Active management over passive strategies in equities: Motilal Oswal Private Wealth

FinTech BizNews Service

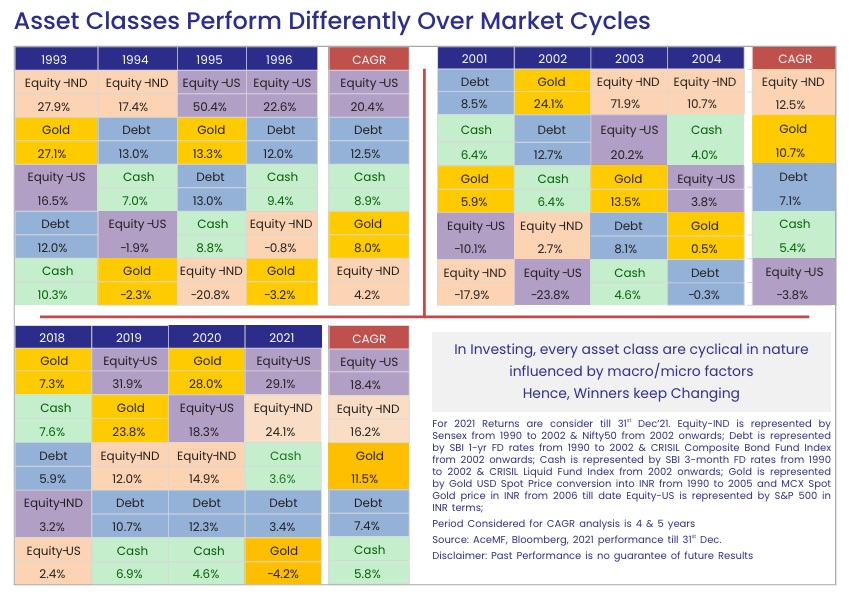

Mumbai, April 21, 2025: According to April 2025 Alpha Strategist report by Motilal Oswal Private Wealth (MOPW), During FY25, active funds have outperformed the passive funds across the categories and MOPW expects that trend to continue. MOPW suggests a neutral stance on equities as an asset class, with a lump-sum approach for Hybrid Funds and a staggered investment strategy over the next 2–3 months for Large Cap, Flexi Cap, Mid- and Small-Cap Funds. If markets experience a deeper correction, faster deployment of capital may be considered.

In fixed income, RBI’s actions on rate cuts and liquidity infusion have resulted in slight steepening of the yield curve. Softening of the longer end of the curve should be used as exit opportunity due to limited upside. MOPW prefers to be overweight on accrual-based strategies within fixed income portfolios.

Lastly, gold continues to serve as a traditional safe haven during times of global uncertainty. Historical patterns support its role as a stabilizing asset in portfolios during turbulent market phases. MOPW suggests gold as a neutral allocation in the portfolio.

