Nominal GDP growth at 8.7% in H1 FY24, however, was much lower than an average growth of 13.4% for this period in the previous 17 years, reflecting the impact of negative wholesale inflation this year

Prerna Singhvi, CFA

Vice President – Economic Policy and Research

National Stock Exchange of India Limited (NSE)

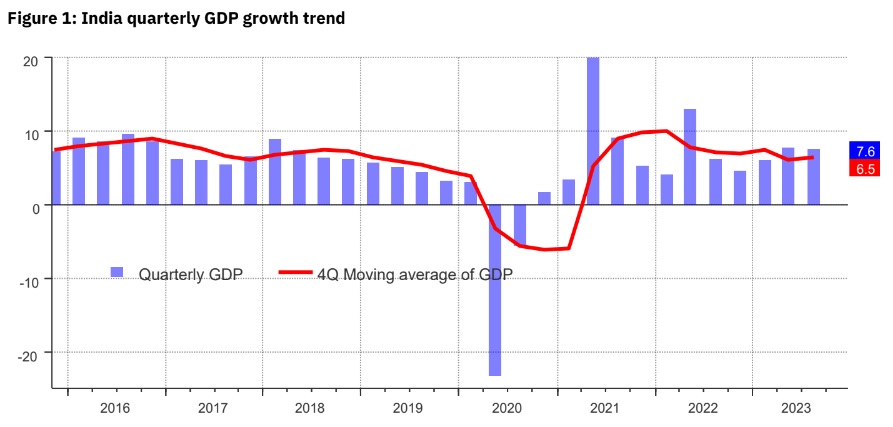

Mumbai, December 2, 2023: India’s second quarter real GDP growth for FY24 came in at a strong 7.6%, much ahead of the Consensus estimate of 6.8% and RBI’s estimate of 6.5%. This translates into a 7.7% growth in the first half—higher than the average growth of 6.9% for the same period in the previous 17 years. A robust expansion in investments, aided by frontloaded capex by the Government, coupled with strong Government consumption—growing at a 10-quarter high of 12.4% YoY, more than made up for weak private consumption and wider trade deficit. By economic activity, Gross Value Added (GVA) growth for Q2FY24 also accelerated to 7.4%, led by strong expansion in Manufacturing and Construction sectors, even as Agriculture and Services sector growth moderated. Industry—comprising 31% of the GVA—contributed to more than 50% to the YoY GVA growth, with the Manufacturing sector alone contributing to one-third. Meanwhile, the share of Agri sector in GVA fell to the series-low of 11.4% in Q2 FY24. Nominal GDP growth at 8.7% in H1 FY24, however, was much lower than an average growth of 13.4% for this period in the previous 17 years, reflecting the impact of negative wholesale inflation this year.

The strong expansion in the manufacturing and investment activity in the quarter gone by is reflected in robust corporate earnings, strong capex push by the Government, and revival in real estate demand. Further, increasing capacity utilisation and healthy balance sheets of corporates and banks provide a conducive environment for a steady recovery in private capex. Urban consumption has remained resilient, as reflected in robust passenger vehicle sales, and non-oil imports. A 110bps higher GDP growth in Q2 takes the RBI’s full-year forecast to 6.7% ceteris paribus. Key downside risks to the growth outlook include persistent weakness in rural demand, slowing global growth and lagged impact of past rate hikes.

Q2FY24 GDP growth at 7.6% surprised positively

Maintaining the growth momentum, India’s real GDP growth stood at 7.6% YoY in Q2FY24, beating the consensus estimate of 6.8% and RBI’s estimate of 6.5% by a wide margin.

This momentum was primarily led by a robust growth in Government consumption, capital expenditure, as also reflected in the state of Government finances in the first half (Capex up 43% YoY in H1FY24), as well as robust household expenditure as evident in the revival in real estate demand. Private consumption, on the other hand, slowed down, partly attributed to weak rural demand in the light of an uneven monsoon. Nominal GDP growth, however, remained low at 9.1%YoY in Q2—a modest increase from a 10-quarter low of 8.0% in the previous quarter, owing to weak deflator due to negative wholesale prices.

Significant Uptick In Investments And Government Consumption

Government Final Consumption Expenditure (GFCE) grew at a robust 10-quarter high of 12.4% YoY in Q2, albeit off a low base (-4.1% YoY in Q2FY24), thanks to a strong 21% YoY growth in the Centre’s revenue expenditure in the September quarter. Gross Fixed Capital Formation (GFCF)—a barometer of investments in the economy—registered a strong growth of 11.0% YoY (+5.1% QoQ) in the quarter gone by, significantly beating consensus expectations (RBI’s SPF: +7.6%), primarily led by front-loaded capital spending by the Centre (+26.4%YoY in Q2FY24 and +43% in H1). In nominal terms, investment (GFCF) to GDP ratio at 31.7% in Q2 was the highest in last 35 quarters. Private Final Consumption Expenditure (PFCE) growth, on the other hand, softened to 3.1% YoY in Q2 (+6.0% YoY in Q1FY24), and declined 8.5% QoQ, owing to moderation in rural demand due to weak monsoon. This is reflected in muted two-wheelers sales (-1.6% YoY in Q2) and weak revenues reported by the FMCG companies in the quarter. On the external front, while exports picked up by 4.3% YoY after a muted June quarter, imports have shown a major uptick by 16.7% YoY in Q2FY24, indicting resilient urban demand conditions. As a result, net imports surged to an all-time high of Rs2.9trn in the September quarter.

Manufacturing and Construction drove GVA growth to 7.4%

The real GVA growth also came in at a strong 7.4% YoY in Q2FY24 as against 7.8% in the previous quarter and 5.4% in Q2 FY23. This was primarily led by a broad-based double-digit acceleration in Industry output, offsetting slowdown in Services and Agriculture. The Industry GVA grew by 13.2% YoY, primarily driven by Manufacturing at 13.9% YoY (favourable base and easing input costs) and

Construction at 13.2% YoY (frontloaded Government capex and strong real estate demand). Within Manufacturing, pharma products, basic metals, fabricated metal products, electrical equipment, and motor-vehicles supported the growth implied by sub-components of IIP: Manufacturing, while export-focused segments such as wearing apparels, and electronic products remained weak. Agriculture sector faltered, recording a mere 1.2% YoY growth—the lowest in 18 quarters, reflecting the impact of an uneven and erratic monsoon on farm output and incomes. Services sector growth also moderated to 5.8% from 10.3% in the previous quarter and 9.4% in Q2 FY23, thanks to slowdown in Trade, Hotels, Transport & Communication and Financial, Real estate and Business Services.

(Disclaimer: This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources, but we do not guarantee the completeness, accuracy, timeliness or projections of future conditions provided herein from the use of the said information. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risk, which should be considered prior to making any investment decisions. Consult your personal investment advisers before making an investment decision.)