The growth-inflation mix since the last policy meet in October does not call for a change in rates or stance

Radhika Piplani

Chief Economist

DAM Capital Advisors

Mumbai, December 7, 2023: The December MPC policy meeting is taking place in the backdrop of (1) better-than-expected Q2 FY24 GDP and (2) headline inflation of 5.0% and 4.9% in September and October, respectively. The growth-inflation mix since the last policy meet in October does not call for a change in rates or stance.

For India, the rate cut cycle is expected to begin in H2FY25.

Food price shock to hit inflation once again

Earlier, the tomato price shock led to food price inflation in July-August, resulting in above 6% headline inflation. This time around (November-December), inflation would likely be affected by high price of onion, apart from pick up in tomato and cereals prices. Although the RBI is likely to ignore the resultant inflation of 6% due to transient factors effect, the members are likely to express a note of caution moving ahead. This aligns with the fact that Rabi sowing as of 1 December 2023 lags last year levels. We do not expect FY24 CPI inflation forecast of 5.4% to see any changes; however, we do expect the constant volatility in food inflation to keep the MPC on its toes through FY24.

FY24 GDP forecast to see upgrade

The MPC is likely to revise its FY24 GDP forecast upwards to 6.7-6.8% (DAM forecast: 6.7%) from its earlier projection of 6.5% after better-than-expected Q2 FY24 GDP of 7.6%. Although normalising of base effects in H2 FY24 is expected to lower annual growth in H2 FY24, the high frequency trends so far (auto, core output, credit growth, capital expenditure) look encouraging. Additionally, festive-led demand and marriage-related spend are expected to boost private consumption, at the margin, during Q3FY24.

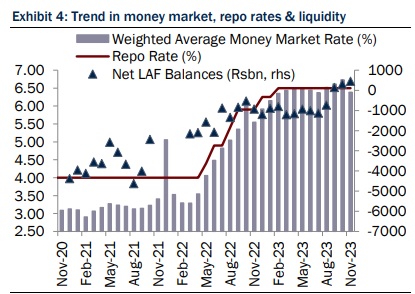

Tight liquidity management and tweaks in macroprudential policies on radar

Banking liquidity (CRR adjusted) averages to a lower deficit of Rs176bn from 27 November to 5 December, amid government spending, vis-à-vis a deficit of Rs1.5tn in the week prior. We expect the liquidity deficit to widen during the month amid seasonal increase in currency leakage (CIC) and FX intervention. As such, while the RBI would continue to focus on tight liquidity management, it is unlikely to introduce auction-based OMO sales in December. However, the possibility of it being introduced in Q4FY24 remains, if the FDI and FII inflows result in a large BoP surplus. Recall, the inclusion of JPM bond index is expected to bring USD30 bn into G-secs (passive inflows starting June 2024), but active managers pre-empt ~USD15+ bn of inflows by December 2023 itself for CY24 allocations. In our view, the positive momentum may continue well into Q4FY24. Along with tighter banking liquidity, the RBI might further tighten macroprudential norms (similar to the recent risk weight increases in a few loan segments to curb risky credit growth, which in turn could have proved inflationary). Cumulative impact of liquidity management and tightening of prudential norms is anticipated to result in faster transmission of past interest rate hikes.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)