INR is trading weaker today, while other Asian currencies are trading mixed.

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, June 26, 2024: Markets kept close eye tracking comments from several Fed officials, which gave conflicting signals. Chicago Fed President spoke of potential rate cuts amidst slowing consumer spending and improvement in labour market conditions.

Fed Governor Lisa Cook said current policy being well positioned. Fed Governor Michelle Bowman on the other hand, flagged upside risks to inflation sustainably returning towards the 2% target, hence suggested a restrictive approach. Elsewhere,

speculation reigned over BoJ’s intervention, to support yen. Similar speculation

persisted over PBOC, where CNY weakened and traded close to its lower end of

fixed daily trading band. On domestic front, external debt to GDP ratio fell to 18.7%

in Mar’24 from 19% in Mar’23 and debt service ratio improved.

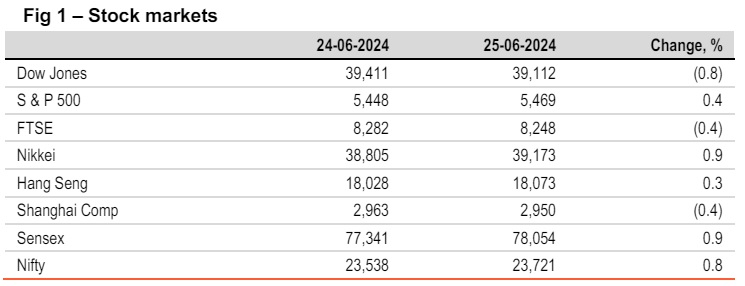

Global indices ended mixed. Dow Jones closed lower as investors monitored

subdued data print (consumer confidence moderated marginally) and awaited

the crucial PCE report. FTSE slid as investors awaited UK's GDP print and

remained cautious ahead of the parliamentary elections. Sensex jumped by

0.9% to a record high, led by a strong rally in IT and banking stocks. It is trading

lower today while other Asian indices are trading mixed.

Global currencies traded in thin ranges. DXY rose by 0.1% led by hawkish

comments from Fed Governor Bowman. However, gains were limited by a

moderation in US consumer confidence index. Both EUR and JPY continued to

decline further. INR appreciated, amidst improved external position. However, it

is trading weaker today, while other Asian currencies are trading mixed.

Global yields traded thinly. US 10Y yield rose a tad tracking mixed comments

from Fed officials. All eyes are on US PCE data where some softening is

anticipated. UK 10Y yield closed stable. Germany’s 10Y yield softened a tad bit.

India’s 10Y yield closed stable as reports suggested much of frontloading by

FPIs has already happened. It is trading at 6.99% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)