INR depreciated by 0.1% to a fresh record low, led by month-end dollar demand from importers. It is trading weaker today

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, April 30, 2024: Manufacturing activity in China showed revival with Caixin PMI index remaining above the 50-mark for the 2nd consecutive month. buoyed by new orders and export orders. Elsewhere, in Japan, Yen strengthened leading to speculation of official intervention. Macro data of the region showed that jobless rate inched up, retail sales decelerated, and industrial production picked up, thus providing conflicting signals about growth inflation duo. In Germany, inflation remained sticky, thus again raising doubts about the last mile of disinflation. In the US, Treasury ramped up its estimate for Apr-Jun’24 borrowing to US$ 243bn from US$ 202bn earlier. However, the impact on its yield is not yet visible. In a recent report by IMF, it has been pointed out that Asia’s improved growth outlook will be supported by India and China.

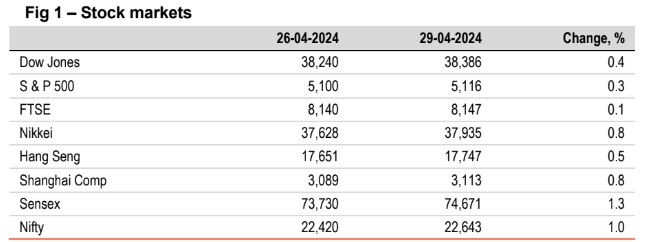

§ Global indices started the data heavy week on a positive note. Stocks in the US rose supported by upbeat earnings reports. The rebound in China’s stock market continued with Shanghai Comp rising by 0.8%, as investors reassessed their view on the state of the economy. Sensex rose sharply by 1.3%, with all sectoral indices (barring real estate) in green. Banking stocks advanced the most. It is trading further higher today, in line with other Asian stocks.

Barring INR, other global currencies appreciated against the dollar. DXY was 0.3% lower, as investors await the outcome of Fed policy meeting. JPY appreciated sharply by 1.3% on suspected BoJ intervention. INR depreciated by 0.1% to a fresh record low, led by month-end dollar demand from importers. It is trading weaker today, in line with other Asian currencies.

Global yields closed mixed. US 10Y fell by 5bps despite higher than estimated borrowing by Treasury for Apr-Jun quarter. 10Y yield in UK, Germany also moderated ahead of Fed policy decision. China’s 10Y yield inched up amidst expectation of some degree of momentum in economic activity. India’s 10Y yield rose a tad by 1bps. It is trading at 7.19% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)