INR is trading stronger today, while other Asian currencies are trading mixed

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, July 18, 2024: Even with mixed macro data coming in from the US, rate cut bets by Fed in Sep’24 continue to hold ground. Retail sales growth in Jun’24 slowed (0% versus 0.3% in May’24), albeit less than estimated (-0.3%). Single-family housing starts fell by (-) 2.2% in Jun’24 to reach 980k—lowest since Oct’23. Industrial output slowed marginally in Jun’24 (0.6% from 0.9% in May’24), thus coming in higher than estimated 0.3%. Separately in the UK, the timing of BoE’s rate cut still remains uncertain.

Chances of a cut in Aug’24 have dimmed as retail inflation (YoY) remained at 2% in Jun’24 (unchanged from last month and versus est.:1.9%). Both core (3.5%) and services CPI (5.7%) also remained unchanged from last month, thus adding pressure on BoE. On the domestic front, keeping in view India’s growth momentum, IMF has revised its GDP forecast for FY25 upward to 7% from 6.8%.

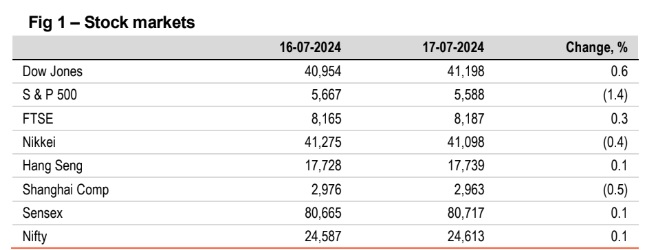

Global equity indices ended mixed. Investors monitored news of a possible export restrictions against China, which is expected to escalate US-China trade conflicts. Technology and specifically chip related stocks suffered the most. Shanghai Comp declined by 0.5% followed by losses in Nikkei. Sensex is trading lower in their morning session today in line with other Asian indices.

Except INR (flat), other global currencies ended higher against the dollar. DXY slipped (4-month low) amidst fears of US-China trade conflicts and the likelihood of Sep’24 cut. GBP breached the US$ 1.3 mark. Yen scaled up raising the possibility of government interventions. INR is trading stronger today, while other Asian currencies are trading mixed.

Global 10Y yields closed mixed. UK 10Y yield rose the most (3bps), while US 10Y yield was flat. Continued stickiness in UK inflation has dimmed the chances of a rate cut by BoE in Aug’24. Mixed macro data from the US, kept investors on edge. Markets in India were closed, but 10Y yield is trading slightly higher today (6.97%), following global cues and rise in oil prices.

Oil prices rose, owing to more than expected draw down from US stockpiles.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)