Equity AUM Scales Record High Of Rs35 Tn

The equity inflows moderate

FinTech BizNews Service

Mumbai, June 13, 2025: According to the latest FUND FOLIO report by Motilal Oswal Financial Services,

- The Nifty gained for the third successive month in May’25 (up 1.7% MoM) to close at 24,751. Notably, the index remained volatile and hovered around 1,181 points before closing 417 points higher. FIIs were net buyers for the third consecutive month, investing USD1.7b in May’25. DIIs also showed healthy inflows, amounting to USD7.9b in May’25. FII outflows into Indian equities have reached USD10.2b in CY25YTD vs. outflows of USD0.8b in CY24. DII inflows into equities remain robust at USD36.7b in CY25YTD vs. USD62.9b in CY24.

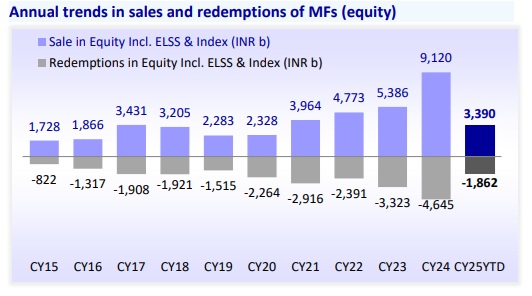

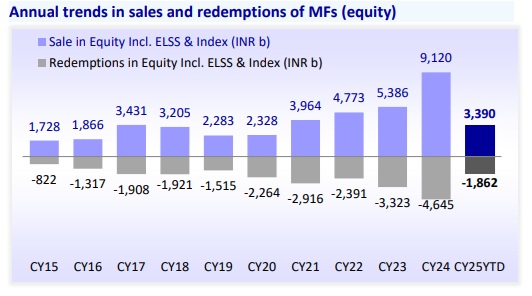

- The MF industry’s equity AUM (including ELSS and index funds) reached a new high of INR35.1t in May’25 (+4.7% MoM), owing to a rise in market indices (Nifty up 1.7% MoM). Notably, the month saw a decline in sales of equity schemes (down 0.7% MoM to INR652b). The pace of redemptions picked up to INR451b (up 13.2% MoM). Consequently, net inflows moderated to a 17-month low of INR201b in May’25 from INR258b in Apr’25.

- Total AUM of domestic MFs increased for the third consecutive month to a new high of INR72.2t in May’25 (+3.1% MoM), primarily fueled by a MoM increase in AUM of equity funds (INR1,564b), income funds (INR213), arbitrage funds (INR209b), and other ETFs (INR208b).

- Investors continued to park their money in mutual funds as inflows and contributions in systematic investment plans (SIPs) stood at INR266.9b in May’25 (+0.2% MoM and +27.7% YoY).

A few interesting facts

- The month witnessed notable changes in the sector and stock allocation of funds. On a MoM basis, the weights of Capital Goods, Automobiles, NBFCs, Chemicals, and Infrastructure increased, while those of Private Banks, Healthcare, Utilities, Oil & Gas, Consumer, Telecom, Retail, Cement, and Consumer Durables moderated.

- Capital Goods saw a rise in weight to 7.5% (+60bp MoM, -100bp YoY) in May'25, claiming the fourth spot in MF allocation.

- Automobiles’ weight climbed for the second consecutive month in May’25 to 8.2% (+20bp MoM; -60bp YoY).

- Private Banks’ weight, after touching a 20-month high in Apr’25, moderated in May’25 to 18.4% (-50bp MoM, +130bp YoY).

- Utilities’ weight slipped to a 20-month low in May’25 to 3.9% (-30bp MoM; -80bp YoY).

- Healthcare’s weight declined to an eight-month low of 7.3% (-30bp MoM, +30bp YoY) in May’25, losing the fourth spot in MF allocation.

- The top sectors where MF ownership vs. the BSE 200 is at least 1% lower: Consumer (18 funds under-owned), Oil & Gas (17 funds under-owned), Private Banks (16 funds under-owned), Technology (11 funds under-owned), and Utilities (11 funds under-owned).

- The top sectors where MF ownership vs. the BSE 200 is at least 1% higher: Healthcare (17 funds over-owned), Capital Goods (10 funds over-owned), Chemicals (10 funds over-owned), Retail (9 funds over-owned), and Consumer Durables (9 funds over-owned).

- In terms of value increase MoM, divergent interests were visible within sectors: The top 5 stocks that witnessed the maximum rise in value were L&T (+INR89.5b), HDFC Bank (+INR89.2b), ITC (+INR66.6b), Bharat Electronics (+INR62.4b), and Eternal (+INR62.4b).