Broader Markets Maintain Strength, Nifty 50 Gains 1.87% in November: Motilal Oswal Mutual Fund

FinTech BizNews Service

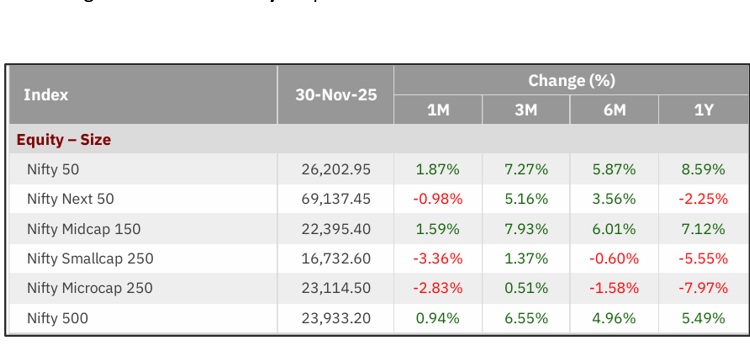

Mumbai, 14 December 2025: According to Motilal Oswal Mutual Fund’s Global Market snapshot report, Nifty 50 & Nifty Midcap 150 have emerged as best performing index with a growth of 1.87% & 1.59% in the month of November respectively.

The Nifty Midcap 150 continued to show steady traction with gains of 7.93%, 6.01%, and 7.12% over the last 3 months, 6 months, and 1 year, respectively. In comparison, the Nifty 50 outperformed with returns of 7.27%, 5.87%, and 8.59% across the same 3-month, 6-month, and 1-year periods.

The broader market also delivered healthy gains, with the Nifty 500 gaining 0.94% in November 2025, with large and midcap up about 1-2% and smallcaps corrected by around 1-3%. Over the last 3 months, 6 months, and 1 year the index has consecutively given positive returns of 6.55%, 4.96% and 5.94%.

The Nifty Smallcap 250 Index showed mixed momentum, declining 3.36% during the month, while recording a moderate 1.37% gain over the past 3 months. However, returns remained subdued over longer periods, with the index slipping 0.60% over 6 months and 5.55% over the 1-year horizon.

The Nifty Microcap 250 Index also reflected volatility, registering a 2.83% decline in November. Over the 3-month, the index delivered a 0.51% over the 3 months and declined −1.58%, and −7.97% over the 6-month, and 1-year periods respectively, underscoring continued pressure in the microcap segment.

The Nifty Next 50 Index ended the month with a marginal decline of 0.98%, but maintained positive momentum over the medium term with gains of 5.16 over 3 months and 3.56% over 6 months, while delivering 2.25% over the 1-year period.

Sector performance remained mixed with IT delivering an increase of 4.74%, Auto 3.60%, Banks 3.42% and Healthcare 2.30% in November.

The Defence sector delivered the strongest annual performance with an impressive 19.43% return, emerging as the best-performing segment over the year.

The Auto sector followed closely at 18.85%, Banking sector also posted a healthy 14.79% gain and Metals also recorded a strong 13.94%. Healthcare generated 6.40%, indicating steady but moderate expansion.

Realty on the other hand slipped further by 4.69% in November and 11.47% in the past year. The broader trend shows a 1–4% decline across these segments during November, reflecting sector-specific pressures and profit-taking after earlier rallies.

Among factor indices, Momentum gained 2.43% in November, outperforming both Low Volatility and Quality. While Value posted a negative return for the month, it continued to outperform over the 3, 6- and 12-month periods.

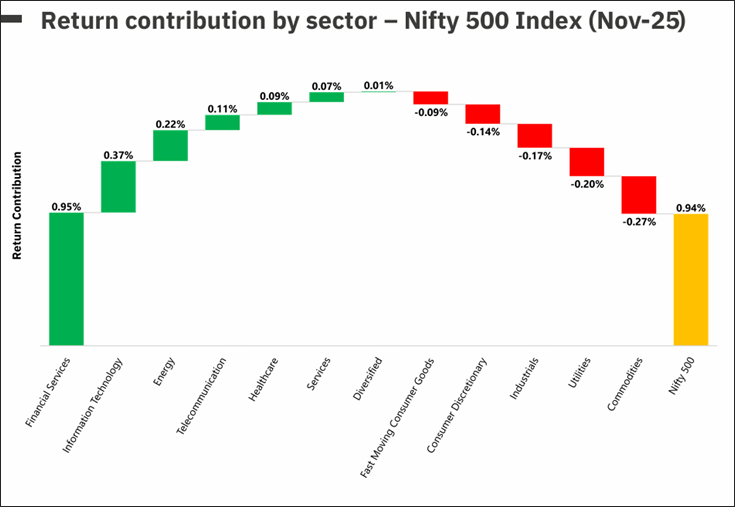

Financial Services, Energy & IT were the major contributors to the overall returns of the Nifty 500 index.

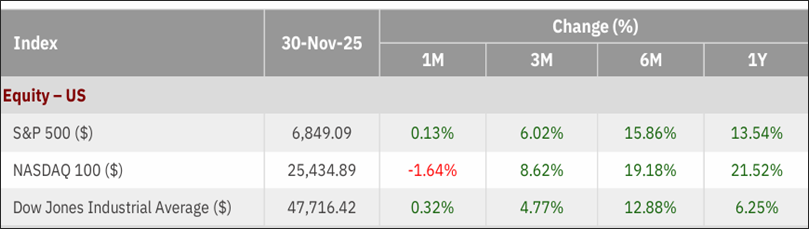

US equities were broadly flat in November, with the S&P 500 up 0.13% while the NASDAQ100 declined 1.64%. Sector performance in the S&P 500 was mixed, as Healthcare, Communication Services and Financials added positively to returns, while IT and Consumer Discretionary weighed on the index. Emerging markets showed divergence with Brazil (+7.42%) and South Africa (+3.87%) posted gains, others saw a declineof 2-7%.

Safe-haven assets outperformed with a surge in Gold and Silver of 4.48% and 10.11% n November. Crude oil (-3.98%) and cryptocurrencies like Bitcoin and Ethereum saw double-digit drawdown. On a yearly basis, Gold advanced 58.09%, while Silver delivered an even stronger performance, surging 75.60% over the year. In contrast, Crude Oil declined and is down 13.90%.

Quick Take