A sharply higher trade deficit for October an emerging worry

FinTech BizNews Service

Mumbai, November 22, 2025: Indian economy is in a “goldilocks scenario” with growth appearing robust despite US tariffs while inflation is at historic lows. “We anticipate India to clock a 7.3% growth in Q2FY26 while the full year growth is likely at 6.9%”, predicts Indranil Pan, Chief Economist, YES BANK, in a special research report titled “INR View: Depreciation pressures to continue.”

Moderate Weakness Likely In The Currency In Remaining Part Of FY26

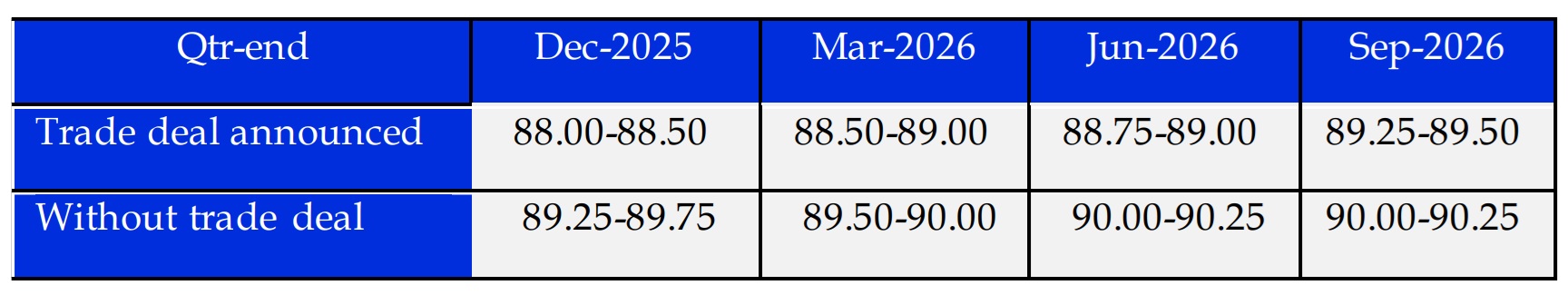

On the other hand, inflation has dropped sharply, mostly on account of GST cuts and a continuing drop in vegetable inflation. Despite strong fundamentals of the domestic economy and a weaker dollar, INR has witnessed depreciation pressures, depreciating to 89.50 against the USD on the close of 21st November trade session. Effectively, INR has depreciated by 4.4% in the FYTD. The 50% tariffs imposed by US may not have been the most important reason for the depreciation pressure on INR. Exports overall have remained steady in the first 10 months of the current FY. On the other hand, imports overall in FY26 till date have averaged at USD 64.4 bn per month against USD 60.6 bn in the same period last year. The USD 41 bn trade gap registered for October has led us to worsen our CAD/GDP estimate to 1.3% of GDP, or a CAD of USD 55 bn for FY26, despite services net receivables remaining sticky at a higher level. On the back of a higher-than-expected trade deficit, net financial flows have been on the weaker side, thereby pressuring the INR to depreciate while RBI had been containing the volatility of the INR. Cumulatively till end August, RBI had been a net seller of USD to the extent of USD 14 bn dollars. Our forecasts now indicate the BoP for FY25 to be on a knife-edge with a small deficit. If the trade gap continues to remain a large negative with net flows not improving, there is a risk for the BoP deficit to widen. Overall, we guide for a moderate weakness in the currency in the remaining part of FY26, as the heavy adjustment has now taken place. For now, we have the comfort of India’s inflation being lower than the US inflation, implying that a heavy depreciation is not warranted. Having said, we expect FY27 Headline CPI for India to increase and is likely above the US inflation, thereby leading to a continued pressure for the INR to depreciate. Our current understanding of the CAD and BoP dynamics indicate a BoP deficit of USD 5.5-6 bn for FY27. On 21st November, USD/INR depreciated to 89.40 after the RBI had held the 88.80 levels for a long time. Once the RBI allowed the USD/INR to trade beyond the 88.80 levels, markets started covering short positions and this led to the currency to depreciate beyond 89.00 levels. While a trade deal may be positive for the INR, the following slides indicate a continuing pressure for INR depreciation over the near future. RBI also continues to hold significant short positions and INR can depreciate if the RBI were to decide to not roll these over. Guessing the end-March levels would be difficult as INR has now moved into the uncharted territory, but we think that it may be capped at 90.00.

INR has been the Second Worst Performing Currency In The Current FY26.

Bulge In Gold Imports

Exports contribution in GDP remains low; US-India trade deal still hangs in balance, but loss of exports to the US is not the principal reason for the worsening of the trade balance. There has been a recent significant widening of the trade deficit – mostly on account of a bulge in gold imports.

Services exports are still holding up – but how long? PMI services is weakening. Risks emerge from Basic Balances – basic balances seen widening over the recent years. Import cover drops to 9.1 month as per the latest available data, much lower than the comfort level of 10 months – thereby pressuring an INR depreciation.

Interest rate differential with the US is lower than historical standards…. …leading to a sharp drop in the net foreign flows – the risks for lower foreign flows remain with global uncertainties and risks. Some comfort comes from India’s low inflation, now lower than the US inflation.

“We forecast a widen-than-earlier expected current A/c deficit; Relatively lower net flows on the capital account keeps BoP on a knife edge,” concludes the YES BANK report.