Sensex declined by 0.1%, dragged down by technology shares. However, it is trading higher today

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, May 22, 2024: Fed officials again gave conflicting signals on future direction of rates. Atlanta Fed President hinted at favourable conditions for lowering rates by the end of the year. Fed vice Chair however signalled caution on the back of US economy’s solid footing. Fed Governor was also of the same tone and pointed out that several good inflation numbers are needed to begin the rate cut cycle. Thus, even if one rate cut translates this year, the rate cut journey by Fed is likely to be a slow one. Elsewhere in Germany, PPI inched down. ECB President indicated rate cut in Jun’24. In Japan, trade deficit widened as exports grew at a slower pace (8.3%, YoY in Apr’24 compared to 7.3% in Mar’24) and imports picked up (8.3% compared to -5.1%). On domestic front, RBI’s report on state of the economy has remained bullish on growth and pointed to cautious approach about policy based on evolution of inflation.

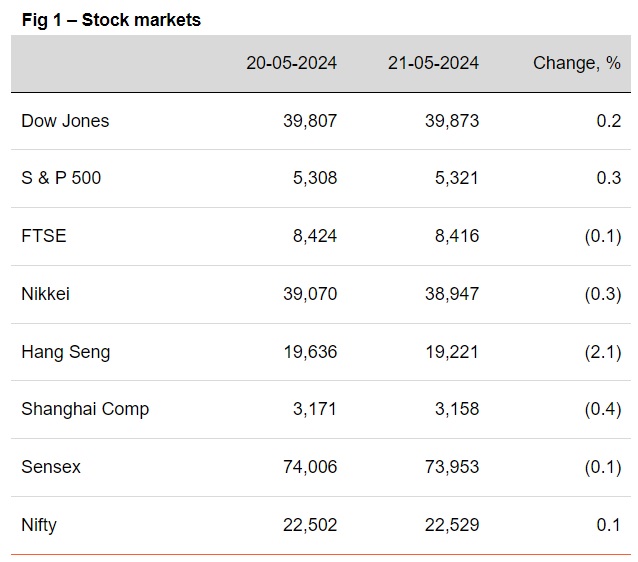

§ Global stocks ended mixed. US indices rose, led by gains in tech stocks. S&P 500 rose the most by 0.3% to a record high. Markets in Asia were mostly lower. Hang Seng led the losses declining by 2.1%, amidst a decline in basic materials and industrial stocks. Sensex declined by 0.1%, dragged down by technology shares. However, it is trading higher today, in line with other Asian stocks.

Global currencies traded in narrow ranges amidst lack of fresh drivers. DXY rose by 0.1% as Fed officials advocated the need for patience before cutting rates. On the other hand, EUR was marginally weaker as ECB President hinted at the possibility of a rate cut in Jun’24. INR appreciated marginally. It is trading further stronger today, while other Asian currencies are trading mixed.

§ Global yields closed lower ahead of release of Fed minutes. Investors closely monitored comments from several Fed officials. The inflation expectation index of US is due to be released this week. UK’s 10Y yield fell the most as CPI is expected to moderate in Apr’24. US and Germany’s 10Y yield also edged down. India’s 10Y yield fell a tad. It is trading at 7.07% today.