In Q2 FY 2025, Paytm’s Revenue From Financial Services & Others Up 34% QoQ To Rs376 Cr; In this quarter, 6.0 Lakh customers availed financial services, which has a large headroom for growth

FinTech BizNews Service

Mumbai, 25 October, 2024: Paytm’s revenue has jumped to Rs1,660 cr on growth in payments and financial services. Its EBITDA has improved by Rs388 Cr QoQ due to one-time exceptional gains. Its PAT is of Rs930 Cr, as per the latest earnings announced by the company for the quarter ending September 2024.

Continued focus on payments and distribution of financial services for sustained, profitable growth

As per Paytm’s statement, In Q2 FY 2025, the company achieved 11% QoQ revenue growth, due to 5% QoQ increase in GMV, better realization from devices and 34% QoQ increase in revenues from financial services. Our net payment margin increased 21% QoQ to Rs465 Cr, largely on account of improvement in payment processing margin, better device realization and growth in GMV. Financial Services revenue was Rs376 Cr, up 34% QoQ, on account of increase in collection bonus in merchant loans due to better asset quality trends, and higher share of merchant loans. With even greater confidence in our merchant loan distribution business, where we help in both distribution and collection, we have started working with select lenders by giving the Default Loss Guarantee (DLG, explained in subsequent sections) for select portfolios. This in long term will give us opportunity to serve wider merchant base and increase our financial services distribution revenue.

Contribution margin without UPI incentives has expanded to 54%, despite including DLG cost in this quarter. It has improved due to higher payment processing margin and growth in high margin financial services revenue. We expect the same contribution margin trends will continue. Our indirect cost has come down by 17% QoQ to Rs1,080 Cr due to reduction in employee costs (down 13% QoQ), marketing expenses and absence of certain one-time expenses incurred in Q1 FY 2025. With growth in revenue, improvement in contribution margin and reduction in indirect costs, EBITDA has improved by Rs388 Cr QoQ to Rs(404) Cr. EBITDA Before ESOP improved by Rs359 Cr QoQ to Rs(186) Cr and we remain committed to reach EBITDA before ESOP profitability by Q4 FY 2025. With one-time exceptional gain of Rs1,345 Cr, on account of sale of entertainment ticketing business, we achieved PAT of Rs930 Cr in Q2 FY 2025.

Financial Services: Revenue growth driven by higher collection bonus

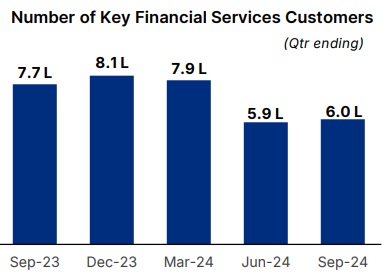

We have seen better collection efficiencies due to increase in mobile payment penetration among our merchants, leading to higher GMV throughput. This has resulted in higher collection bonus during the quarter. Significant financial service cross sell opportunity; New metrics to track Our core business is to acquire customers (consumers and merchants) for payments and cross selling financial services. For financial services, the relevant metric is number of unique payment customers we successfully cross-sell to and revenue earned from them. Starting this quarter, we have started disclosing the number of key financial services customers. These are unique consumers and merchants who have availed Paytm’s and group entity’s financial services offerings, i.e. equity broking, insurance and credit products, such as merchant and consumer loans distributed through our platform. However, it does not include customers availing mutual fund distribution, Postpaid loans or any attachment insurance products, as they contribute negligible revenue/profitability.

For the next couple of quarters, we will continue to report the value of loans disbursed, but over time, the relevant metrics will be the number of key financial services customers (consumer and merchant) and revenue from financial services. During Q2 FY 2025, 6.0 lakh key financial services customers (consumer and merchant) availed financial services through our platform, versus 5.9 lakh during Q1 FY 2025. Low penetration and high engagement of customers on our platform provides opportunity for us to drive cross sell of financial services. We continue to partner with various financial institutions to enhance and widen our financial service offerings.

