Market Pulse May 2024

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited (NSE)

Mumbai, May 29, 2024: This is the first part of the series on the May 2024 edition of the ‘Market Pulse’, published by NSE. In the monthly publication issued by the Economic Policy and Research (EPR) department of the National Stock Exchange of India, titled Market Pulse, a review of major developments in the economy and financial markets for the month gone by, is undertaken.

Markets Bolstered By Strong Economic Fundamentals

Indian markets touched the US$5trn market cap figure (Rs 415 lakh crore) for the first time in May this year. Country-wise, the Indian market today is the fourth largest in the world, after the US, China and Japan. The Indian market has done rather well in the recent past with 20% growth in 2023, 28.6% in FY24, positive growth in 8/9 calendar years and the last trillion added in six months. More than the recent rise of the market, however, is the cause for reflection a milestone like US$5trn provides. In the nearly 30 years since the NSE was launched on Diwali in 1994, the Indian markets have risen from a market cap of Rs 3.6 lakh crore to over Rs 416 lakh crore today, a rise of 114x at a CAGR of 18%, and a testimony to the rise of the Indian economy too, which has increased by 29x over the same period and currently ranks as the fifth largest in the world. We have over 9.3 crore registered investors today, whose direct ownership in the equity markets has reached Rs 36.4 lakh crore, and whose belief in the markets is also visible in the monthly SIP inflows of over Rs20,000 crore.

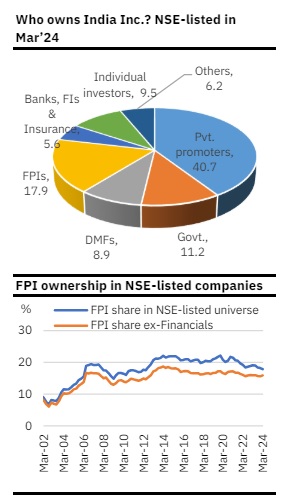

Our story of the month gives an idea of how the equity culture in the country could rise further. Regular readers of the Market Pulse are aware of our ownership tracker (Who Owns India Inc.), wherein we consider the quarterly ownership trends in the market since the year 2000. Apart from the regular analysis pillars like flows, sector alignments across institutions and ownership by size deciles, we also consider the actual number of shareholders by company and examine the distribution of shareholders by company has changed over a decade. This is not generally studied, considering that the disclosure of the number of shareholders in a company varies significantly across countries and is not uniformly required to be publicly disclosed. What is provided instead is a list of substantial shareholding institutions and of major shareholders. For Indian markets, though, the data is available, and we see interesting trends. Illustratively, the number of companies with over two lakh investors has increased from 59 to 178 in a decade; with over five lakh investors, from 12 to 72; with over ten lakh investors, five to 39, and with over 25 lakh investors, from 2 to 16! More details in the Story of the Month.

Further on the markets, global equity and debt markets faced significant challenges last month, weighed down by higher-than-expected U.S. inflation and a strong job market. The Fed Chair's comments suggested a prolonged battle to reduce inflation to the 2% target, dampening hopes for an easier term structure and prompting a sell-off in across assets. The MSCI World Index fell by 3.8% in April, marking its first drop in six months, although it rebounded by 4.7% in May, bringing its year-to-date (YTD) gain to 9.2% as of May 24, 2024. Emerging markets outshone developed ones, with Chinese equities benefiting from supportive fiscal measures and Indian equities maintaining steady growth. The MSCI EM Index rose modestly by 0.3% last month and added another 3.5% in May (YTD: +5.8%). In the U.S., the 10-year sovereign yield peaked at a six-month high of 4.7% last month but eased to 4.5% by May, while yields in the UK and Europe also rose significantly during the year.

Indian markets had a positive April, bolstered by strong economic fundamentals, robust corporate earnings, and consistent domestic institutional investor involvement. Mid- and small-cap companies, which had sharply declined in March, rebounded strongly in April, outpacing large caps. The Nifty50 Index saw a modest May gain of 1.2%, adding another 1.6% so far (YTD: +5.6% as of May 24th, 2024). Meanwhile, the Nifty Midcap 50 and Smallcap 50 Indices increased by 4.7% and 11.8% respectively in April. Indian debt mirrored global trends with a decline in April due to delayed US rate cuts, rising oil prices, and foreign outflows, though it outperformed its international counterparts. A drop in global bond yields, an unexpected high profit transfer from the RBI to the government, and reduced state borrowings boosted domestic bonds in May.

April’s performance helped investors back into the markets to some extent, with the cash markets seeing turnover rise to Rs 21.2 lakh crore (i.e., ADT back above Rs 100,000 crore) and participation by 1.25 crore investors, higher than March’s 1.21 crore, but significantly lower than the 1.5 crore we saw in a short February, which had a turnover of Rs 24.6 lakh crore. Options saw a drop in both turnover and participation for the second month in a row. Individual investor portfolios have seen a reduction in concentration since the pandemic.

