US expected to start easing rates by cumulative 50bps in H2 2024

Radhika Piplani

Chief Economist

DAM Capital Advisors

Mumbai, December 13, 2023: CPI inflation rose to 5.6% in November 2023, led by increase in food price, after falling below 5% in October 2023. Nevertheless, core inflation - at 4.1% - continues to maintain downward momentum, a relief for the RBI.

Food Inflation: Higher On Onion And Tomato Prices

On a YoY basis, food inflation posted 8% growth in November 2023 (+0.9% MoM) after rising by 6.3% in October 2023 (+1.0% MoM), led by the rise in prices of vegetables, fruits, pulses, cereals and sugar.

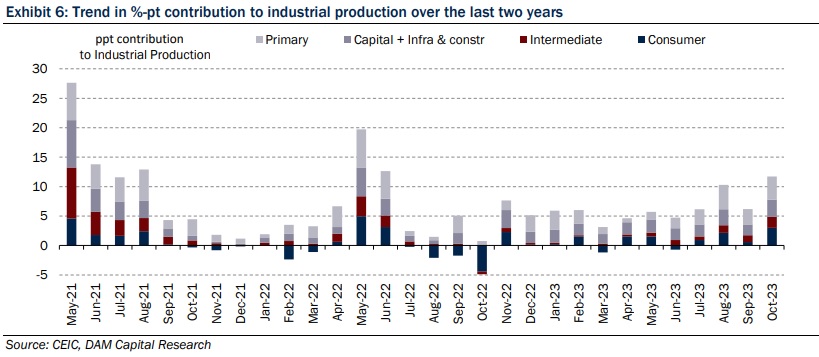

Core inflation maintains downtrend Core inflation (e.g., food, fuel, PTI) moderated to 4.1% YoY (+0.2% MoM) in November 2023, the lowest since April 2020 when the COVID-19 pandemic struck. Housing, clothing, footwear, health, recreation moderated on both annual and sequential basis. The increase in gold and silver prices led to higher personal care inflation. The impact of higher global metal prices is likely to have been exaggerated by marginally higher rupee depreciation during the month. We remain comfortable with the trajectory of core inflation going forward and expect it to continue below 5% for the remaining months of the fiscal year. q IIP: Coal and motor vehicle production support October output IIP grew by 11.7% YoY (+1.8% MoM) in October 2023 from an upwardly revised print of 6.2% YoY (-2.1% MoM) in September 2023, supported by favourable base at the margin (Diwali occurred in October last year, leading to lower workdays). Mining sector posted a strong growth of 13.1% (+14.3% MoM) amid robust coal production, as further indicated by the eight-core index. Manufacturing sector grew by 10.4% YoY (+0.4% MoM), on a low base and strong motor vehicle production in October. Electricity output grew by 20.4% YoY but contracted sequentially for the second consecutive month. On the use-based side, primary sector posted a strong 11.4% growth, a reflection of mining sector’s output. Capital goods posted strong annual growth, on low base of last year, but declined sequentially. A similar situation was observed for consumer durables and non-durables production. Intermediate goods, and infrastructure and construction sector registered strong growth on annual terms while also picking up sequentially, a reflection of strong investment demand.

MPC On Prolonged Pause

Last Friday, the MPC recognised that CPI inflation would be higher in November and December on account of food inflation (refer MPC: Pragmatically balanced, 8 December 2023). The committee also maintained that they would look through such one-off shocks. That said, to prevent these shocks from getting generalised and derail the disinflation process, the committee would continue to maintain caution.

The focus of the MPC continues to bring back inflation within the target of 4%. As per MPC’s forward-looking inflation trajectory, a quarterly average of 4% is expected in Q2 FY25 (FY24 forecast: 5.4%; FY25 forecast: 4.5%). This falls in line with our rate cut expectations, wherein we expect a cumulative rate cut of 50 bps in H2 FY25, once the inflation is closer to the target on a sustained basis. Until then, tight liquidity is likely to remain the key driver behind monetary policy tightening. Although we expect liquidity to be in surplus in Q4FY24 on account of higher FPI inflows and active inflows ahead of the JPM bond inclusion, it is expected to be offset by auction-based OMO sales.

US Inflation In Line With Expectations

In November, US CPI inflation moderated to 3.1% annually (+0.1% MoM) from 3.2% in October. The Core CPI, excluding volatile food and energy prices, remained consistent at 4% YoY (+0.3% MoM) as predicted. Looking at the components of inflation, we find that shelter costs continue to rise offsetting the decrease in gasoline index. With inflation gradually coming down towards the 2% target, it reinforces the FOMC’s resolve to keep interest rates unchanged in the near term (FOMC rate decision due tomorrow). Meanwhile, the overall positive inflation report released today and reasonably strong labour market data released last week resulted in traders trimming their rate cut bets on aggressive monetary policy easing in 2024. We expect US to start easing rates by cumulative 50bps in H2 2024.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)