The Defence index gained the most, rallying over 3.5 percent.

Shrikant Chouhan,

Head Equity Research,

Kotak Securities:

Mumbai, May 21, 2025: Today, the benchmark indices experienced a volatile trading session. After a roller-coaster activity, the Nifty ended 130 points higher, while the Sensex was up by 410 points. Among sectors, almost all the major sectoral indices traded in positive territory, but the Defence index gained the most, rallying over 3.5 percent.

Technically, after an early morning intraday rally, the market faced resistance near 24,950/82,000 and corrected sharply. However, it eventually managed to close above 24,650/81,200, which is largely positive. We believe that the intraday market texture is non-directional, and as long as it is trading between 24,650 and 25,000, the range-bound texture is likely to continue. A breakout above 25,000/82,200 could push the market up to 25,100–25,150/82,500–82,700.

On the flip side, if the market drops below 24,650/81,200, sentiment could turn negative. Falling below this level, the correction wave is likely to accelerate. In such a scenario, the market could retest the levels of 24,500–24,450/80,700–80,500.

As per Gaurav Garg, Lemonn Markets Desk:

Summary:

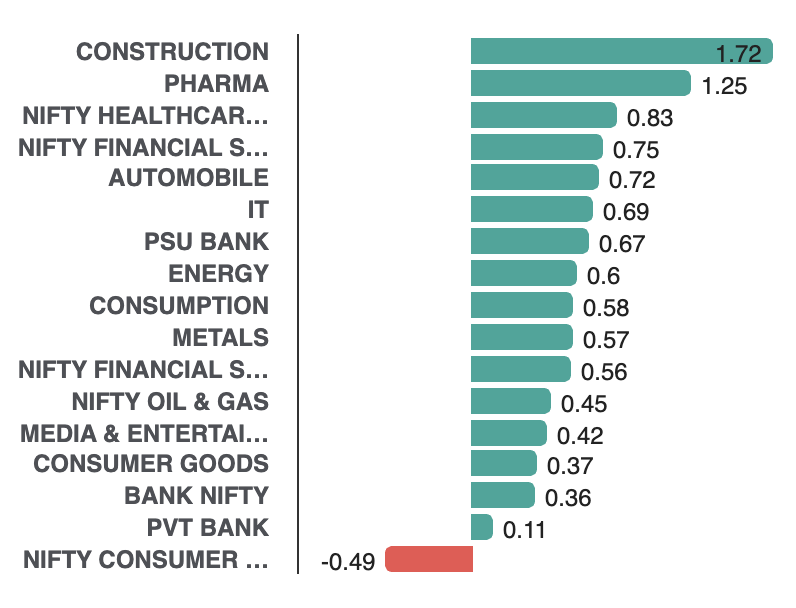

Sectors:

What Next?

Snapshot:

Index | Close | Net change | % change |

Nifty 50 | 24,813.45 | 129.55 | 0.52% |

BSE Sensex | 81,596.63 | 410.19 | 0.51% |

Nifty Midcap 100 | 56,619.6 | 436.95 | 0.78% |

Nifty Small cap 100 | 17,548.00 | 65.6 | 0.38% |