India’s 10Y yield is trading steady today, despite decline in oil prices

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, 20 December, 2024: US macro data shows that economy continues to remain strong, giving further merit

to Fed’s higher for longer rates in CY25. GDP growth for Q3 was revised up to 3.1%

from 2.8% estimated earlier, backed by upward revisions to exports and private

consumption. Initial jobless claims for the week ending 14 Dec’24, fell by 22k from

the previous week to 220k (est.: 229k), signalling labour market strength. Existing

home sales jumped by 4.8% (MoM) to 4.15mn units (highest since Mar’24), despite

higher mortgage rates. Elsewhere in Europe, BoE decided to leave its policy rate

unchanged at 4.75%, but the spilt amongst members widened. Markets are pricing in

fewer rate cuts (upto two) in CY25, given continued increase in wage growth and

elevated services inflation. In Germany, Gfk consumer confidence shows sentiment

improving for Jan’25 (-21.3 from -23.1 in Dec’24), despite labour market concerns.

Barring Dow Jones (flat), other global indices ended lower. Investors monitored

the Fed's decision and hawkish outlook. US data (weekly jobless claims and Q3

GDP print) further supported this decision. Sensex ended in red led by sharp

losses in banking and consumer durable stocks. It is trading lower today while

other Asian indices are trading mixed.

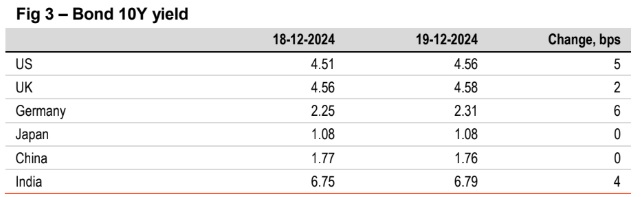

Except Japan and China (flat), other global 10Y yields inched further up.

Upward revision to US Q3 GDP, and lower than expected jobless claims

reaffirmed fears that Fed will cut rates more slowly in CY25. BoE also seems

less willing to cut rates aggressively next year. India’s 10Y yield rose by 4bps,

tracking global cues. It is trading steady today, despite decline in oil prices.