Uttar Pradesh finally became the second state in the country to cross a crore investors, contributing 11% of the 9.32 crore investor base vs. 6.1% of 1.15 crore in 2010. UP’s 1.01 crore investors now from a mere 7.01 lakh then have not been risen linearly, nearly quadrupling since the pandemic.

High-Frequency Indicators

On the macro front, high-frequency indicators continued to exhibit optimism and momentum in the new fiscal. April's Composite PMI stood strong at 61.5, maintaining above 60 for the fourth consecutive month, albeit slightly lower than the previous month, indicating resilience in both manufacturing and services. Industrial activity gauged by the IIP showed robust growth, particularly in manufacturing (5.2% YoY) and electricity (8.6% YoY). The merchandise trade deficit expanded to $19.1 billion in April, as import growth of 10.3% YoY outstripped exports, which grew only 1.1% YoY, impacted by geopolitical tensions and higher shipping costs, although electronic goods saw a significant 25.8% YoY increase. The overall trade deficit reached a six-month peak at $6.5 billion.

Retail inflation remained stable at 4.8% YoY, while wholesale prices rose to a 13-month high of 1.3% YoY. Noteworthy are the sequential increases in most retail core sub-components and easing deflation in manufacturing. Seasonal rainfall will likely influence the overall inflation trend. Government GST collections exceeded Rs 2 lakh crore for the first time in April, supported by strong economic activity at the year's end and a record RBI dividend payout of Rs 2.1 lakh crore, significantly above the budgeted Rs 1.02 lakh crore for FY25(BE), as we had mentioned earlier, bolstering fiscal consolidation.

In the Insights section, we have three papers from the NSE CBS team at IIM Ahmedabad, all in the realm of behavioural finance. The first paper looks at how consumers pay their debts faster when the debt amount is a round number due to cognitive ease (greater retrieval fluency and processing fluency). The second paper tries to establish a causal link between family ties and the size of the underground economy and reveals that indeed stronger family ties are associated with higher levels of the underground economy while the last paper looks at the behaviour of long term swap spreads in face of demand-supply imbalance risk.

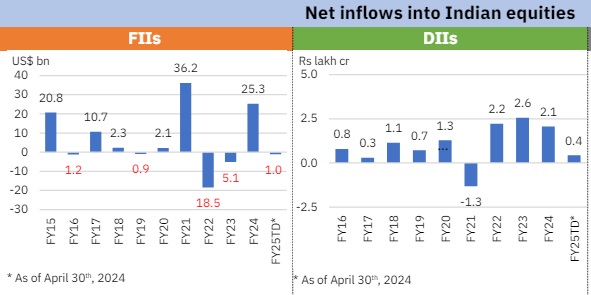

While their participation may be on the wane in the near term, domestic investors in India through direct and indirect investments have ensured that ‘Sell in May and go away’ remains an adage, despite the sustained FPI selling in May after April, with over US$2.75 bn of outflows.

Who owns India Inc.?

