Fed Chair reiterated that US inflation is on track to return to the Fed’s target range but shied away from committing to a widely expected rate cut in Sep’24

Sonal Badhan

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, July 11, 2024: Fed Chair reiterated that US inflation is on track to return to the Fed’s target range

but shied away from committing to a widely expected rate cut in Sep’24. This comes

on ahead of CPI data which is likely to show a further moderation to 3.1% in Jun’24

from 3.3% in Jul’24 (YoY). Traders are now pricing in two possible rate cuts by the

Fed in 2024, with the first expected in Sep’24 (70% probability as per CME

FedWatch Tool) and another in Dec’24 (probability at 46%). Separately, Bank of

England’s Chief Economist flagged the continued stubbornness in inflation and

increase in wage growth as risks to policy easing. As a result, investors have pared

back expectations of a rate cut by the BoE in Aug’24. In Japan, core machinery

orders declined by 3.2% (est. 0.9% drop), following a decline of 2.9% in Apr’24. The

data complicates BoJ’s decision to raise rates amid faltering growth and increasing

price pressures.

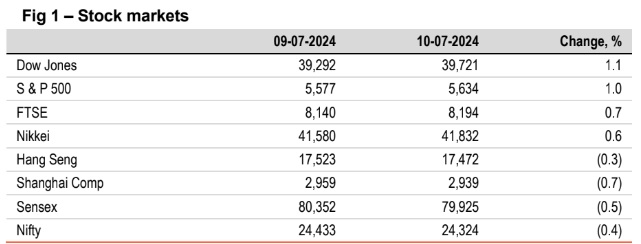

Global indices ended mixed. Investors remained cautious monitoring comments

of key central bank officials. Stocks in China fell the most amid worries over

persisting pressure in pricing power. In US, stocks rose led by hopes that the

Fed will start its easing cycle in Sep’24. Sensex fell by 0.5%, led by metal and

auto stocks. It is trading higher today, while Asian stocks are trading mixed.

Global currencies ended mixed. DXY declined by 0.1% as investors have raised

bets of two rate cuts by Fed this year. GBP rose by 0.5% tracking comments

from key BoE official. JPY depreciated further to its weakest since Dec’86. INR

fell a tad. However, it is trading stronger today, in line with other Asian peers.

Global yields closed lower. In Germany, 10Y yield fell the most by 5bps led by

political uncertainty in France. In UK, 10Y yield fell by 3bps even as BoE

member flagged risks of underlying inflation. US 10Y yield fell a tad following

comments of Fed official who spoke of US data reaffirming soft landing. India’s

10Y yield inched down marginally and is trading flat today.

Oil prices rose as OPEC upgraded its global growth forecast.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)