India’s Q2FY25 GDP growth surprised markets at 5.4%, falling short of expectations.

FinTech BizNews Service

Mumbai, 16 December, 2024: According to Alpha Strategist Report from Motilal Oswal Private Wealth (MOPW), India’s economic momentum is expected to recover in H2FY25, driven by a rebound in government capex post-elections, recovery in rural consumption, and on the back of festive season demand.

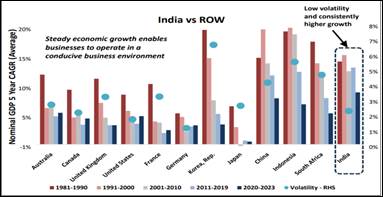

India’s Q2FY25 GDP growth surprised markets at 5.4%, falling short of expectations. The decline was driven by weaknesses in mining, manufacturing, electricity, and construction, while the tertiary sector remained resilient. Despite this, the growth remains slow but steady, positioning India as one of the fastest-growing major economies globally, with relatively low volatility and stable growth.

In the evolving interest rate environment, MOPW maintains a neutral stance on duration strategies and an overweight position on accrual strategies.

According to MOPW, with the recent market correction, large-cap valuations appear attractive. Investors can adopt a lump-sum strategy for Hybrid, Large, and Flexi-cap funds while taking a staggered approach over three months for select mid- and small-cap strategies.

India: FII Selling spree slowing down, turned Net Buyer in Dec

FII turned net buyers after 38 trading sessions with an infusion of 9947 Crores, this was owing to the MSCI rebalancing and positive market sentiment due to the BJP’s victory in Maharashtra. On the same day, DII were net sellers after 13 trading sessions. Pace of FII selling has slowed down since then. Dec (till 6th) has seen net FII inflow of 2.5bn USD.

Equity Portfolio Strategy

Equity markets now are in consolidation phase after a corrective phase of 10-12% in the benchmark indices. While corporate earning had hinted towards the slowdown, GDP growth numbers confirmed that. However Indian economy continues to remain on strong footing and signs are visible for growth coming back on track gradually. Hence, we continue to remain positive on the equity markets from long term perspective.

However, in the short run, given the uncertainties in the global context like the geopolitical situation, central bank policies, and rich domestic valuations, Indian equities may face concerns. It is advisable to tread with caution by adopting a strategy which is balanced and resilient.

Based on their risk profile, investors having the appropriate level of Equity allocation can continue to remain invested.

Considering the recent corrections, if Equity allocation is lower than desired levels, investors can increase allocation by implementing a lump sum investment strategy for Hybrid, large & flexicap strategies and 3 to 6 months for select mid & small-cap strategies with accelerated deployment in the event of a meaningful correction.

Fixed Income View & Portfolio Strategy

With the evolving interest rate scenario, the fixed income portfolio should be Overweight on Accrual Strategies and Neutral on Duration Strategies