Intraday correction witnessed by about 800 points in the Bank Nifty

Ruchit Jain,

Lead Research,

5paisa.com

Mumbai, July 23, 2024: Nifty traded with high volatility on the Budget day where it initially corrected during the announcement of the Budget and sneaked below 24100 mark. However, it recovered all the intraday losses from the low and ended the day marginally negative below 24500.

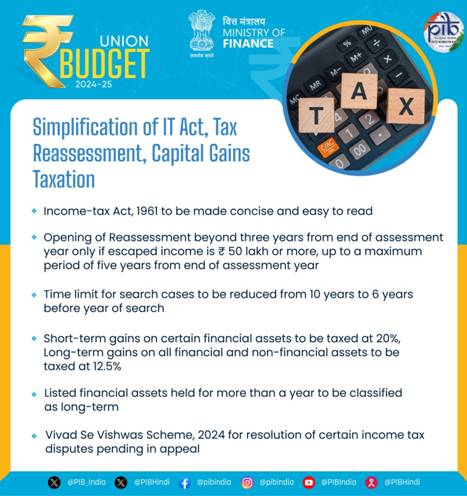

It was a volatile day which was much expected due to the big event of Budget. Certain negative announcements with respect to capital gains (CG) taxations led to a negative sentiment and hence we witnessed intraday correction by about 400 points in Nifty and 800 points in the Bank Nifty. However, there were many positive announcements as well and a buying interest in such a decline led to sharp recovery from the lows in the later part of the day. If we look at the broader structure post the event, it seems that the index has entered a corrective phase as we had already seen a rally ahead of the Budget and the RSI oscillator has given a negative crossover from the overbought zone. The correction could be a time-wise correction as well and hence there could a phase of consolidation.

Amongst sectoral indices, defensive index such as IT, Pharma and FMCG has seen a relative strength in this volatility.

It may be noted that FM Nirmala Sitharaman while presenting today Union Budget 2024-25 proposed that on Capital gains, short term gains shall henceforth attract a rate of 20 per cent on certain financial assets. Long term gains on all financial and non-financial assets to attract 12.5 per cent rate. Limit of exemption of capital gains has been increased to ₹1.25 Lakh per year to benefit lower and middle-income classes. Listed financial assets held for more than a year and unlisted assets (financial and non-financial) held for more than two years to be classified as long term assets. Unlisted bonds and debentures, debt mutual funds and market linked debentures will continue to attract applicable capital gains tax.