD) index.

❑ The index provider has thus added the securities starting June 28, 2024. Monthly net inflows into FAR securities have already touched Rs90,000 crore during Oct’23-June’24 post the announcement.

❑ Only Indian government bonds issued by the Reserve Bank of India under the Fully Accessible Route (FAR) are included in the index. All FAR-designated IGBs maturing after December 31, 2026 are eligible. The GBI-EM GD had benchmarked AUM of $213 Billion as per last public available data (Aug’23).

❑ India's weight, post inclusion, is expected to reach the maximum weight threshold of 10% in the GBI-EM Global Diversified, and approximately 8.7% in the GBI-EM Global index (thus, ensuring likely passive flows of $20-22 Bn at current AUM/holdings by March’25).

❑ We believe choosing the JPM GBI-EM first could be a deliberate move on part of GoI/RBI to ensure future developments have a natural progression, evolving & maturing organically to mitigate possible points of friction along taxation / capital control

❑ Adding to this the Bloomberg Barclays EM bond index which would incorporate Indian bonds into its Bloomberg EM Local Currency Government indices starting January 2025, and the funds flow numbers further inch up. There are already a host of marquee ETFs (iShares, Vanguard, SPDR) modelled along these benchmark indices that should further crowd in inflows

❑ Though Indian bonds continue to remain on watch list by another major index provider, FTSE Russell (which cited criteria around taxation, FPI registration and settlement process for Indian markets) for inclusion in its Emerging Markets Government Bond Index (EMGBI), the next annual revision due could put a strong case for the Index managers, with the FOMO (Fear of Missing Out) effect as global trading platforms like MarketAxess, Bloomberg and Tradeweb, working closely with CCIL, are now awaiting the RBI's approval for new launches.

Rise in Passive inflows to drove in active investors while smoothening liquidity / supplementing BoP

❑ Several global marquee funds, at present clients of multiple indices forming a passive investment channel, and taking proxy exposures to India via instruments such as total returns swaps and supranational bonds, have evinced keen interest to enter the most rapidly growing Large Economy directly, indicating incremental Indianisation of global flows, and making the country compete directly with China in AXJ (Asia Ex Japan) category with foreign ownership in its bonds standing a tad above $750 billion.

❑ India stands tall meeting the dual mandate for global funds- risk diversification and Total Returns (TR). Bond issuances in China totaled 71 trillion yuan (about 10 trillion U.S. dollars) in 2023, PBOC data showed. Going by trends, India should ascend to second largest bond market among EMs, post China, overtaking Brazil soon that could pitch it directly with the mainland for funds allocation.

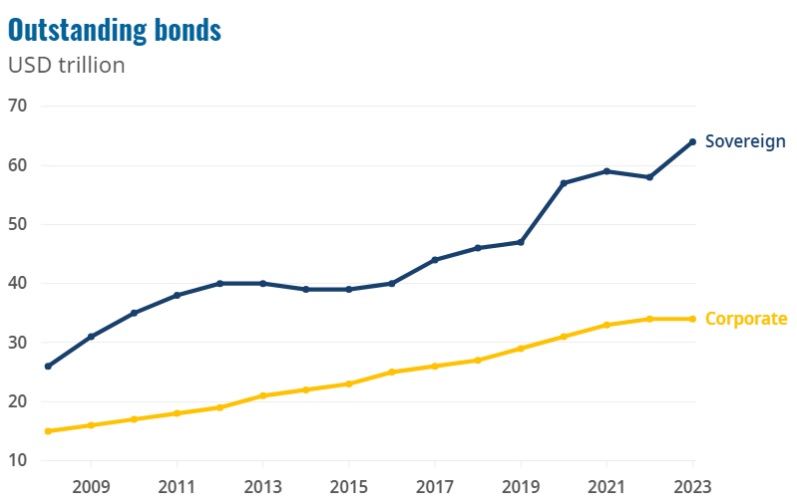

❑ With the world economy geared for a soft launch, the global bond issuances should witness traction due to a sizeable portion of both sovereign as also Corporate bonds due for maturity by 2026. However, the enhanced borrowing costs, with embedded refinancing at likely higher rate of interest (as against issuance RoI) is making the investors quite sensitive to arbitrage opportunities that should benefit nations like India.

❑ Anticipated Inflows along with fiscal consolidation and easing of inflation, as also resulting higher possibility of rate cut should further support sobering of yield which should head south further, remaining range bound with a lower bound of 6.80% though remaining susceptible to multiple actors/situations. The substantial foreign investment will enhance the government bond market depth and support system liquidity further. Thus, the liquidity situation which has been affected due to the adoption of JIT mechanism through its impact on government surplus cash balances might get some respite.

❑ However, it should also be emphasized that increase in primary liquidity from index inclusion flows is expected to be drained out. We expect RBI’s deft handling of debt as also Fx markets to smoothen the frictions going forward while the Central Bank remains committed to protect the foreign currency debt to GDP levels as India pitches for a strong case to major agencies to revisit the rating.

