Domestic wholesale PV volumes saw >25% growth

FinTech BizNews Service

Mumbai, 7 January 2026: Kotak Institutional Equities has come out with an insightful research report on Automobiles & Components India:

Strong momentum continues

The auto sector continued to report a robust set of wholesale volumes, with

all segments reporting a strong set of numbers. All auto segments’ wholesale

volumes grew strong double-digits, driven by GST cuts and improved

consumer sentiment. Retail trends remained strong across segments,

suggesting sustained momentum after the festive season. The export

segment also witnessed strong traction across the CV, tractor and 2W

segments. Most OEMs reported numbers ahead of our expectations and we

expect upgrades for FY2026E volume expectations across most names.

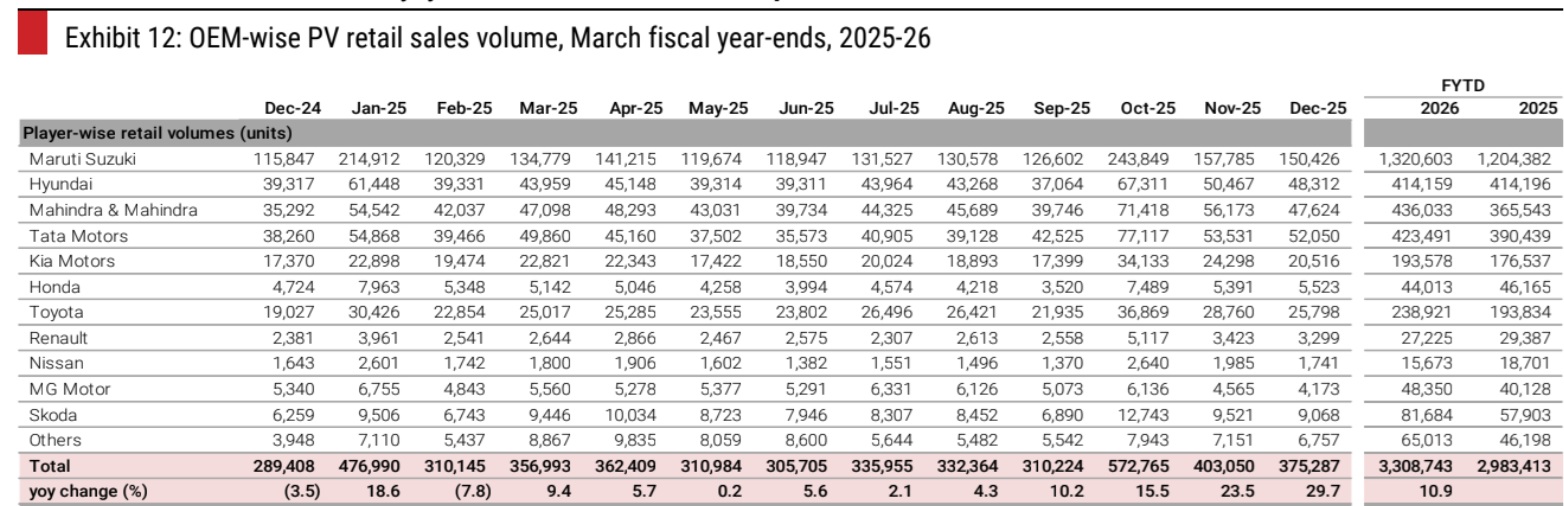

Domestic wholesale PV volumes saw >25% growth yoy in December 2025

According to our estimates, the domestic PV industry’s wholesale volumes

grew >25% yoy, led by strong retail trends on GST rationalization and improved

consumer sentiment. Retail volumes grew 30% yoy in December 2025. MSIL’s

volumes increased 22% yoy, led by a 36% yoy growth in the domestic segment,

offset by a 31% yoy decline in exports. TTMT volumes increased 14% yoy,

whereas M&M’s PV volumes increased 23% yoy. HMIL reported 1% yoy growth

in domestic volumes in December 2025. Toyota reported a >30% yoy rise in the

month, whereas Kia Motors doubled its yoy numbers.

Domestic 2W wholesales grew >30% yoy in December 2025

According to our estimates, domestic 2W wholesale volumes grew >30% yoy,

driven by strong momentum in the EV and ICE 2W segments and pickup in

replacement demand. Retail volumes grew 10% yoy due to favorable base and

GST-related benefits in 2025, with EV 2W retail sales increasing 33% yoy in

December 2025. TVSL’s 2W volumes grew 50% yoy, driven by 54% yoy growth

in domestic 2W volumes and 35% yoy growth in export volumes. Royal Enfield’s

volumes grew 30% yoy, led by 37% yoy growth in domestic, offset by a 10% yoy

decline in exports. HMCL reported a 40% yoy increase in volumes.

CV segment volumes witnessed >20% yoy growth in December 2025

The domestic CV segment’s wholesale volumes saw a >20% yoy increase yoy,

led by strong growth in M&HCV segments (lower base) and continued recovery

in the LCV segment. Retail volumes saw a 20% yoy rise in December 2025,

driven by the MGV and HGV segments. TTMT’s domestic CV volumes increased

24% yoy, led by (1) a 31% yoy rise in the HCV truck segments, (2) a 40% rise in

the ILMCV truck segment and (3) a 19% yoy rise in SCV segments. AL reported

a 27% yoy increase, whereas VECV’s volumes grew 25% yoy in December 2025.

Domestic tractor segment’s momentum remains strong in December 2025

According to our estimates, the domestic tractor segment’s volumes grew

strong >30% yoy in December 2025, with Maharashtra being one of the key

drivers after the introduction of the SMAM Tractor subsidy. Excluding

Maharashtra, the tractor segment would have grown >15% yoy, led by (1) the

benefit of the GST cut, (2) normal monsoon and (3) favorable terms of trade for

farmers. M&M’s tractor volumes grew 39% yoy, whereas Escorts Kubota’s

tractor volumes grew 39% yoy in December 2025.