Promoter Holdings Slid To All-Time Low Of 49.5%

FII-DII ownership ratio has halved to 1x, down from 2.1x a decade ago

FinTech BizNews Service

Mumbai, May 8, 2025: The strong domestic inflows and buoyant capital markets in 2024 has led to a historic shift in ownership, with DII holdings surpassing FII holdings in Nifty-500 companies for the first time, according to the ‘India Strategy Report’ by Motilal Oswal Financial Services Ltd. (MOFSL).

The MOFSL report notes that promoter holdings dipped to an all-time low, while Retail holdings hovered around their lows as of Mar’25. FII holdings slid to the lows of 18.8% (vs. 22.8% in Mar'15), while DII holdings surged to an all-time high of 19.2% (vs. 10.8% in Mar'15).

The Indian equity markets experienced a dynamic and volatile decade from FY15 to FY25, characterized by rising domestic participation, expanding market breadth, the impact of Covid-19, a surge in global interest rates to multi-decade highs, and valuation expansion in domestic markets. In line with these trends, DIIs invested USD195b, which is 3.7x the FII inflows of USD53b during the decade. The predominance of domestic flows also led to a significant shift in institutional holdings across India Inc. This structural shift, which developed over the past decade, gained substantial momentum after FY21.

The trends continued into FY25, with markets initially jittery ahead of the 2024 Lok Sabha elections but later rallying to all-time highs, driven by robust domestic inflows. This was followed by a correction prompted by concerns over slowing earnings growth, stretched valuations, and mounting geopolitical risks, which were exacerbated by sharp FII selling.

MOFSL ‘India Strategy’ report delve deep into their ownership across the Nifty-500 sectors and companies, examining how their holdings have evolved. Key findings of report were:

DII holdings in the Nifty-500 surge for the fourth consecutive quarter

- Over the past one year, DII ownership rose 160bp YoY (+70bp QoQ) to an all-time high of 19.2% in Mar’25 (vs. 17.6% in Mar’24), while FII ownership dipped 40bp YoY (-10bp QoQ) to an all-time low of 18.8% (vs. 19.2% in Mar’24).

- Promoter holdings, which have historically remained range-bound, also declined meaningfully by 140bp YoY (down 30bp QoQ) to an all-time low of 49.5% in Mar’25. The sharp drop was driven by a buoyant primary market in 2024, where high valuations and strong investor appetite provided an attractive opportunity for several promoters to liquidate their stakes.

- Retail holdings were broadly stable and increased marginally by 10bp YoY, but declined 40bp QoQ to reach 12.4% by Mar'25.