We note: 1) An increase in promoter ownership for the fourth quarter in a row to 51.4% in NSE listed companies, primarily led by a rise in Government share; 2) A drop in FPI2 (foreign portfolio investors) ownership for fourth consecutive quarter to more than 12-year low of 17.9% despite strong inflows, weighed down by relative underperformance of FPI-heavy stocks in the Financials sector; 3) An increase in DMF (domestic mutual funds) share to fresh record high level of 8.9% (Active: 7.2%, Passive: 1.7%), aided by strong SIP inflows; 4) A modest drop in individual investors’ ownership to 9.5% in the listed universe; 5) FPIs trimmed their outsized OW3 bet on Financials, turned incrementally less negative on Consumer Staples, and remained negative on Materials and Industrials; 6) DMFs kept their sector positioning broadly steady with a strengthened OW position on large-cap financials while maintaining a cautious stance on mid and small companies in the sector and negative view on commodity sectors, viz., Energy and Materials; 7) A drop in the share of Nifty 50 companies in the institutional and individuals’ portfolios to over 16- and six-year lows respectively, even as they continued to have a significant exposure to such companies. For instance, companies in the top decile by market cap (~200) accounted for 66%, 81%, and 89% of the individuals’, DMFs’ and FPIs’ holdings respectively; 8) A significant increase in direct participation of individual investors in the last 10 years, with the share of the number of companies with more than 50,000 individual shareholders more than doubling in the last 10 years to 45.1%. • Promoter share inched up further: Total promoter ownership in the Nifty50, Nifty 500 and NSE listed companies rose for the fourth quarter in a row by 87bps, 73bps and 65bps QoQ to 42.9%, 50.8% and 51.4% respectively. This was primarily led by a significant rise in in Government promoter share and a modest rise in foreign promoter share, partly offset by drop in Indian private promoters’ holding for the third straight quarter. • Government ownership continued amid PSU rally: The Government ownership (promoter and non-promoter) in the NSE listed universe saw a percentage point increase in the March quarter, taking it to a 28-qaurter high of 11.2%. The Nifty 500 and Nifty 50 index also saw a 106 and 77bps QoQ increase to a 26-quarter high of 11.7% and 16- quarter high of 7% respectively. The March quarter saw a strong rally in Government-owned companies, with Nifty PSE Index generating return of 16% in the March quarter vs. 3% for the Nifty 50 Index. • FPI ownership declined for the fourth consecutive quarter: FPI ownership continued to taper off across the board with the Nifty 50, Nifty 500 and NSE listed companies witnessing a drop of 81bps, 44bps and 36bps QoQ to 24.3%, 19% and 17.9% respectively. This marked the fourth drop in a row and came despite strong foreign capital flows last year (US$25.3bn). This is partly attributed to relative underperformance of the FPI-heavy financial sector (particularly private banks) in the quarter and the whole of last year. In the March quarter, while the Nifty50 and Nifty500 Index rose by 2.7% and 4.3%, Nifty Financial Services Index and Nifty Private Bank Index actually declined by 2.3% and 5.3% respectively. That said, FPIs’ investment in NSE listed companies still expanded by 41% to Rs 68.3 lakh crore in FY24. FPIs significantly trimmed their outsized OW bet on Financials, and remained negative on Materials, Industrials and Consumer Staples. That said, FPIs have turned incrementally positive on India’s consumption theme in the light of resilient discretionary demand and recovering rural demand. This is reflected in a reduced UW position on Consumer Staples and a neutral stance on Consumer Discretionary. Among other sectors, FPIs remained neutral on Communication Services, Energy, Healthcare, IT, Real Estate and Utilities

• DMFs share rose to fresh all-time high level: Aided by sustained SIP inflows, DMF share rose further to fresh all-time high of 10.5%, 9.4% and 8.9% in Nifty 50, Nifty 500 and NSE listed companies respectively. DMFs injected a net amount of Rs 2 lakh crore into Indian equities in FY24, taking total net inflows to Rs 5.3 lakh crore in the last three years. Out of total share held by DMFs, passive funds’ share remained steady at 1.7%, with the balance 7.2% held by active funds, up 11 bps QoQ4 . DMFs broadly maintained their sector positioning with a strengthened OW position on large-cap financials while maintaining a cautious stance on mid- and small companies in the sector. Among other sectors, DMFs maintained the OW stance on large Utilities companies and smaller Healthcare and Consumer Discretionary companies while continuing to be bearish on commodity sectors viz., Energy and Materials. • Individual investors’ share fell marginally in the March quarter: Individual investors’ ownership declined by 12bps QoQ to 9.5%, 14bps QoQ to 8.6% and 11bps QoQ to 8.1% in the NSE listed, Nifty 500, and Nifty 50 companies respectively, marking the second drop in a row. This was despite strong net investments by individual investors, amounting to Rs 52,568 crores in the March quarter—the highest in last nine quarters. • Ownership concentration: The share of Nifty 50 companies in total institutional investments fell for the fourth quarter in a row by 123bps QoQ to a 16-year low of 62% in the March quarter, a result of the combination of higher allocation to mid- and small-cap companies and relative outperformance of these companies. Individuals also saw the share of these companies in their overall portfolio falling to sub-40% in the March quarter for the first time in six years, translating into an 8pp decline in FY24. That said, large companies still contribute to a significant portion to both individual and institutional portfolios, with companies in the top decile (200 companies) by market cap contributing to 66% of individuals’ holdings and 87% of institutional holdings. • Companies with 50k+ individual holders doubled in the last 10 years: In this edition, we also analyse the direct participation of individual investors in terms of number of holders today and compare this with the state a decade ago. In 2014, one-third of the companies had less than 10,000 individual holders, with another 46% having individual holders in the range of 10,000 to 50,000. This trend has changed meaningfully in the last 10 years, such that only 12.4% of the listed companies now have less than 10,000 holders, with another 22% having holders in the range of 10,000 and 25,000 and 21% between 25,000 and 50,000. In fact, the share of the number of companies with 50k+ shareholders has more than doubled in the last 10 years to 45.1% today. Further, there are about 55 companies today having more than 10 lakh individual shareholders, while this number was just 7 a decade ago. Of the 1100 companies that are common in both the periods, 971 saw an increase in the number of individual shareholders, with 22% seeing more than 5x jump.

(To be continued)

(This report is intended solely for information purposes. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources. NSE does not guarantee the completeness, accuracy and/or timeliness of this report neither does NSE guarantee the accuracy or projections of future conditions from the use of this report or any information therein. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risks, which should be considered prior to making any investments.)