INR is trading higher today, while other Asian currencies are trading lower

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, July 16, 2024: The recent dovish commentary by Fed Chair weighed in on investors' sentiments and reinforced the rate cut expectations, with the earliest cut likely in Sep'24. It is expected there will be 3 rate cuts during the year. Furthermore, underwhelming data from China, weaker than expected Q2CY24 GDP print added concerns around

economic recovery. On the domestic front, WPI came in at 3.4% (16-month high) in

Jun'24 compared with 2.6% in May'24 led by elevated food prices. Separately, on

the back of good monsoon, Kharif sowing has been 10.3% higher than last year.

India's trade deficit narrowed to US$ 21bn in Jun'24 (US$ 23.8bn in May’24). Export

growth moderated to 2.6% in Jun'24 and import growth was at 4.9% in Jun'24.

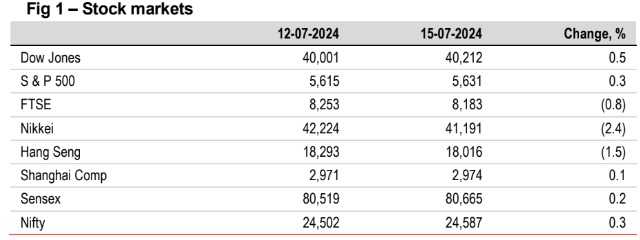

Global equity indices ended mixed. Investors monitored dovish commentary by

Fed chair as he stated Fed 'will not wait for inflation to hit the 2% mark' to cut

rates. Investors also closely tracked subdued GDP print from China. On the

other hand, Sensex ended in green, supported by gains in real estate and oil &

gas stocks. It is trading higher today while other Asian indices are trading mixed.

Major global currencies ended lower against the dollar. DXY rose by 0.1%, supported by gains in US treasury yields. GBP fell the most ahead of services inflation data, due tomorrow, which is expected to shed light on timing of BoE’s rate cut. Following global cues, INR also fell by 0.1%. However, it is trading higher today, while other Asian currencies are trading lower.

Apart from US 10Y, other global yields inched down. US 10Y yield was up by 5bps, due to concerns surrounding long-term fiscal outlook, and investors assessing the political impact of assassination attempt on former President Trump. Demand for bonds was also weak on Monday. India’s 10Y yield fell by

1bps, as oil prices cooled. It is trading further lower today at 6.97%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)