Interestingly, the Netra report from DSP Mutual Fund highlights early signs of a potential mean reversion, as evidenced by the 12- month rate of change.

FinTech BizNews Service

Mumbai, November 12, 2024: The November edition of the Netra report from DSP Mutual Fund reveals

a notable shift in market dynamics, indicating that large-cap stocks are beginning to outperform small

and mid-cap stocks. This change is underscored by the Midcap Index currently trading at its highest

relative level compared to the Sensex, while the Smallcap Index approaches its peak since 2005. Such

trends suggest that the Small and Midcap sectors have outperformed large caps, reaching some of their

most expensive valuations in relative terms.

Interestingly, the report highlights early signs of a potential mean reversion, as evidenced by the 12-

month rate of change. This could make larger-cap indices appear more attractive to investors. Despite

this shift, large caps are now seen as relatively favorably valued, although overall market valuations

remain above average.

The Nifty Index is trading at 1.5 standard deviations above its long-term historical average, echoing

levels observed during previous bull market peaks. Additionally, analyst earnings upgrade ratios have

surged to the 90th percentile of historical readings, creating a challenging landscape for companies

striving to meet elevated expectations.

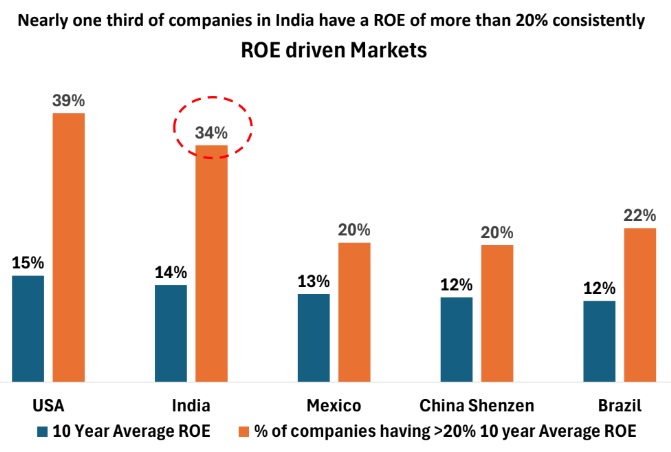

A key takeaway from the report is India's impressive return on equity (ROE), which serves as a

fundamental driver of long-term market performance. India ranks second globally, trailing only the U.S.,

in terms of firms consistently achieving an ROE exceeding 20% for over a decade. Notably, 34% of Indian

companies maintain this performance level, reinforcing the notion that robust fundamentals are crucial

for sustained stock market success.

However, the report does not shy away from addressing vulnerabilities within India's Balance of

Payments. With oil trade deficits projected at $95 billion for FY24, India's reliance on foreign

inflows—particularly Foreign Institutional Investment (FII)—is critical for maintaining macroeconomic

stability. In contrast, services and remittances play a vital role in supporting the economy, contributing

$269 billion in net inflows.

“India’s economic resilience and robust market fundamentals make it a standout amid global volatility,

yet current high valuations and elevated corporate earnings expectations call for prudent investing. For

sustained growth, it’s essential that capital is channeled into high-ROE companies and sectors with long-

term potential, rather than focusing solely on the momentum of rising stock prices and IPOs,” said Sahil

Kapoor, Head of Products; Market Strategist, DSP Mutual Fund.