Investors will closely track US GDP, global PMI readings and BoJ’s guidance on rate hike this week.

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, April 22, 2024: Recent reports of possible de-escalation in the ongoing conflict in the Middle East between Iran and Israel gained prominence, after Iran signalled the possibility of no retaliation against Israel. Investors have downsized the possibility of rate cut by Fed which was earlier expected in Jun’24 and now has been postponed to Sep’24, given the hotter-than-expected inflation data, tight labour market and ongoing geopolitical conflict. Separately, Bundesbank’s official recently made comments stating that ECB is expected to cut rates by Jun’24, but noted there are ‘still some caveats’. Investors will closely track US GDP, global PMI readings and BoJ’s guidance on rate hike this week.

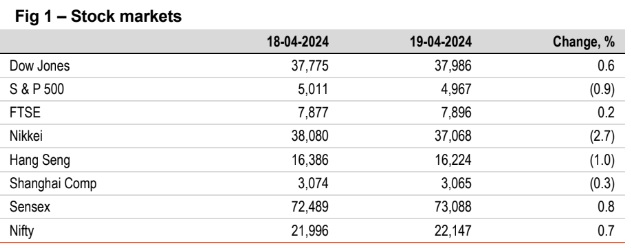

§ Global indices ended mixed. Investors monitored quarterly earnings reports and scaled back expectations of rate cut possibilities by Fed. Developments surrounding the tensions in Middle East also kept investors on the edge. Nikkei dropped the most led by a slump in semiconductor shares. On other hand, Sensex ended in green, supported by gains in banking and metal stocks. It is trading higher today, in line with other Asian stocks.

Global currencies ended mixed. DXY rose by 0.1%, as Israel’s attack on Iran and hawkish comments of Fed officials, impacted investor sentiments. Other safe-haven currencies like JPY and Swiss Franc pared gains. INR rose by 0.1%, as oil prices remain below US$ 90/bbl mark. It is trading stronger today, while other Asian peers are trading mixed.

Global yields closed mixed. US 10Y yield fell by 1bps as investors assess the impact of Israel’s attack on Iran. UK 10Y yield fell the most, following comments of BoE deputy governor Ramsden stating that UK inflation might come in lower than bank’s projection in the next 3 years. Following stickiness in oil prices, India’s 10Y yield rose by 4bps to 7.23%. It is trading at similar levels today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)