Sensex is trading lower today

FinTech BizNews Service

Mumbai, May 8, 2024: Reserve Bank of Australia, in line with market expectations, left its policy rates unchanged for the 4th consecutive time in May’24. This was owing to slower than anticipated decline in inflation (3.6% in Q1CY24). Fuel and services inflation continue to pose a threat and inflation is even expected to inch up to 3.8% towards the end of the year. Hence analysts are now expecting delayed rate cut by RBA in CY25. Impact of higher rates is visible on domestic consumption as retail sales in Q1CY24 fell by (-) 0.4% versus est.: (-) 0.2% and from 0.3% in Q4CY23. In UK as well, elevated rates have hit the disposable income and led to (-) 4% YoY decline in retail sales (BRC-KPMG monitor) versus 5.1% increase in Apr’23. Non-food sales fell sharply (-2.8%), paving way for BoE’s rate cut trajectory. Domestically, Mospi data shows that household’s net financial savings fell to a 5-year low in FY23 and rose by only 5.3% versus 7.2% in FY22, as household liabilities increased.

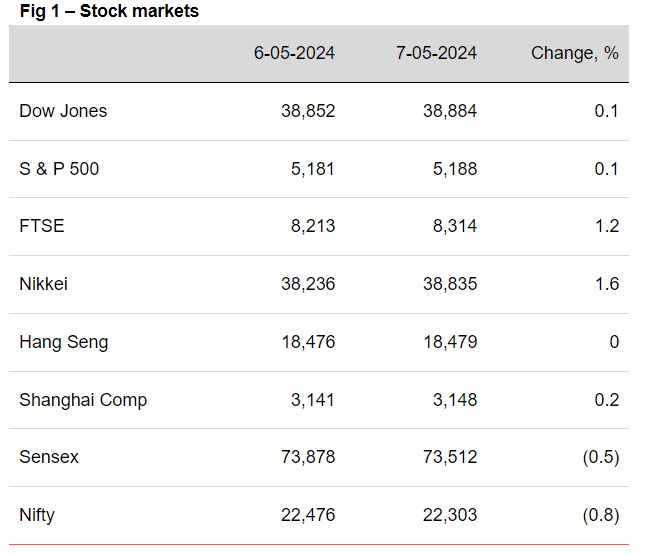

§ Barring domestic indices, other global indices ended higher. US indices continued to gain amidst renewed expectation of rate cut this year, with first one expected in Sep’24. Better than expected earnings report have allayed some fears around sticky inflation. Sensex ended in red, with the VIX remaining elevated. It is trading lower today, in line with other Asian stocks.

§ Except INR, other global currencies ended lower. DXY strengthened as investor monitored commentary by Fed officials over trajectory of rates. JPY weakened further by 0.5% with the focus shifting towards PMI data and BoJ statement. INR is trading stronger today, while other Asian currencies are trading mixed.

§ Global yields continue to decline, led by 10bps drop in UK’s 10Y yield. Weaker than anticipated retail sales in UK has strengthened the case for BoE’s rate cut in the coming months. Its decision is due tomorrow, which may provide forward guidance. India’s 10Y yield rose by 2bps, ahead of RBI’s bond buyback tomorrow. It is trading further higher at 7.14% today.

§ Oil prices fell, following the news of higher than anticipated US crude stocks.