Flash PMI readings of other economies such as Eurozone and UK showed some strain

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, June 24, 2024: Flash PMI data of US showed that the economy is holding ground with services index expected to climb up to its 26-month high. Business confidence and employment scenario also improved. Investors are closely eyeing the PCE data, widely gauged by Fed, where some softening is anticipated (est.: 2.6%). Flash PMI readings of other economies such as Eurozone and UK showed some strain.

Elsewhere, in Japan, yen continued to reel under pressure amidst officials’

comments to take appropriate steps, to control excessive foreign exchange

movement. On domestic front, MPC members remained confident on growth and raising doubts on the pace of disinflation. Some members spoke of normalisation in policy. In a separate news, GST Council announced few measures for easing compliance.

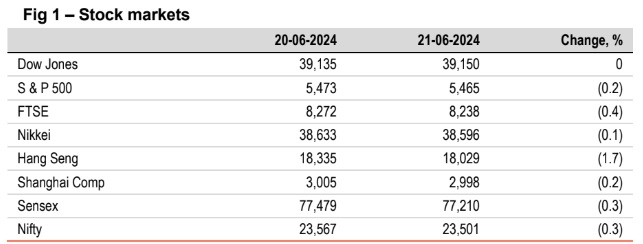

Barring Dow Jones (flat), other global indices ended lower. S&P 500 closed in

the red and was dragged down by losses in the technology sector. Amongst

other indices, Hang Seng (1.7%) dropped the most followed by FTSE (0.4%).

Sensex too ended lower amidst subdued global cues and selling pressure from

oil & gas and FMCG stocks. It is trading lower today in line with Asian indices.

Except CNY (flat) and INR (higher), other global currencies ended lower against

the dollar. The greenback strengthened (0.2%) and the focus now shifts towards

upcoming PCE data. The yen continued to weaken further and remained under

pressure. INR appreciated amidst the dip in oil prices. It is trading stronger today while other Asian currencies are trading mixed.

Global yields ended mixed. US 10Y yield closed broadly unchanged as macro

data was mixed. Flash composite PMI in US edged up, while housing sales

declined. 10Y yield in China inched up sharply. A decline in industrial production

in Germany weighed on bond yields in the region. India’s 10Y yield dipped

marginally by 1bps. It is trading further lower at 6.96% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)