S&P has revised India’s outlook from stable to positive with a rating of BBB- on the back of improved quality of government expenditure, political commitment to fiscal consolidation and robust economic growth

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, May 30, 2024: Fed’s Beige book noted the economic activity in the US continued to expand at modest pace during the Apr-Mid May period. There has been a pushback by consumers after retail spending inched up moderately, ‘reflecting lower discretionary spending and heightened price sensitivity’. IMF revised its growth forecast for China to 5% in CY24, with risk titled to the downside given the ongoing measures taken by the government. For CY25, it expects the economy to moderate by 4.5%. On the domestic front, S&P has revised India’s outlook from stable to positive with a rating of BBB- on the back of improved quality of government expenditure, political commitment to fiscal consolidation and robust economic growth.

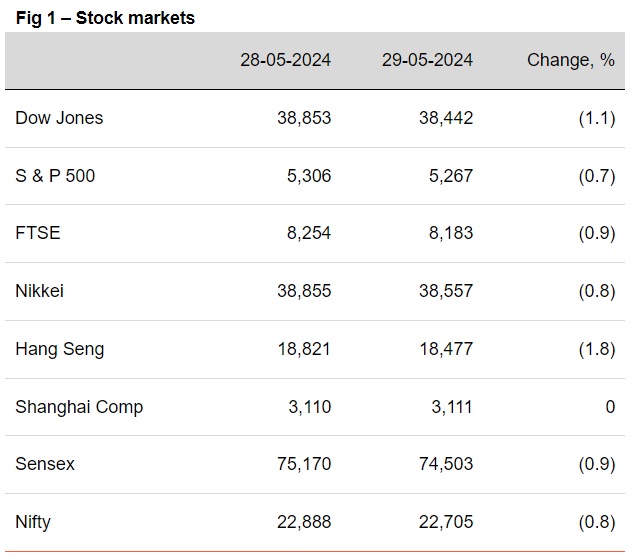

§ Global indices ended mixed. US indices ended in red after treasury yields registered gains amidst conflicting signs of timing and cuts in interest rates by Fed. Amongst other indices, Hang Seng dropped the most followed by losses in FTSE and Nikkei. The drop in Nikkei was due to growing threats of a possible hike by BoJ which affected the demand for stocks. Sensex ended lower and was dragged down by losses in banking and oil & gas sector. It is trading lower today, in line with other Asian markets.

§ Global currencies ended weaker as dollar regained strength. DXY rose by 0.5% to a near 3-week high, as investors dialled back expectations of Fed rate cuts. A jump in US treasury yields also supported the dollar. Both EUR and GBP depreciated by 0.5%. INR also ended weaker by 0.2%. It is trading further lower today, in line with other Asian currencies.

§ Anticipation of a delayed start to the global rate cut cycle has led to a sharp sell-off in global yields. Germany’s 10Y yield inched up by 10bps amidst a higher-than-expected CPI print. In US, 10Y yield rose by 6bps, ahead of PCE data. India’s 10Y yield also rose in line with global cues. However, an upgrade of India’s rating outlook by S&P, limited losses. It is trading flat today.