Global currencies ended broadly stronger against the dollar

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, April 24, 2024: India’s business activity (flash composite PMI) surged to a 14-year high to 62.2 in Apr’24 from 61.8 in Mar’24 supported by strength in both services and manufacturing sector. Uptick in new orders and strong domestic trend pushed the index higher. Separately, in Australia CPI rose by 3.5% in Mar from 3.4% in Feb’24 led by services inflation. In Q1CY24, annual CPI moderated at a slower pace at 3.6% against an estimate of 3.5% dimming hopes of a possible rate cut by RBA. On the other hand in Japan, services PPI rose by 2.3% in Mar’24 from 2.2% in Feb’24. Additionally in Japan, investors expect a possible intervention by the authorities, if the currency weakens any further.

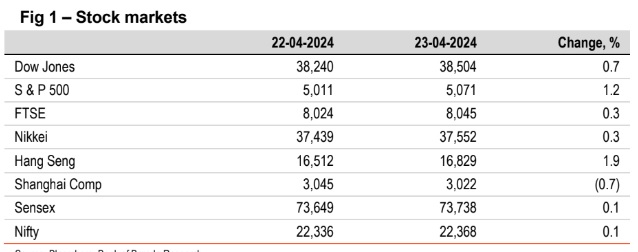

§ Barring Shanghai Comp, other global indices ended higher. US indices rose for the second straight day with focus on earnings reports and awaiting the release of PCE data. FTSE pared some gains during the day after hawkish comments by BoE officials, however it closed in green. Hang Seng rose the most. Sensex edged up supported by gains in real estate and IT stocks. It is trading higher today, in line with other Asian stocks.

Global currencies ended broadly stronger against the dollar. DXY fell by 0.4% as flash PMI for US suggested a weakening momentum in both manufacturing and services activity. EUR and GBP appreciated amidst a sharp pickup in services PMI in both the regions. INR appreciated marginally. It is trading further stronger today, in line with other Asian currencies.

Global yields ended mixed. 10Y yield in US fell by 1bps as flash PMI surveys suggested a moderation in economic activity. Focus now shifts to US PCE and GDP data due this week. On the other hand, 10Y yields in UK and Germany rose, as services PMI in UK and Eurozone surged to 11-month highs. India’s 10Y yield eased by 3bps to 7.16%. It is trading flat today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)