Bajaj Housing Finance Ltd. could possibly have market cap of over Rs. 1 lakh crore and could possibly become the most valued housing finance company and upper layer housing finance NBFC on Indian stock market

FinTech BizNews Service

Mumbai, September 11, 2024: Bajaj Housing Finance Ltd. IPO has been able to attract record-breaking response from investors. It has indicated a new era in Indian IPO market and investor response.

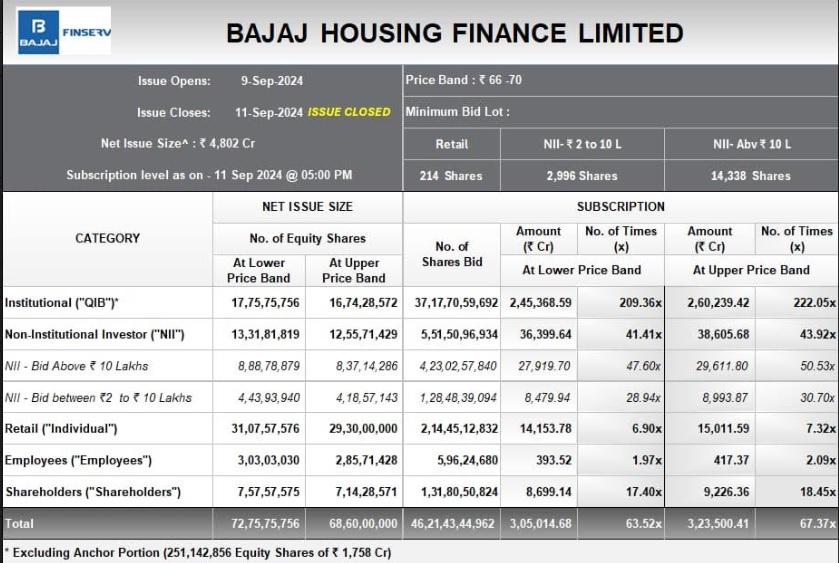

Bajaj Housing Finance Ltd. IPO has recorded highest ever number of applications (88.94 lakh applications) and demand (Rs. 3.24 lakh crore) received for any IPO at upper end of price band* for a Net Public Issue of Rs. 4,802 crore (excluding anchor investor portion of Rs. 1,758 crore)

Bajaj Housing Finance Ltd. could possibly have market cap of over Rs. 1 lakh crore and could possibly become the most valued housing finance company and upper layer housing finance NBFC on Indian stock market*

Overall 63.56 times (Cumulative demand schedule as per BSE) at lower end of price band and 67.42 times (Source: Axis Cap) at upper end of price band.

*Attracted subscription of over Rs. 3.05 lakh crore (at lower end of Price Band) and Rs. 3.24 lakh crore (Source: Axis Cap) at upper end of price band*

*QIB portion subscribed 209.36 times (Source: BSE) at lower end of price band and subscribed 222.05 (Source: Axis Cap) at upper end of price band. Subscription in QIB category was Rs. 260,239 crore (Source: Axis Cap) at upper end of price band*.

*HNI-NII portion subscribed 41.46 times (Source: BSE) at lower end of price band and 43.97 (Source: Axis Cap) at upper end of price band. Subscription in HNI-NII category was Rs. 38,605 crore (Source: Axis Cap) at upper end of price band*.

Retail portion subscribed 6.98 times (Source: BSE) at lower end of price band and 7.32 (Source: Axis Cap) at upper end of price band. Subscription in Retail category was Rs. 15,011 crore (Source: Axis Cap) at upper end of price band.

Shareholder portion subscribed 17.47 (Source: BSE) at lower end of price band and 18.45 (Source: Axis Cap) at upper end of price band. Subscription in Shareholder category was Rs. 9,226 crore (Source: Axis Cap) at upper end of price band.

IPO response overall reflects strength of Bajaj brand.

Strong oversubscription in shareholder category reflects trust and faith reposed by Bajaj Finance and Bajaj Finserve shareholders who have had a first hand experience of gains, appreciation and returns*

Bajaj Group companies have been high on corporate governance. Bajaj Housing Finance Ltd. embodies values and legacy of Bajaj Group: Bajaj Finance and Bajaj Finserve.