Gold and copper prices are trading at near high levels

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, May 21, 2024: Fed officials remained jittery about the trajectory of inflation. Fed Vice Chair signalled policy rate is likely to be restrictive for some time unless policymakers are convinced that current inflation slowdown is not transitory. Atlanta Fed President also hinted at more time before price stability will be achieved. Reserve Bank of Australia’s latest minutes signalled higher for longer rates on the back of upside risks to inflation. Even some statements in the minutes could not rule out the possibility of rate hike. Elsewhere, global commodity prices are on an uptrend. Gold and copper prices are trading at near high levels. This got reflected in the Bloomberg Commodity Spot index which rose to its highest since Jan’23. Thus, yields globally firmed up. On domestic front, all eyes are on the progress of General Elections.

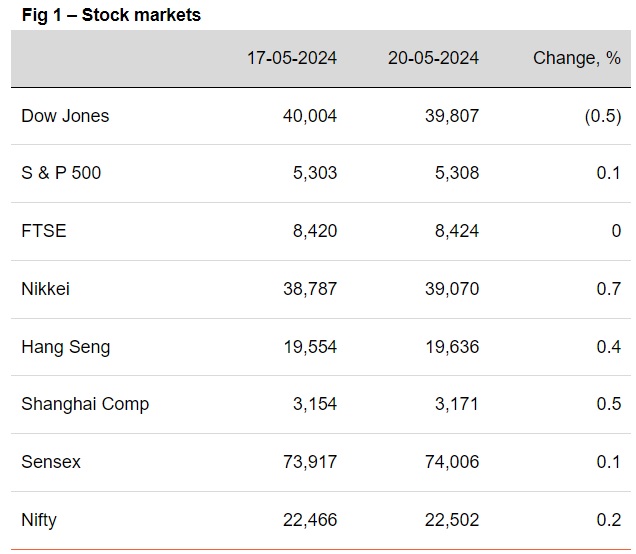

§Except Dow Jones, other global stocks ended in green. Investors’ focus remained on minutes of Fed meeting and earnings reports. Stocks in Asia rose sharply, with Nikkei surging by 0.7%. Sensex rose marginally by 0.1% in the special trading session with capital goods stocks leading the gain. However, it is trading lower today, in line with other Asian stocks.

§ Global currencies closed mixed. DXY edged up by 0.1% as Fed officials reiterated the need for keeping policy sufficiently restrictive while monitoring the path of inflation. JPY remained under pressure and depreciated by 0.4% with investors looking for signs of possible intervention. INR is trading stronger today, while other Asian currencies are trading mixed.

§ Barring China (lower), global yields closed higher. Yields showed upside pressure tracking comments of major Fed officials which showed discomfort with regard to inflation. UK’s 10Y yield firmed up by 4bps despite BoE Deputy Governor hinting at rate cut ‘some time over the summer’. China’s 10Y yield showed moderation over concerns surrounding its property sector. India’s 10Y yield inched up, taking global cues. It is trading at the same level today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)