INR continues to hover near record low levels

Sonal Badhan,

ECONOMIST

Bank of Baroda

FinTech BizNews Service

Mumbai, 4 November, 2024: US labour market data is pointing towards a slowdown,

as non-farm payrolls rose by only 12k in Oct’24 versus est.: 113k increase. However,

analyst believe that this is temporary and was largely due to factors such as: strike by

Boeing workers and 2 major hurricanes. Manufacturing sector was hit the most.

This is last jobs report before Presidential elections and Fed rate decision, both due this week.

US ISM manufacturing index for Oct’24 also showed that activity contracted at a faster pace

(46.5) versus last month (47.2). Production was most impacted, and input price

reportedly increased. In view of this, and awaiting the result of closely fought US

Presidential elections, investors expect 25bps Fed rate cut this week. Apart from

developments in the US, markets this will also react to RBA’s decision, China’s

parliamentary meeting outcome, and South Korea’s inflation report.

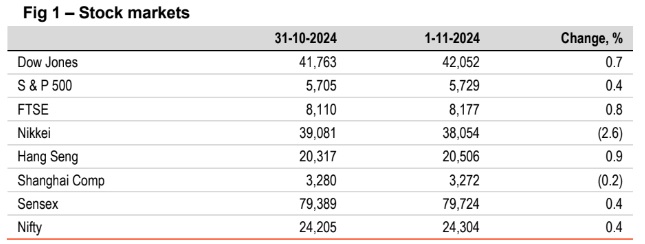

US stocks edged up as traders are frontloading positions ahead of election.

Opinion polls suggested a tight run. This will also coincide with Fed meeting

where policy easing is anticipated. Nikkei moderated weighed down by yen.

Shanghai Comp softened awaiting fiscal stimulus. Sensex inched up driven by

auto stocks. It is trading lower today while Asian stocks are trading mixed.

Global currencies ended mixed. DXY rose by 0.3%, driven by heightened

political uncertainty ahead of a close US Presidential election race. Further,

despite softer labour market data, analysts are expecting Fed to cut rates less

aggressively. INR continues to hover near record low levels, and is trading flat

even today, while other Asian currencies are trading mixed.

US 10Y yield rose at the sharpest pace as earnings data showed some

stickiness. This was also supplemented by uncertainty looming over US

elections. US and Japan’s 10Y yield remained stable monitoring differential with

US yield. China’s 10Y yield moderated ahead of policymakers meet. India’s 10Y

yield inched up by 2bps. It is trading at the same level today.