Indian bonds have a competitive edge

Bonds issuances have truly been a stabilizing factor for the world at large post GFC and PIIGS crisis (sovereign inching up during pandemic), financing the humongous growth and investment needs across jurisdictions though USA and China corner a sizeable part of outstanding pie.. With close to 40% of O/S debt maturing in next 2-3 years, the elevated borrowing costs pose a significant refinancing risk due to higher interest costs (than prevailing at issuance) furthering stretched Debt-to-GDP ratios when major economies are resorting to QT regime. Truly, Indian bonds have a competitive edge, attracting global investors with a further pass-through effect on incremental issue of GSS (Green, Social and Sustainability) Bonds to help the country meet its climate transition goals along milestones envisaged.

The outstanding (OS) amount of sustainable bonds globally rose to $4.3 trillion as on end-2023, up from $641 billion just five years back, with Eurozone leading the pack.

Recent issuance challenges and measures employed by Sovereign issuers

Even with uber volatility plaguing the global Bonds markets, multiple headwinds checkmating Central Bank’s ability to manoeuvre through the maze dotted with still hot price prints, RBI appears to have deftly managed the debt issuance at favorable terms of trade, sans irrational choppiness.

Strategic diversification and focus on returns amidst a Risk-On environment to benefit Debt markets of select economies MORE! Even with mercurial jump in global equity markets valuations post-pandemic, front led by Big Tech and sizeable flows to alternate assets classes by hedge/wealth funds, Fixed Income securities remain the single largest asset class providing near stable cash flows with abundant liquidity, meeting the sovereign as also corporate borrowing needs ensuing a strong appetite for new markets, away from DMs.

Bond Inflows to finally come to terms with Equity Inflows even as India reverses the EM trends

Existing literature shows benchmark driven investments (BDI) growing correlation with portfolio flows to emerging markets, as investment benchmarks are increasingly shaping portfolio allocation dynamics in EM countries… The growing role of benchmark-driven investments appears to reflect the confluence of several factors and may be contributing to more synchronized portfolio flows. Thus, India could be the recipient of sustained incremental portfolio flows in the future…. For example, portfolio flows to EM local bond markets have traditionally been much more synchronized for countries in a benchmark index (viz. the J.P Morgan GBI[1]EM Global) than those that were not in the index (IMF Working Paper WP/20/192).

The sovereign debt ownership pattern to undergo significant changes, benefitting the long tenor MOST…

Currently 38 securities under FAR are eligible for inclusion in JP Morgan Index

….out of Rs 37 trillion ($446 bn), still only 4.5% utilized…significant headroom available even after accounting for current FPI holdings… Aggregate holding of FPI has increased by Rs 16,990 crore ($2.0 bn) since June’24 and Rs 95,687 crore ($11.7 bn) since the announcement of bond inclusion by JP Morgan.

Current Liquidity trend shows Rs 0.4 lakh crore average deficit in FY25.

The Net liquidity was in deficit mode from 22 Apr’24 to 27 Jun’24 (except for 03 Jun’24 to 06 Jun’24, where it was in surplus mode with an average of Rs 0.4 lakh crore, mainly on account of month end government spending) with an average deficit of Rs 1.1 lakh crore. It came to surplus mode since 28 Jun’24 with an average of Rs 0.94 lakh crore till date

❑ RBI has been actively managing liquidity through main and fine tuning operations ❑ Average supply of liquidity by way of variable rate repo auction held in FY25 is Rs 1.3 lakh crore, and average absorption through variable rate reverse repo auction amounts to Rs 0.27 lakh crore

❑ Durable/core liquidity surplus has went up to Rs 3.69 lakh crore as on 10th July.

FPI inflows will support liquidity and put downward pressure on yield

The index inclusion of Indian bonds is expected to result in monthly inflows of around $2 bn for the next 9 months, which in turn is expected to boost demand of government papers, leading to lower yields with greater and faster impact on short-end tenor

❑ Inflows along with fiscal consolidation and easing of inflation, and resulting higher possibility of rate cut should further support softening of yield

❑ The substantial foreign investment that is likely to come after inclusion in the indices will enhance the government bond market depth and support system liquidity ❑ Thus, the liquidity situation which has been affected due to the adoption of JIT mechanism through its impact on government surplus cash balances might get some respite. However, it should also be emphasized that increase in primary liquidity from index inclusion flows is expected to be drained out during the year. RBI holding of G-secs maturing in the current FY also shall lead to decline in primary liquidity

❑ Furthermore, any global event which triggers outflows would make the Indian financial system more prone to bouts of market volatility

FPI inflows will supplement BoP surplus, add to forex reserves; but no major change expected in Re/$ exchange rate

❑ For FY25 we expect the current account deficit at $36 bn (0.9% of GDP) with exports of goods around $455 bn and imports at $708 bn. Meanwhile, service exports are expected to grow to $171 bn.

❑ Net FDI which dropped to the lowest level since 2007 in FY24 (on account of higher repatriation $ 44 bn) is expected to recover in FY25 to around $30 bn

❑ FII inflows which are $3.5 bn so far this fiscal are expected to be around $25 bn getting the support through the debt inflows on account of bond inclusion ($2.3 bn so far plus another $18 bn expected)

❑ We estimate overall Balance of Payment surplus to be around $52 bn in FY25

❑ However, we do not expect any major change in Re/dollar exchange rate. The majority of the flows are likely to result in FX reserves accretion. The historical data also shows that positive (negative) change in BoP is not always associated with major appreciation (depreciation) of rupee viz-a-viz dollar