For FY25, India's GDP growth is expected at 6.5%. There is a reason to remain positive on the capex-driven growth to sustain into next year, whereas rural recovery is expected to be slow

Radhika Piplani

Chief Economist

DAM Capital Advisors

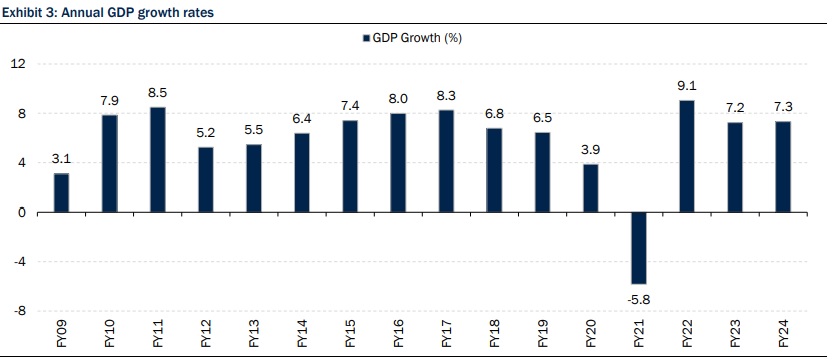

Mumbai, January 6, 2024: India’s FY24 real GDP and GVA growth got pegged at 7.3% and 6.9%, respectively, (FY23 GDP: 7.2%, FY23 GVA: 7.0%), as per the first advance estimate of national income prepared by the NSO (National Statistical Office). The estimate is sharper than the 7% growth projection of the RBI and the 6.7% consensus estimates of the street. More importantly, the nominal GDP growth is expected at 8.9%, much below the 10.5% estimate used for budget maths.

· A high real GDP growth is expected on account of: (1) increased net tax collections anticipated during the year and (2) higher contribution from investments, which are estimated to account for 35% of the GDP in FY24, marking the highest share thus far. Consumption expenditure is likely to underperform - its share in GDP has been the lowest over the past five years.

· As H1FY24 GDP growth is at 7.7%, the implied growth momentum for H2FY24 is projected to be at 7.0%. This points towards the likelihood of growth momentum having peaked with anticipation of a reversal in H2FY24.

· For FY25, we expect India’s GDP growth at 6.5%. We remain positive on the capex-driven growth to sustain into next year, whereas rural recovery is expected to be slow. Investment-driven demand-side growth.

On the demand side, acceleration in FY24 growth momentum is anticipated to be led by investments (10.3% YoY) (proxy to gross fixed capital formation). Total consumption expenditure and net exports are to be the laggards. Within consumption expenditure, private consumption is likely to increase by 4.4% YoY, whereas government consumption is expected to increase by 4.1% YoY. Exports are forecasted to grow by a meagre 1.4% YoY, whereas imports to grow by 13.2% YoY. The high frequency trends so far (auto, core output, credit growth, capital expenditure) look encouraging from investment perspective. Festive-led demand and marriage-related spends are expected to boost private consumption in Q3FY24 and weaken thereafter. Although frontloading of government expenditure has positively contributed to GDP, we expect a slowdown to sweep in during Q4FY24 ahead of the General Elections.

Manufacturing-drives supply-side growth

On the supply side, FY24 GVA growth is projected to be at 6.9%, 10 bps lower than FY23. The drag is expected to arise from weakness in agriculture and allied activities (1.8% YoY). The share of the agriculture sector at 14.4% is the lowest in the series thus far. This is likely on account of sub-optimal Kharif output, dismal Rabi sowing, negative impact of El-Nino, and uneven distribution of rainfall. Mining, manufacturing, construction are poised to register strong growth. Meanwhile, trade, hotels, transport and communication are expected to underperform.

Higher net tax collections to boost FY24 GDP growth: FY25 GDP expected at 6.5%

The GDP equation is an aggregate sum of net taxes and GVA. The NSO anticipates 12.5% YoY growth in net tax collections, highest post FY19. Conversely, GVA is 10 bps lower than last year’s growth of 7%. Taking this into account, FY24 GDP growth of 7.3% is expected as against FY23 GDP growth of 7.2%. Apart from the statistical logic, the increase in investments on the demand side of the growth equation and manufacturing on the supply side underpinned the surprisingly strong growth print. Although high frequency trends are suggestive of strong growth in both these accounts, we remain more cautious on private consumption (demand side) and agriculture (supply side). For FY25, we continue to expect GDP growth at 6.5%. We maintain a positive outlook on the capex-driven growth to sustain into next year, but mostly in H2FY25. H1CY24 is expected to be weak from ordering perspective, ahead of the General Elections in May 2024. Execution is expected to pick up in H2CY24. Government capex is also anticipated to pick up in H2CY24 after the pre-poll lull. Rural recovery is expected to be slow amid tepid growth in real rural wages, declining household savings and tighter lending standards. This can change depending on monsoon patterns and government dole outs.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.