The household spending data in Japan declined unexpectedly by 1.8% in May’24 (much lower than anticipated)

Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, July 04, 2024: The recent softening of labour market data from US bolstered hopes of Fed rate cut as early as Sep’24. Investors cued in on the growing developments in Europe and remained on political watch. UK’s Labour party expected to form the new government, ending 14-years of conservative party rule. Separately, household spending data in Japan declined unexpectedly by 1.8% in May’24 (much lower than anticipated). Higher prices have weighed in on consumers’ purchasing power.

Recently, the Q1CY24 GDP reading was also revised downwardly. This raises

concerns on BoJ’s view on inflation remaining under the target and economy

recovering at a solid pace. Thereby, complicating the Central Bank’s decision to

raise rates. On the domestic front, FPI turned net buyers in Jun’24 after selling in the

last 2-months, with financial and telecom sectors registering the highest flows.

Most of the global indices ended higher. FTSE climbed 0.9% ahead of the

formation of the new government. On the domestic front, Sensex edged up by

0.1% led by gains in IT and real estate stocks. It is trading lower today while

other Asian stocks are trading mixed. Nikkei even breached the 41,000 mark in

the morning session.

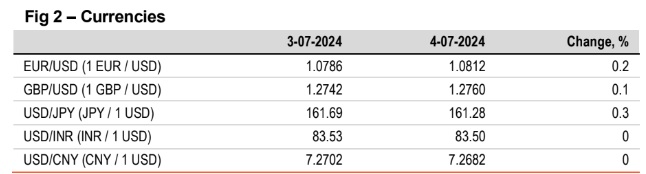

Barring INR and CNY, other global currencies ended higher against the dollar.

Amidst thin trading, due to holiday in the US, DXY fell by (-) 0.3%. JPY, EUR

and GBP gained. Investor sentiments were impacted by political developments

in UK (Labour Party set to win) and France (hung parliament is likely outcome).

INR was flat. It is trading stronger today, in line with other Asian currencies.

Except Japan and India, other major yields closed higher. Markets in US were

closed. 10Y yields in Europe reacted to ongoing political developments. In UK,

Labour party is set to form the new government. Markets also await US non-

farm payroll report. India’s 10Y yield ended flat, and is trading at similar levels

today, amidst tepid bond inflows so far.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)