Trends indicate that the jump in US economy post COVID may have been an outlier because of policy extravaganza....

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, March 16, 2025: US economy heading towards (un)exceptionalism?..... Trends indicate that the jump in US economy post COVID may have been an outlier because of policy extravaganza.... Long trends indicate possible downturn

in US economy GDP growth along with slowdown in US exports and consumption...The overall US value

add is showing declining trend with shrinking TFP growth....Net savings to GDP is also at the lowest level

since 2011...India however stands to gain in an increasingly uncertain world of tariffs.

Plight of US Economy

Long term US GDP growth shows a declining trend, more pronounced after 2000. Our estimated Lowess Smoother confirm the declining trend in US real GDP growth

❑ The trends indicate that the jump in US economy post COVID may have been an outlier as a result of policy extravaganza.... Long trends indicate possible downturn in US economy.

The long-term US export growth show declining trend after its peak in 1990s. The US private consumption growth also declining since 2000...... The current momentum in consumption will also lose momentum if overall GDP growth slows down as expected.

While CPI has eased, the lagged impact on demand will take time to reflect in demand. The real private investment has remained flat and is declining since 2020. The overall value add is showing declining trend with shrinking TFP growth.

US unemployment rate & Non-farm payroll.... High wages could hold back new investment

❑ NFP for Feb’25 showed addition of 1,51,000 jobs, a little lower than estimates (1,56,000) whereas the unemployment rate is moving in a tight zone around 4%..... Still, the Fed can be in a dilemma due to inflationary impact of tariffs that could impede economic growth

❑ Employer costs for private industry workers averaged $31.47 per hour worked for wages and salaries and $13.20 for benefits in December 2024. Employer costs in leisure and hospitality averaged $16.25 per hour worked for wages and salaries and $3.65 for benefits..... such high compensation costs can counter check trillions of investments being sought under the new political regime, in particular, in traditional manufacturing

The debt to GDP ratio shows a secular rising trend.... ...but the US currency still holding strong, exhibiting cyclical trends with falling peaks

Drastically cutting Federal spending can be disastrous.....

❑ The zealotry mission of departments like DOGE can “undo” a lot of ground works done in the previous decades, putting downward pressure on the beleaguered economy

Expected trends in US economy in light of long-term history

❑ The US economy long-term trends in GDP indicate decline in potential GDP, demand and investments

❑ The US indebtedness has sharply increased over the years, crowding out the private sector

❑ Although high debt has not reflected in US dollar, which shows cyclical trends its strength has over

the years has declined

❑ The current tariff policy will have short term pain and US GDP will not see acceleration in material way

❑ The economic rational of US DOGE is evident from long-term term trends

❑ If the structural adjustment gains traction, then potential GDP trend can see a upward shift. The larger

national savings that come from exercise despite nominal improvement in productivity can still push

the potential GDP up. The crowding in of the private sector that follows along with technical progress

can add significantly to growth prospects. However, this adjustment will have short term costs

Is Recession Coming?

❑ US economic growth is sliding in the last one year. From 3.2% in Q4 2023 GDP growth decelerated to 2.5% in

Q4 2024

❑ The GDP Now model estimate from Atlanta Fed for real GDP growth (seasonally adjusted annual rate, running

estimate) in the first quarter of 2025 is -2.4% on 06 Mar, down from +2.9% on 31 Jan (first estimate)

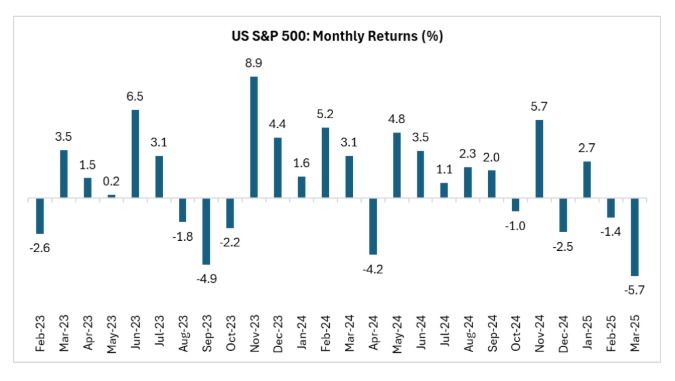

Markets are giving up gains...

❑ The S&P500 has given up all its gains since the November elections and the monthly return for Mar’25 month

are going to be lowest since Covid-19

Globally, major markets appear to be fatigued, distorting capital flows...

After doling out stupendous returns, most markets including the US markets (M-cap of S&P is hovering around ~52.9 Tn (Feb’25)) are appearing to have run out of breath, trimming all intermittent gains as investors increasingly question earnings guidance against ‘pricing in’ of unebbing volatility.... The magnificent 7 too are showing signs of crack after Deep Seek phenomenon, with ‘flight to safety’ being questioned in sound stocks like Apple too!

