India’s 10Y yield is trading flat today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, July 12, 2024: US CPI report cemented the case for a Fed rate cut in Sep’24. On a MoM basis, CPI

inflation in the US declined by 0.1% (est. +0.1%), marking its first drop since May’20.

Core CPI also eased to 0.1% from 0.2% in May’24. The drop in inflation was

welcomed by a voting member of the FOMC who termed it “excellent”. Jobless

claims declined more than expected due to seasonal factors. In Germany, CPI

inflation in Jun’24 was confirmed at 2.2%, moderating from 2.4%. UK’s GDP posted

a solid 0.4% growth in May’24 (0% in Apr’24), providing a significant boost to the

new government. Separately, China’s exports increased by 8.6% in Jun’24 (est. 8%).

However, domestic demand remained subdued as reflected in the unexpected

decline in imports (-2.3% vs. est. +2.8%). In India, CPI inflation is likely to inch up to

4.9% in Jun’24 from 4.75%, as food prices remain elevated. IIP growth is expected

to improve to 6% from 5% in Apr’24 (BoB estimate).

Except S&P 500 and Indian stocks, global indices ended higher. Investor

sentiments were bolstered by encouraging CPI print in the US which

strengthened case for rate cut. Hang Seng has risen the most followed by

Shanghai Comp. Moderation of S&P 500 was led by technology stocks. Sensex

closed flat. It is trading higher today, while Asian stocks are trading mixed.

Except INR, other global currencies ended higher. DXY slid by 0.6% after the

US CPI report. JPY appreciated sharply with reports suggesting a possible

intervention by the BoJ. INR depreciated amid increased dollar demand from

importers. However, it is trading stronger today, in line with other Asian peers.

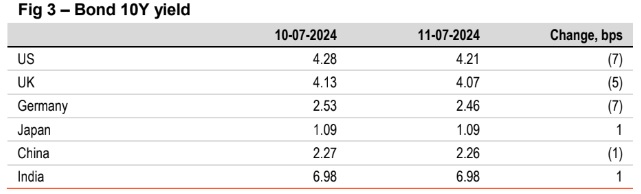

Barring Japan and India, global yields closed lower. US 10Y yield fell by 7bps

supported by encouraging CPI data. Chicago Fed President also spoke of the

same. CPI along expected lines in Germany also put a downward pressure on

its yield. Japan’s 10Y yield edged up over speculation of intervention in the

currency market. India’s 10Y yield rose a tad and is trading flat today.

Oil prices edged up amidst falling US inventories.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)