Payment Services: Gross Device addition and GMV growth has reached erstwhile trends

New subscription paying device merchant sign ups has surpassed January 2024 levels. Our plan is to pick up inactive devices and redeploy them after refurbishment, which helps us reduce capex. When we pick up inactive devices, our merchant count reduces. We plan to continue reactivating merchants and redeploying inactive devices to new merchants over the next 2-3 quarters. This will lead to higher active merchant base and higher revenue. We see additional monetisation opportunities on Soundbox. For example, we have piloted advertisements through Soundbox which seamlessly integrate branding between companies and consumers. Paytm has partnered with several brands, including Meesho, Coca-cola, Mondelez and Dabur, among others for Soundbox Ads. Q2 FY 2025 GMV grew by 5% QoQ and we expect this trend in GMV growth to continue, and accelerate in Q3 due to the festive season. In addition to focus on growth of GMV, we were able to significantly improve payment processing margin.

Financial Highlights:

• Operating revenue of Rs1,660 Cr, up 11% QoQ

• Contribution margin of 54%, up 356bps QoQ; contribution profit of Rs894 Cr, up 18% QoQ

• EBITDA before ESOP of Rs(186) Cr, an improvement of Rs359 Cr QoQ

• EBITDA of Rs(404) Cr, an improvement of Rs388 Cr QoQ • Profit after Tax (PAT) of Rs930 Cr, including exceptional gain of Rs1,345 Cr on account of sale of entertainment ticketing business

• Cash balance of Rs9,999 Cr

Business Highlights:

• Payment services revenue of Rs981 Cr, up 9% QoQ

• Net payment margin of Rs465 Cr, up 21% QoQ, GMV of Rs4.5 Lakh Cr, up 5% QoQ

• Merchant subscriber base for devices has reached 1.12 Cr as of Sep’24, an increase of 3 Lakh QoQ • Financial services revenue of Rs376 Cr, up 34% QoQ

Awaiting NPCI Approval for UPI customer onboarding

The Reserve Bank of India, in its press release dated February 23, 2024, advised the National Payments Corporation of India (NPCI) to examine the request of One97 Communication Ltd (OCL) to become a UPI ThirdParty Application Provider (TPAP) for the continued operation of the Paytm app and to minimize concentration risk in the UPI system by incorporating multiple payment app providers. It further instructed NPCI that the ‘@paytm’ handles should be migrated seamlessly from PPBL to a set of newly identified banks to avoid any disruption. Subsequently, NPCI granted approval to OCL (Paytm) to participate in UPI as a TPAP under the multi-bank model. This allows us to directly participate in UPI customer business as TPAP like other popular UPI apps in the industry. We have completed the migration of 13.5 crore UPI customers to the OCL (Paytm) TPAP app in partnership with leading banks like SBI, HDFC Bank, Axis Bank, and Yes Bank. As a result of this migration, along with natural churn and a hold on new UPI user addition, our MTU base has declined from 7.8 Cr in Q1 FY 2025 to 7.1 Cr in Q2 FY 2025 (6.8 Cr in September). While we are working on retaining and reactivating these 13.5 Cr customers , new UPI customer onboarding is pending approval of NPCI. Once given opportunity and permission from NPCI to onboard new UPI customers, we plan to go ahead with marketing to get sizable market share of UPI customer transactions. This in turn will help serve the purpose of minimising concentration risk in the UPI system.

Key Focus Areas

We are focusing on the following areas to drive sustainable growth and profitability:

• Compliance-first: Stringent focus on a compliance-first approach across our businesses

• Merchant payment innovations: Continue to be a market leader with merchant payment innovations, including new devices and aggregation of various MDR-bearing payment instruments

• Customer acquisition: Currently focusing on reactivating customer base; Committed to aggressively acquire UPI customers post receipt of NPCI approval

• Cross sell: Increase high margin financial services revenue by expanding financial services partners

• Leverage AI to reduce costs: Continued automation of various operations to reduce costs