P/E multiples are stretched for most markets, warranting a ‘due’ correction

❑ Capital flows are increasingly being routed to jurisdictions that are relatively cheaper as returns hungry investors bay for higher returns there, all other things being (un)equal as heightened flows to mainland China / Hong Kong suggests... a strong likelihood of mean reversion for runaway markets is also not being ruled out..... The ongoing cycle of reciprocal, and retaliatory tariffs prepares a perfect breeding ground for the volatility laced downswings in coming periods

Tech supremacy is driving the US dominance...a ‘Deep Seek’ moment can unsettle much of it...

❑ The NYSE and the Nasdaq - the two largest stock exchange operators in the US - held a combined M-Cap for

domestic listed companies of over USD 62 trillion as of January’25, with parity being approached in their sizes at USD

32 trillion and USD 30 trillion, in a sign of reversal of fortunes since early 2018 when their respective domestic M-

Caps were USD 23 Tn and USD 11 Tn, the later buoyed by the galloping Technology majors’ supremacy

Personal Consumption Expenditures (PCE) fell for the first time in January nearly 2-years

❑ Consumer spending fell for the first time in nearly two years in January and the goods trade deficit widened to a

record high as businesses front-loaded imports to avoid tariffs, setting up the economy for weak growth or even

a contraction this quarter

Resilience of Indian Economy

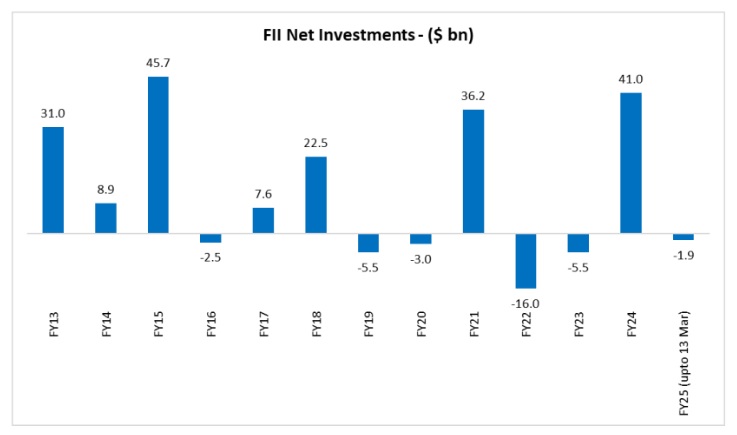

Sector-wise FII flows

❑ While FY25 is expected to an FII outflow year, during FY24,

India received FII inflows of $41 billion, highest since FY16

❑ Sector wise data indicate that there are plethora of robust sectors

which received inflows in last 3 FYs

❑ Only two sector exhibited continuously outflows in last three FYs

Free Trade Agreements

❑ India has been talking about free trade agreements with several partners – both bilateral and regional – in a bid

to boost export-oriented domestic manufacturing.

❑ These FTAs cover a wide array of topics, such as tariff reduction impacting the entire manufacturing and the

agricultural sectors; rules on services trade; digital issues such as data localization; intellectual property rights

that may have an impact on the accessibility of pharmaceutical drugs; and investment promotion, facilitation, and

protection

❑ India has signed 13 FTAs in the last five years with its trading partners like Mauritius, UAE, Australia, etc.

❑ India is negotiating FTAs with the UK, Canada, and the EU, targeting sectors like services, digital trade, and

sustainable development. The FTA with the UK alone is expected to increase bilateral trade by $15 billion by

2030. Future FTAs will likely focus on enhancing digital trade, with projections indicating that the digital economy

could add $1 trillion to India's GDP by 2025

❑ The shift towards regional supply chains and the impact of geopolitical changes, such as US tariff war are

influencing India's FTA strategies to ensure alignment with global trade dynamics

Iron and Aluminum tariff

❑ Donald Trump's 25% tariff on all steel and aluminum imports go into effect on 13th Mar’25

❑ US imports of steel and aluminum have shown an upward trend despite the trade war beginning in 2018

❑ Primary steel imports reached $31 billion in 2024, showing an increase from $29.5 billion in 2018

❑ Major steel suppliers are Canada, Brazil and Mexico

❑ Major aluminium suppliers are Canada, China and Mexico

❑ India has a trade deficit for Aluminium ($13 mn) and Steel ($406 mn) trade with US.. India can potentially take

advantage...

Reciprocal Tariff may not impact India much....

❑ We estimated the decline in exports in the range of 3-3.5% which again should be negated through higher export

goals across both manufacturing and services fronts, as India has diversified its exports kitty, pitched value

addition, exploring alternate areas and works on new routes that transcend from Europe to USA via the Middle-

East, redrawing new supply chain algorithms