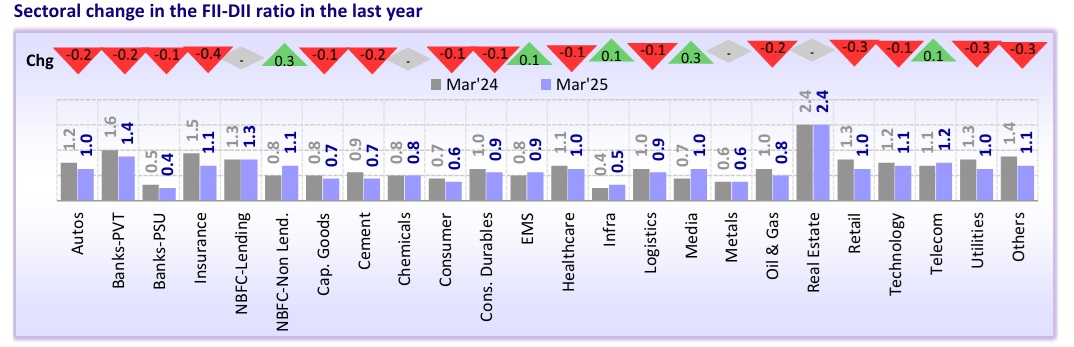

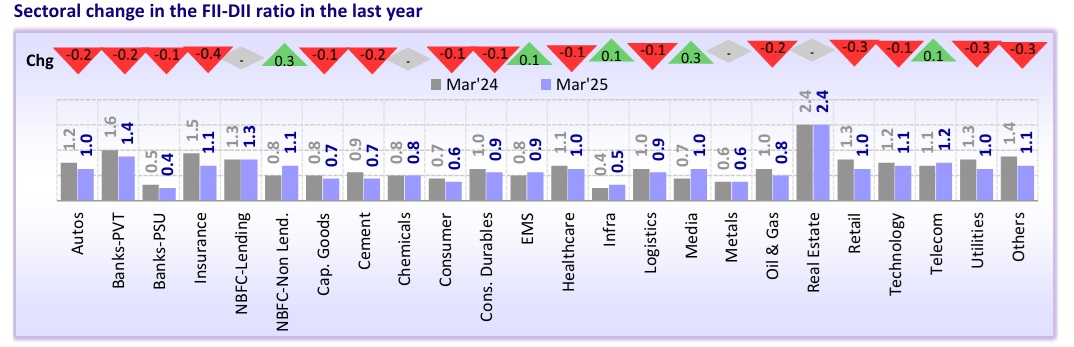

- Sectoral holdings trends: Within the NIfty-500, FIIs and DIIs showcased divergent trends. On a YoY basis, DIIs increased their holdings in 18 sectors (out of 24 sectors) – the top increase in holdings was seen in Banks (Private & PSU), Consumer Durables, Consumer, Insurance, Utilities, Technology, Cement, Oil & Gas, Automobiles, and Retail. In contrast, FIIs experienced a decline in all these sectors, except Technology and Consumer Durables.

- On a QoQ basis, DIIs increased their holdings in most of the sectors, except NBFC-Non Lending, Consumers, Logistics, and Media. Conversely, FIIs reduced their holdings in most sectors, barring Telecom, NBFCs, Chemicals, Insurance, and Media, which saw an increase QoQ.

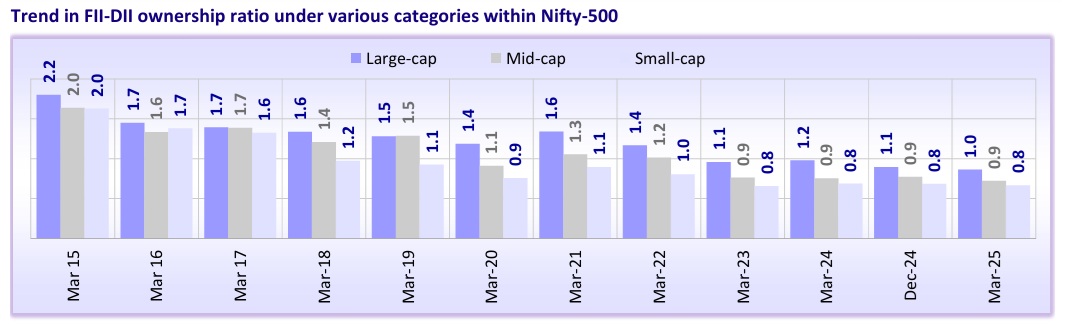

FII-DII ownership ratio continues to contract

- As a proportion of the free float of Nifty-500, FII ownership decreased 190bp YoY (-30bp QoQ) to 37.3%, while DII ownership increased 220bp YoY (+110bp QoQ) to 38%.

- The FII-DII ownership ratio in the Nifty-500 contracted 10bp YoY (flat QoQ) to 1x in Mar’25. Over the last one year, the FII-DII ratio has expanded primarily in NBFC Non-lending, EMS, Infrastructure, Telecom, and Media sectors, while it contracted in 15 out of 24 sectors. n

- Within the Nifty-500 companies, FIIs reduced their holdings in 48% of the companies YoY, while DIIs increased their stake in 67% of the companies.

- In the Nifty-50, FIIs reduced their holdings in 82% of the companies, while DIIs raised their holdings in 84% of the companies.

Analyzing the Caps: Domestic institutions raise their stakes across the board

- According to SEBI's categorization, large-, mid-, and small-cap stocks accounted for 68%, 21%, and 11% of the total Nifty-500 market cap, respectively.

- FII, Promoter, and Retail holdings in large-caps dipped to near-lows/the lowest levels of 21.1%, 47.6%, and 10.8%, respectively. In contrast, DII holdings in large-caps rose to an all-time high of 20.4% as of Mar’25.

- Analyzing the institutional holding patterns: (i) FIIs reduced their stakes in large caps by 50bp YoY, whereas their holdings in mid-caps remained unchanged YoY, and increased in small-caps (+20bp) on YoY basis. On a QoQ basis, FIIs reduced their stakes across all categories by 10bp/60bp/10bp to 21.1%/14.7%/12.2%; ii) DIIs significantly raised their stakes across market caps by 200bp/80bp /60bp YoY (+60bp/+50bp/+20bpQoQ), to 20.4%/17.1%/ 15.2%; and iii) Promotors notably reduced their YoY holdings across market caps (-160bp/-130bp/-30bp YoY and 30bp/+40bp/+10bp QoQ) to 47.6%/54.9%/51.4% as of Mar’25.

- Notably, Promoter holdings in large-caps dipped to an all-time low, while holdings in mid-cap stocks reached the second-lowest level and remained low in small-caps; iv) Retail holdings were near their lows in large- and mid-caps at 10.8% and 13.3%, respectively, while their holdings remained strong in small-caps at 21.2%.

PSU stocks – apple of the eye for both DIIs and FIIs!

