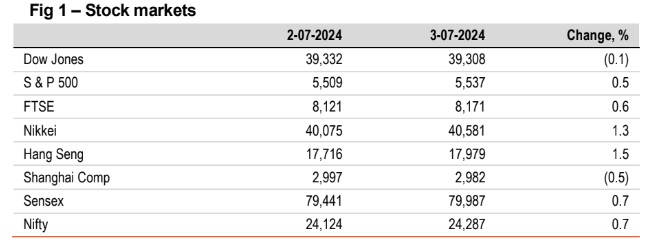

Barring Dow Jones and Shanghai Comp, other global indices ended higher

Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, July 04, 2024: A slew of data from the US signalled softening of economy and stoked hopes of Fed

rate cut. This included signs of weakness in labour market, as was reflected by both

ADP employment report (150,000 versus 157,000 in May’24) and the weekly jobless

claims (rose more than expected-to 238,000). This comes ahead of the non-farm

payrolls report. Additionally, the non-manufacturing PMI data from ISM surprised

negatively, dropping down to 48.8 in Jun’24 from 53.8 in May’24, with weak

employment levels. Furthermore, US factory orders contracted for the first time, after

rising for 3-straight months (-0.5% in May’24 from 0.4% in Apr’24). Separately, Fed

minutes noted that even as inflation is moving towards its target goal, the committee

needs to see more information which will ‘give them greater confidence’ before they

lower the rates.

Barring Dow Jones and Shanghai Comp, other global indices ended higher. US

stocks closed in green amidst renewed hopes of rate cut, given softer labour

data. Amongst other indices, Nikkei and Hang Seng surged the most. Sensex

climbed higher by 0.7% led by strong gains in banking and metal stocks. It is

trading further higher today in line with other Asian stocks.

Global currencies ended mixed. DXY ended lower as a slew of macro data from

the US reinforced views of a rate cut in Sep’24. Both EUR and GBP appreciated

by 0.4% against the dollar. On the other hand, JPY depreciated further to hit a

fresh 38-year low. INR depreciated marginally, tracking a rise in oil prices. It is

trading stronger today, in line with other Asian currencies.

Except Japan and China, other major yields closed lower. 10Y yields of UK and

US fell the most. Sharp decline in US ISM services index and softer ADP

employment report, has further firmed the hopes of a Fed rate cut in Sep’24.

India’s 10Y yield eased a tad, even as oil prices inched up. Following global

cues, it is trading further lower at 6.99% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)