The ECB officials sounded dovish and stated the likelihood of rate cut in Jun’24 in their commentary as inflation continues to fall in a ‘sustained way’

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, May 28, 2024: Germany’s IFO business sentiment index remained steady in May at 89.3 with sectors such as manufacturing, construction and trade making steady recovery even as services sector continues to remain a challenge. In Japan, services PPI climbed up to 2.8% in Apr’24 (fastest in 9-year) from 2.4% in Mar’24, signalling sustained rise in inflation. Separately, ahead of the release of inflation data, the ECB officials sounded dovish and stated the likelihood of rate cut in Jun’24 in their commentary as inflation continues to fall in a ‘sustained way’. Inflation in Eurozone has been below the 3% mark for the last 7 months.

In Australia, retail sales inched up but at a much slower rate than anticipated, raising caution over slower discretionary spending by consumers. On domestic front, IMD retained its forecast of above normal monsoon.

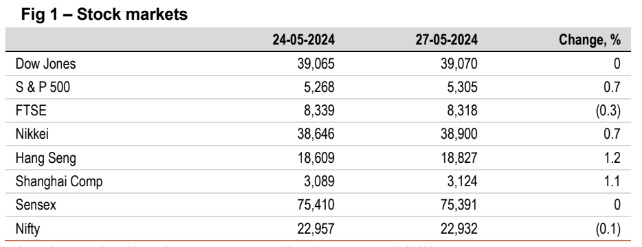

Global indices ended mixed. The recent upbeat data from the US has raised

concerns of possible overheating by some investors and thereby making US

equities more vulnerable than its global counterparts. Investors will await key

economic readings from US, Europe and Japan. Sensex ended flat. However, it

is trading higher today, in line with other Asian markets.

Global currencies ended mixed. DXY dipped by 0.1% as investors await US

core PCE data scheduled to be released later in the week. GBP logged another

session of gains led by expectations that BoE’s rate cut might be delayed. INR

depreciated by 0.1% as oil prices increased. However, it is trading stronger

today, in line with other Asian currencies.

Global yields ended mixed. Germany’s 10Y yield declined the most by 4bps as

a key ECB policymaker suggested that a Jun’24 rate cut is a “done deal”.

Sombre data (Germany’s business climate index) also weighed on yields. 10Y yield in US dipped marginally ahead of key inflation report. India’s 10Y yield eased by 1bps. It is trading flat today. 07.10 GS 2034 is trading lower at 6.97%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)