Sensex is trading further lower today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, August 5, 2024: A perceptible slowdown in US labour market spooked global investors and bolstered the case for the start of an aggressive policy easing cycle by the Fed. US non-farm payrolls eased to 114,000 in Jul’24 (est. 178,000). Unemployment rate inched up to 4.3% from 4.1%, the highest level since Sep’21. Wage growth eased to 0.2% from 0.3% in Jun’24 (MoM). The weak macro data has raised fears of a US recession

leading to a sharp sell-off in global markets. Investors also rejigged expectations of the future course of Fed policy. While a Sep’24 rate cut has largely been priced in, there is a growing belief that the quantum could be higher at 50bps. Further, majority of market participants now see the Fed fund rate at 4.25-4.75% by Dec end, implying at least 3 rate cuts this year. This weighed on the dollar. In India, South-West monsoon is 4% above LPA which has helped Kharif sowing. RBI’s policy decision will be the key driver for markets.

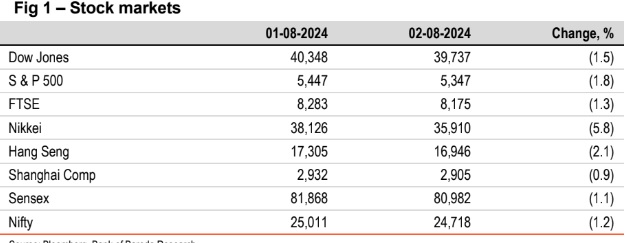

Global equity indices closed lower, as weak US data has led to fears of a recession in the US. Apart from this, other factors driving equity flows ranged from tensions in the Middle East, weak macro data in China and volatility in commodity prices. Asian stocks fell the most. Sensex fell by 1.1%. It is trading further lower today, in line with other Asian indices.

Except INR, other global currencies ended stronger against the dollar. DXY declined by 1.2% after US jobs report. JPY appreciated by 1.9%. INR

depreciated to a fresh record-low of 83.75/$, despite lower oil prices. It is trading further weaker today, while other Asian currencies are trading mostly stronger.

Global yields closed lower. US 10Y yield fell the most as reports suggested

money market traders are pricing increased quantum of rate cuts by the Fed.

Similar impact was felt in yields of other AEs which showed a softening bias.

India’s 10Y yield fell by 2bps, monitoring auction results. It is trading further

lower at a ~28-month low of 6.86% today.