INR is trading weaker today, while other Asian currencies are trading mixed

Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, July 1, 2024: Macro data from the US shows that inflation is cooling down and consumer spending has also weakened. PCE inflation moderated to 2.6% in May’24 from 2.7% in Apr’24.

Core PCE too eased to 2.6% from 2.8% in Apr’24. On MoM basis, inflation index was flat (0%) compared with 0.3% increase in Apr’24. Further, University of Michigan

final consumer sentiment survey showed that the headline index fell to 68.2 in Jun’24 from 69.1 in May’24, dragged by current situation index. Consumers now expect inflation at 3% versus 3.3% expected in May’24 survey. This has raised the possibility of a rate cut in Sep’24. However, increased political uncertainty (US and France) also impacted investor sentiments. Separately in China, manufacturing activity remains weak with official PMI index unchanged in Jun’24 at 49.5. Non-manufacturing PMI also eased to 50.5 from 51.1 in May’24.

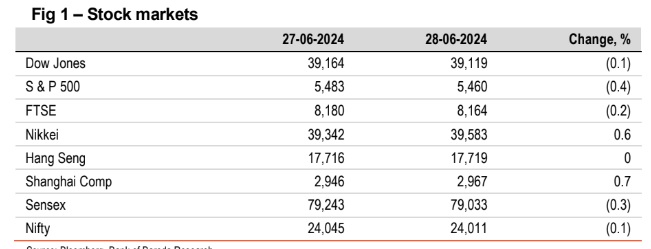

Global indices ended mixed. US stocks closed lower as investors monitored PCE data with investors expecting rate cut as soon as Sep’24. Shanghai Comp

and Nikkei were the biggest gainers. Sensex closed in red, breaking away from

its 4-day winning streak. Banking and IT stocks dropped the most. It is trading

higher today, while other Asian stocks are trading mixed.

Global currencies closed mixed. DXY remained steady surrounded by rate cut

optimism amidst slower inflation data. JPY weakened with a possible

intervention likely by authorities. INR appreciated by 0.1% amidst higher FPI

inflows. It is trading weaker today, while other Asian currencies are trading

mixed.

Barring Japan (lower), other global yields closed higher. US 10Y yield rose by

11bps, amidst growing uncertainty around US presidential elections. This was

despite a lower inflation reading. Germany and UK’s 10Y yield closed higher by

5 and 4bps respectively. India’s 10Y yield was broadly stable amidst the much

anticipated bond inclusion. It is trading at the same level today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)