- The report classified the Nifty-500 universe among Private, PSU, and MNC companies. Notably, FII holdings in Private companies reduced to an all-time low of 20.1% (down 90bp YoY/30bp QoQ), while their stakes in PSUs rose to 18.1% in Mar’25 (up 140bp YoY/50bp QoQ).

- DII holdings in both Private and PSU companies rose to all-time highs of 18.7% (+180bp YoY, +60bp QoQ) and 18.8% (+120bp YoY, +100bp QoQ), respectively.

- Buoyant primary and secondary markets also led to increased stake dilution by Promoter groups of Private companies. This resulted in a dip in their overall holdings in the Nifty-500 to an all-time low level of 47.5% (-110bp YoY) in Mar’25. Further, Promoter holdings in the PSU companies also reduced to 54.1% (-270bp YoY/-140bp QoQ) from 56.8% in Mar’24.

Sector holdings YoY: FIIs gain in nine sectors, while DIIs in 18

- Within the Nifty-500: i) FIIs had the highest holding in Private Banks (47.5%), followed by Telecom (22.5%), Real Estate (21%), NBFC Non-lending (20.5%), Technology (19.5%), Healthcare (18.7%), and Consumer (18.6%). Among the top sectors, FII raised their stakes in NBFC - Non-Lending (+400bp), EMS (+220bp), Telecom (+200bp), Real Estate (+170bp), and Infrastructure (+70bp) YoY. (ii) DIIs had the highest holding in Private Bank (33.1%), Consumer (23.9%), Oil & Gas (21.3%), Consumer Durables (20.9%), and Metals (20.7%). Among the key sectors, DIIs increased their stakes in Private Banks (+340bp), Consumer Durables (+290bp), Consumer (+230bp), Utilities (+220bp), PSU Banks (+220bp) on a YoY basis.

FII allocation in BFSI surges both sequentially and YoY

- BFSI’s (Private Banks, PSU Banks, NBFCs, and Insurance) growth continued to reflect in FII allocation, which rose 280bp YoY/300bp QoQ to 34.4% in the Nifty 500 as of Mar’25. FIIs remained significantly overweight (by 420bp) in BFSI vs. the Nifty-500 (BFSI’s weight in the Nifty-500 currently stands at 30.2%).

- BFSI was followed by Technology, in which FIIs had 10% weightage (down 40bp YoY and 150bp QoQ), and Telecom (up 130bp YoY and 60bp QoQ). Overall, the Top 5 sectoral allocations of FIIs in the Nifty-500 accounted for 64.7% of total allocation – BFSI (34.4%), Technology (10%), Automobiles (6.9%), Oil & Gas (6.8%), and Healthcare (6.5%).

- FIIs were significantly overweight (vs. Nifty-500) in Private Banks/Telecom/Real Estate/Technology and underweight in Capital Goods/ Consumer/ PSU Banks.

- FIIs raised their weights in Private Banks, NBFC – Lending, Telecom, Oil & Gas, Metals, Chemicals, Insurance, and Cement, while they reduced their holdings in Technology, Automobile, Healthcare, Real Estate, Capital Goods, Retail, Consumer, Consumer Durables, Infrastructure, and EMS.

- In terms of absolute holdings, out of the total FII holdings of USD815b, Private Banks topped with USD193b in investment value. The top-5 companies that contributed 31% to the holding value were HDFC Bank (USD89.2b), ICICI Bank (USD61.5b), Reliance (USD41b), Bharti Airtel (USD30.6b), and Infosys (USD30.3b).

DIIs: Overweight on Consumer and O&G; Underweight on Private Banks and NBFCs

- Within Nifty-500, DIIs were overweight on Consumer, O&G, and Metals, while they were underweight on Private Banks, NBFCs, and Real Estate.

- Overall, the Top 5 sectoral holdings of DIIs in the Nifty-500 accounted for 62% of the total allocation – BFSI (27.3%), Consumer (9.8%), Technology (9.3%), O&G (8.5%), Automobiles (7%), and Capital Goods (6.3%).

- Of the total DII holdings of USD830b in the Nifty-500, Private Banks topped at USD134b, followed by Consumer at USD81b, and Technology at USD77b.

- The top 5 stocks by holding value were HDFC Bank (USD50.1b), ITC (USD41.8b), ICICI Bank (USD40.3b), Reliance (USD38.4b), and Infosys (USD26b).

Retail holdings stable over the last three years

- Retail holdings for the overall Nifty-500 universe have been broadly stable over the last three years in the range of 12-13%. The holdings inched up 10bp YoY but declined 40bp QoQ to 12.4% as of Mar'25.

- Within Nifty-500, the Top 5 sectoral holdings of Retail accounted for 57% of the allocation – BFSI (23.8%), Capital Goods (10.3), Consumer 8.3%), Technology (7.4%), and Automobiles (7.1%).