Market Valuations: A Mixed Bag

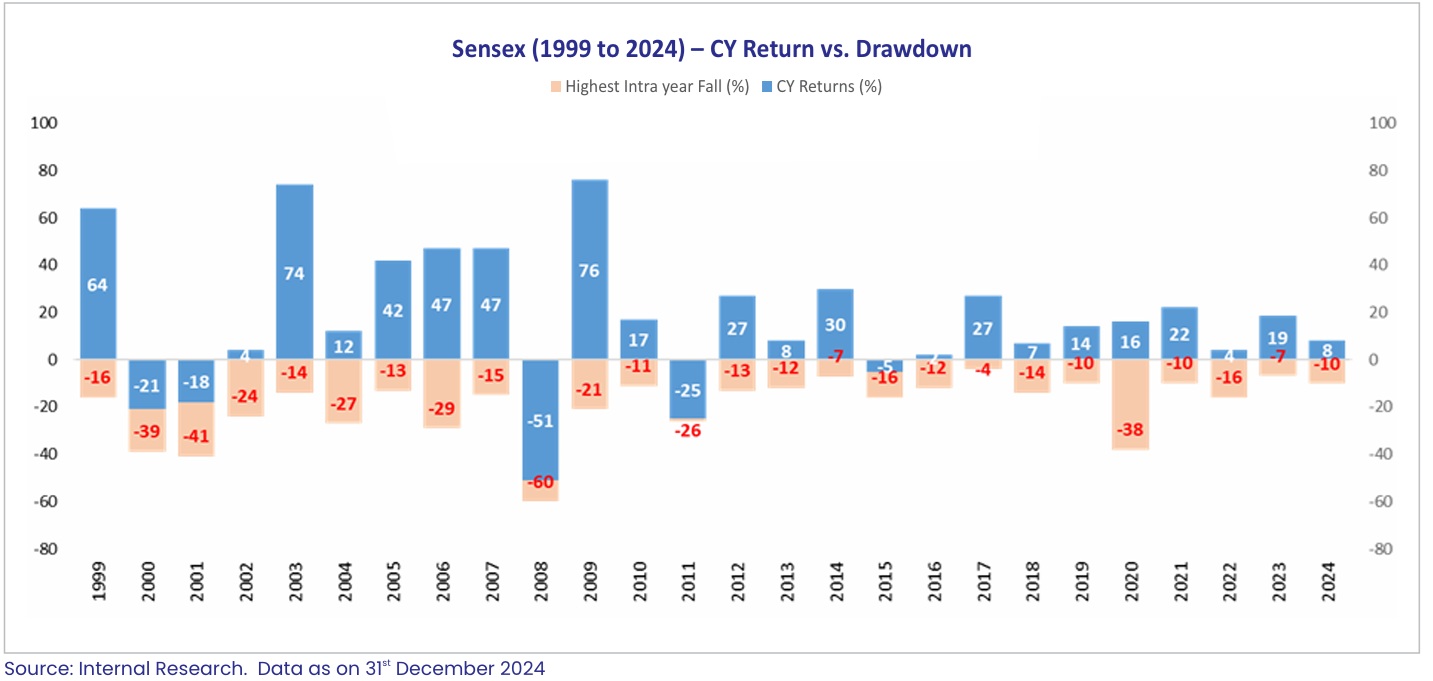

The Indian equity market currently presents a mixed picture in terms of valuations. The 12-month forward P/E of Nifty-50 is 15% below its September 2024 high. This moderation suggests some cooling off from peak valuation levels. Furthermore, Nifty-50 is trading at a 3% discount to its long-period average (LPA). Mid-cap and small-cap indices trading at significant premiums to their respective LPAs, at 26% and 32% respectively. Indicates that while large-cap valuations have become more reasonable, the mid and small-cap segments remain relatively expensive.

Equity Strategy

Considering the recent corrections, if Equity allocation is lower than desired levels, investors may increase allocation by implementing a lump sum investment strategy for Hybrid and a staggered approach for Large Cap, Flexi Cap, Mid & Small cap over the next 2-3 months, with accelerated deployment in the event of a meaningful correction.

Fixed Income View & Portfolio Strategy:

With the evolving interest rate scenario, MOPW believes the duration play is in its last leg and long-term yields to remain higher for longer and hence duration can be exited fully. Actions by RBI on rate cuts and liquidity, are likely to result into steepening in yield curve. MOPW recommends fixed income portfolio to be Overweight on Accrual Strategies.

Accrual can be played across the credit spectrum by allocating 45% – 55% of the portfolio to Performing Credit & Private Credit Strategies, InvITs & Select NCDs

• 30% – 35% may be invested in Performing Credit Strategies/NCDs and InvITs

• 20% – 25% may be invested in Private Credit including Real Estate/Infrastructure strategies and select NCDs

25% - 35% of the portfolio may be invested in Arbitrage Funds (minimum 3 months holding period), Floating Rate Funds (9 – 12 months holding period), Absolute Return Long/Short strategies (minimum 12 -15 months holding period)

For tax efficient fixed income alternative solutions, 20% - 25% of the portfolio may be allocated in Conservative Equity Savings funds (minimum 3 years holding period)

Robust Gold ETF Demand Continues

Gold-backed ETFs experienced strong buying interest in March, with all regions contributing to the inflows. US funds led the charge with US$6 billion (67t) of net inflows, followed by Europe and Asia, each with approximately US$1 billion in net inflows. This continued buying pace in ETFs indicates a sustained investor appetite for gold as a safe-haven asset amidst prevailing uncertainties.