The Marcellus–D&B Wealth Survey 2025 spans over 465 households across 28 cities, cutting across age groups, occupations, income brackets, and city types, offering a comprehensive view of India is growing affluent class.

FinTech BizNews Service

Mumbai, June 4, 2025: Marcellus Investment Managers, in collaboration with Dun & Bradstreet, today released its India Wealth Survey 2025, an in-depth study capturing the evolving financial behaviours, asset preferences, and retirement planning patterns among high-net-worth individuals (HNIs) across India. The survey spans over 465 households across 28 cities, cutting across age groups, occupations, income brackets, and city types, offering a comprehensive view of India is growing affluent class.

Saurabh Mukherjea, Co-Founder, Marcellus Investment Managers,

As India emerges as one of the largest economies in the world, the wealth landscape is undergoing a dramatic transformation. From rising disposable incomes to generational shifts in asset allocation, India’s high-net-worth individuals (HNIs) are more financially aware, globally exposed, and digitally empowered than ever before. Yet, many continue to struggle with disciplined wealth creation; highlighting the need for personalized guidance and structured financial planning.

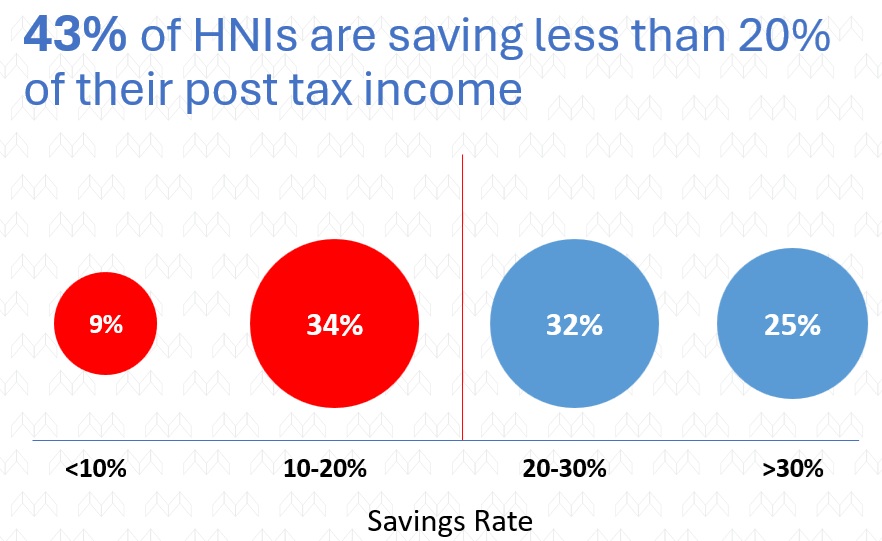

According to the survey, 43% of HNIs save less than 20% of their post-tax income. Despite aspirations like early retirement, home ownership, entrepreneurship, and children’s education, many lack the personalised planning and financial discipline to turn goals into reality. Notably, 14% do not maintain an emergency fund, and more than half allocate over 20% of their wealth to real estate.

These insights point to a growing appetite for expert advice. A striking 82% believe professional financial planning improves their chances of achieving long-term goals, while 51% seek help with diversification, and 38% want customised asset allocation aligned to their risk-return appetite.

Speaking during the launch, Saurabh Mukherjea, Co-Founder, Marcellus Investment Managers, said: "As India steps confidently onto the global economic stage, its wealthy households are embracing greater sophistication and clarity in their financial journeys. They are seeking expert guidance, not just to manage their wealth, but to bring structure, discipline, and purpose to their long-term financial aspirations. This signals a shift from transactional choices to intentional, goal-driven financial decisions."

Pramod Gubbi, Co-Founder, Marcellus Investment Managers, added: “Financial discipline and thoughtful asset allocation are the cornerstones of a solid financial foundation, essential for fulfilling future goals. India’s HNIs are no longer passive; they’re seeking a structured approach and professional assistance to help realise their life goals.”

Manish Hemnani, Co-Founder, Marcellus Investment Managers, stated: “We’re seeing a clear pattern from investors: plan the course, personalise the journey, and stand by them through uncertain times. It’s no longer about standard products or investment returns; it’s about tailored solutions and relationships built on transparency and trust.”

Key Insights from the Survey:

As India’s affluent households continue to grow in number and sophistication, the demand for financial advisors who offer personalized, transparent, and goal-driven guidance will only increase. The Marcellus–D&B Wealth Survey 2025 highlights a pivotal moment in India’s wealth management journey where building lasting partnerships based on trust and alignment will shape the future of financial planning for generations to come.